Avantor Investor Presentation Deck

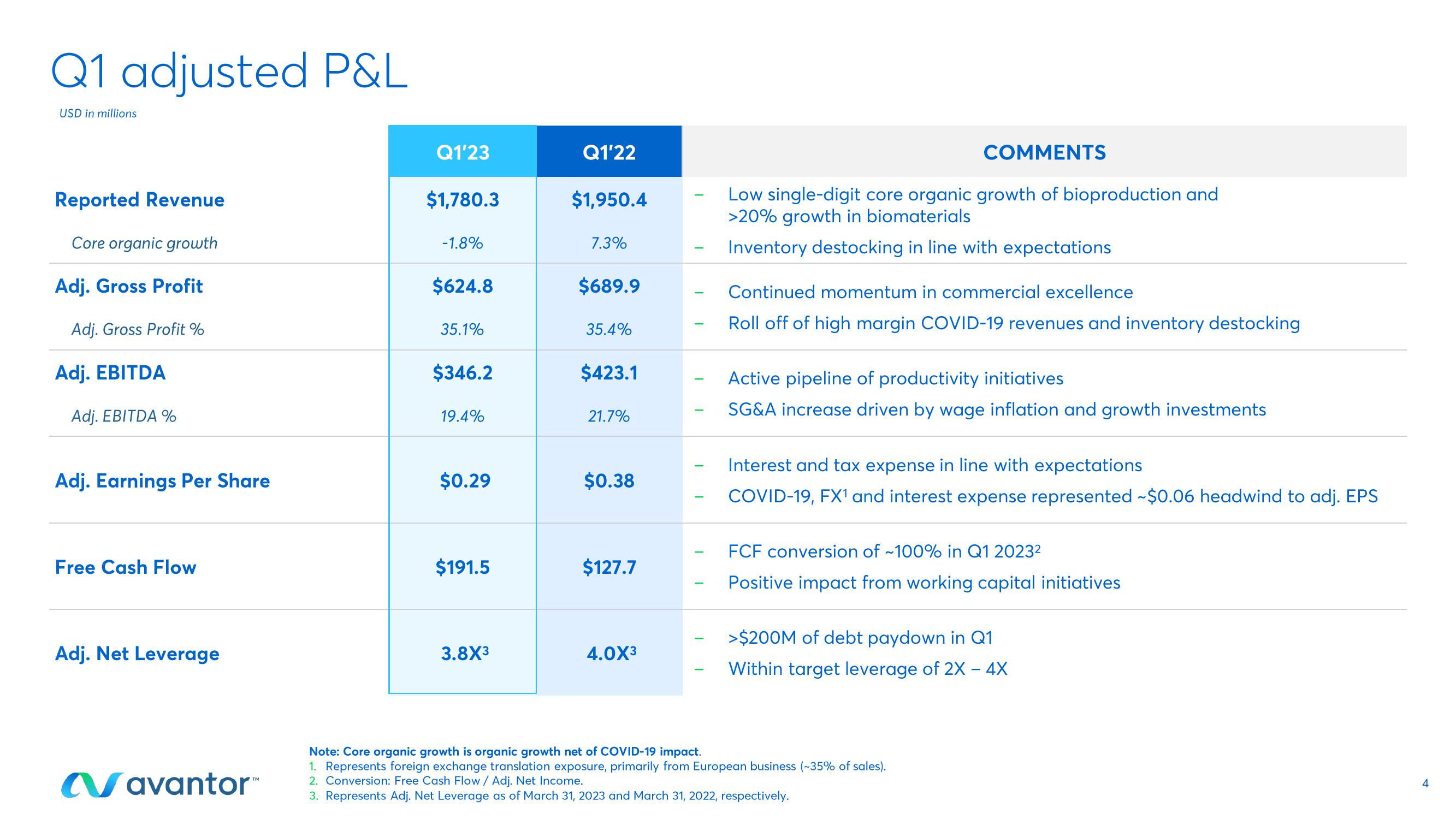

Q1 adjusted P&L

USD in millions

Reported Revenue

Core organic growth

Adj. Gross Profit

Adj. Gross Profit %

Adj. EBITDA

Adj. EBITDA %

Adj. Earnings Per Share

Free Cash Flow

Adj. Net Leverage

Navantor™

Q1'23

$1,780.3

-1.8%

$624.8

35.1%

$346.2

19.4%

$0.29

$191.5

3.8X3

Q1'22

$1,950.4

7.3%

$689.9

35.4%

$423.1

21.7%

$0.38

$127.7

4.0X³

T

COMMENTS

Low single-digit core organic growth of bioproduction and

>20% growth in biomaterials

Inventory destocking in line with expectations

Continued momentum in commercial excellence

Roll off of high margin COVID-19 revenues and inventory destocking

Active pipeline of productivity initiatives

SG&A increase driven by wage inflation and growth investments

Interest and tax expense in line with expectations

COVID-19, FX¹ and interest expense represented ~$0.06 headwind to adj. EPS

FCF conversion of ~100% in Q1 2023²

Positive impact from working capital initiatives

>$200M of debt paydown in Q1

Within target leverage of 2X - 4X

Note: Core organic growth is organic growth net of COVID-19 impact.

1. Represents foreign exchange translation exposure, primarily from European business (~35% of sales).

2. Conversion: Free Cash Flow / Adj. Net Income.

3. Represents Adj. Net Leverage as of March 31, 2023 and March 31, 2022, respectively.

4View entire presentation