Oatly Results Presentation Deck

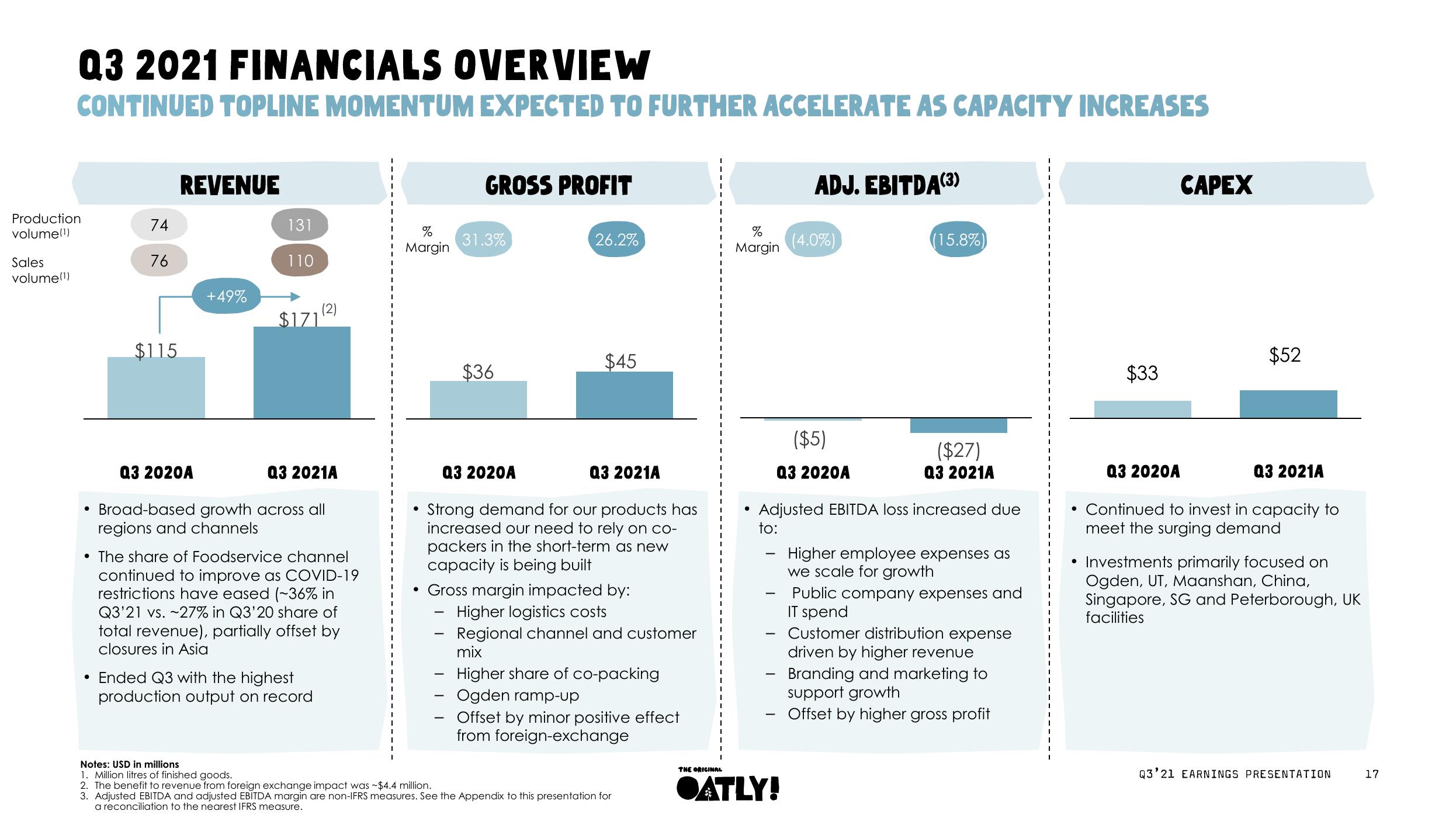

Q3 2021 FINANCIALS OVERVIEW

CONTINUED TOPLINE MOMENTUM EXPECTED TO FURTHER ACCELERATE AS CAPACITY INCREASES

Production

volume(¹)

Sales

volume(1)

●

74

76

$115

REVENUE

Q3 2020A

+49%

131

110

$171(2)

Q3 2021A

Broad-based growth across all

regions and channels

• The share of Foodservice channel

continued to improve as COVID-19

restrictions have eased (~36% in

Q3'21 vs. -27% in Q3'20 share of

total revenue), partially offset by

closures in Asia

• Ended Q3 with the highest

production output on record

%

Margin

●

-

-

GROSS PROFIT

-

31.3%

Q3 2020A

Q3 2021A

Strong demand for our products has

increased our need to rely on co-

packers in the short-term as new

capacity is being built

• Gross margin impacted by:

$36

26.2%

$45

Higher logistics costs

Regional channel and customer

mix

Higher share of co-packing

Ogden ramp-up

Offset by minor positive effect

from foreign-exchange

Notes: USD in millions

1. Million litres of finished goods.

2. The benefit to revenue from foreign exchange impact was ~$4.4 million.

3. Adjusted EBITDA and adjusted EBITDA margin are non-IFRS measures. See the Appendix to this presentation for

a reconciliation to the nearest IFRS measure.

THE ORIGINAL

%

Margin

●

-

-

ADJ. EBITDA(3)

(4.0%)

($5)

Q3 2020A

●ATLY!

Adjusted EBITDA loss increased due

to:

(15.8%)

($27)

Q3 2021A

Higher employee expenses as

we scale for growth

Public company expenses and

IT spend

Customer distribution expense

driven by higher revenue

Branding and marketing to

support growth

Offset by higher gross profit

$33

CAPEX

Q3 2020A

$52

Q3 2021A

• Continued to invest in capacity to

meet the surging demand

• Investments primarily focused on

Ogden, UT, Maanshan, China,

Singapore, SG and Peterborough, UK

facilities

Q3'21 EARNINGS PRESENTATION

17View entire presentation