Silicon Valley Bank Results Presentation Deck

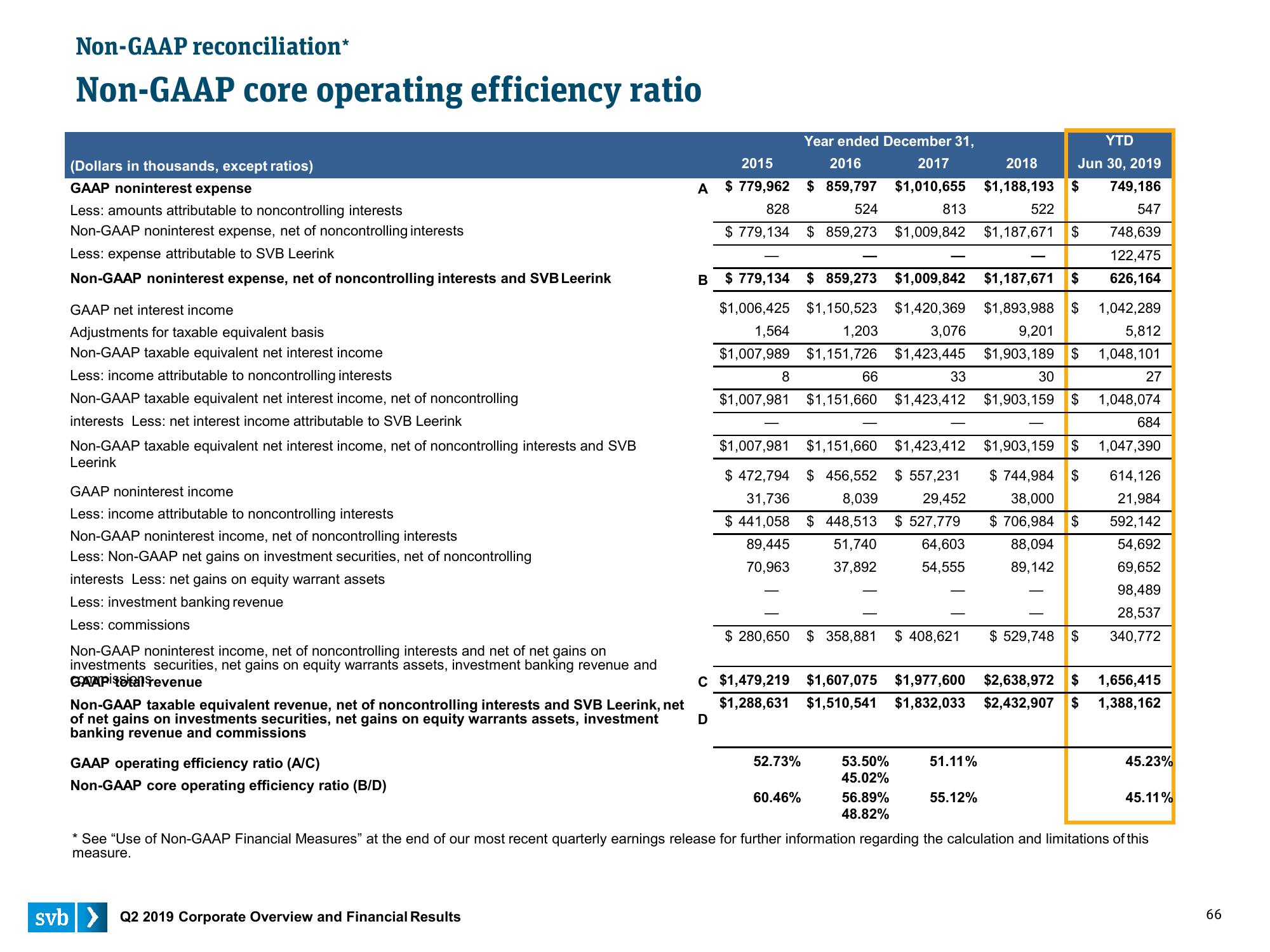

Non-GAAP reconciliation*

Non-GAAP core operating efficiency ratio

(Dollars in thousands, except ratios)

GAAP noninterest expense

Less: amounts attributable to noncontrolling interests

Non-GAAP noninterest expense, net of noncontrolling interests

Less: expense attributable to SVB Leerink

Non-GAAP noninterest expense, net of noncontrolling interests and SVB Leerink

GAAP net interest income

Adjustments for taxable equivalent basis

Non-GAAP taxable equivalent net interest income

Less: income attributable to noncontrolling interests

Non-GAAP taxable equivalent net interest income, net of noncontrolling

interests Less: net interest income attributable to SVB Leerink

Non-GAAP taxable equivalent net interest income, net of noncontrolling interests and SVB

Leerink

GAAP noninterest income

Less: income attributable to noncontrolling interests

Non-GAAP noninterest income, net of noncontrolling interests

Less: Non-GAAP net gains on investment securities, net of noncontrolling

interests Less: net gains on equity warrant assets

Less: investment banking revenue

Less: commissions

Non-GAAP noninterest income, net of noncontrolling interests and net of net gains on

investments securities, net gains on equity warrants assets, investment banking revenue and

GAVPistal revenue

Non-GAAP taxable equivalent revenue, net of noncontrolling interests and SVB Leerink, net

of net gains on investments securities, net gains on equity warrants assets, investment

banking revenue and commissions

GAAP operating efficiency ratio (A/C)

Non-GAAP core operating efficiency ratio (B/D)

A

svb> Q2 2019 Corporate Overview and Financial Results

B

Year ended December 31,

2015

$ 779,962

828

2016

$859,797

524

$ 779,134 $ 859,273

D

8

$779,134 $ 859,273 $1,009,842 $1,187,671 $

$1,006,425 $1,150,523 $1,420,369 $1,893,988 $

1,564

1,203

3,076

9,201

$1,007,989 $1,151,726 $1,423,445 $1,903,189 $

66

YTD

2017

2018 Jun 30, 2019

$1,010,655 $1,188,193 $ 749,186

813

547

$1,009,842 $1,187,671 $ 748,639

122,475

626,164

1,042,289

5,812

1,048, 101

27

$1,007,981 $1,151,660 $1,423,412

$1,007,981 $1,151,660 $1,423,412

$ 472,794 $ 456,552 $ 557,231

31,736

8,039

29,452

$441,058 $448,513 $ 527,779

89,445 51,740

64,603

70,963 37,892

54,555

52.73%

C $1,479,219 $1,607,075 $1,977,600

$1,288,631 $1,510,541 $1,832,033

60.46%

33

53.50%

45.02%

56.89%

48.82%

$ 280,650 $ 358,881 $ 408,621 $529,748 $

522

51.11%

55.12%

30

$1,903,159 $

$1,903,159 $

$744,984 $

38,000

$706,984 $

88,094

89,142

$2,638,972 $

$2,432,907 $

1,048,074

684

1,047,390

614,126

21,984

592,142

54,692

69,652

98,489

28,537

340,772

1,656,415

1,388,162

45.23%

45.11%

See "Use of Non-GAAP Financial Measures" at the end of our most recent quarterly earnings release for further information regarding the calculation and limitations of this

measure.

66View entire presentation