First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

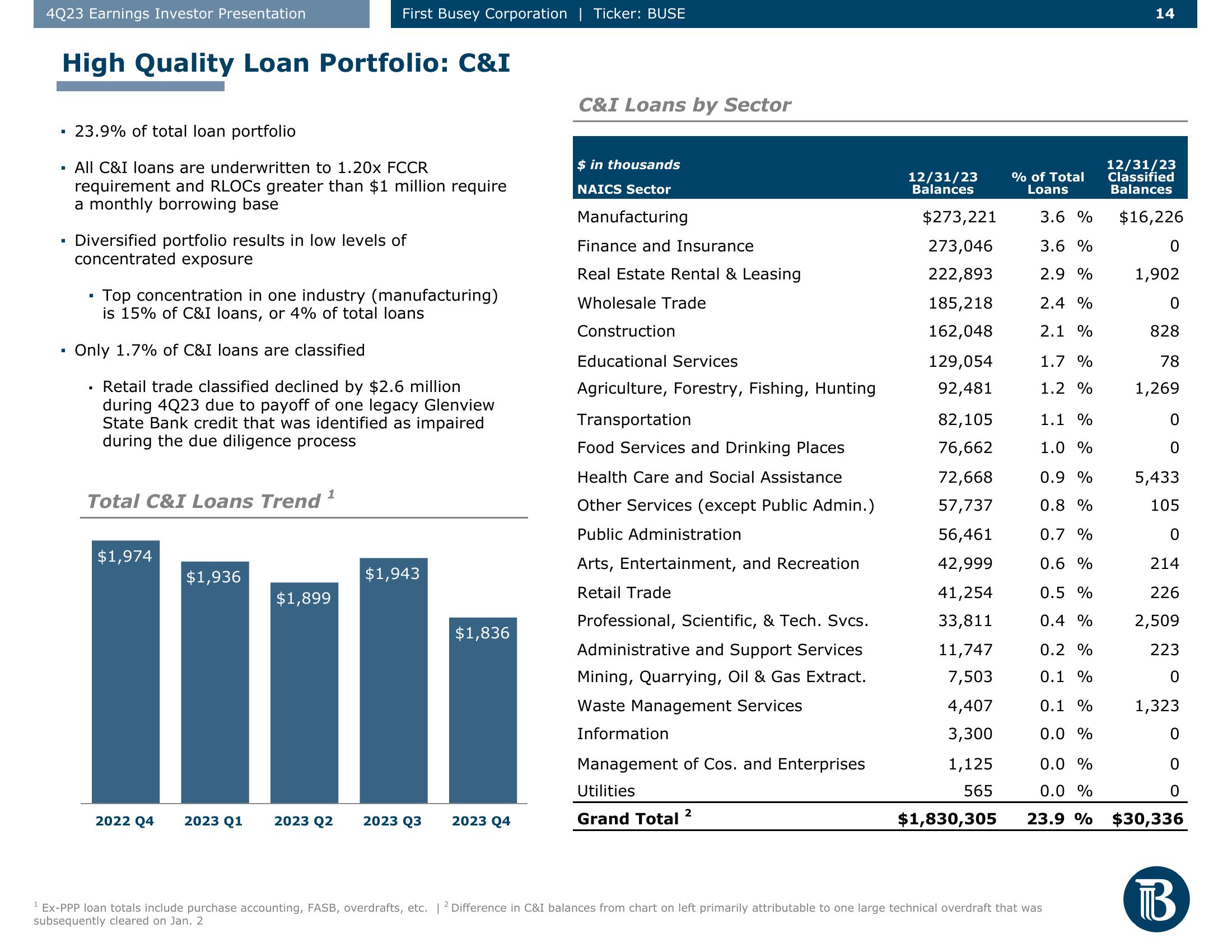

High Quality Loan Portfolio: C&I

■

■

23.9% of total loan portfolio

All C&I loans are underwritten to 1.20x FCCR

requirement and RLOCS greater than $1 million require

a monthly borrowing base

First Busey Corporation | Ticker: BUSE

Diversified portfolio results in low levels of

concentrated exposure

Top concentration in one industry (manufacturing)

is 15% of C&I loans, or 4% of total loans

Only 1.7% of C&I loans are classified

Retail trade classified declined by $2.6 million

during 4Q23 due to payoff of one legacy Glenview

State Bank credit that was identified as impaired

during the due diligence process

Total C&I Loans Trend ¹

$1,974

$1,936

$1,899

$1,943

2022 Q4 2023 Q1 2023 Q2 2023 Q3

$1,836

2023 Q4

C&I Loans by Sector

$ in thousands

NAICS Sector

Manufacturing

Finance and Insurance

Real Estate Rental & Leasing

Wholesale Trade

Construction

Educational Services

Agriculture, Forestry, Fishing, Hunting

Transportation

Food Services and Drinking Places

Health Care and Social Assistance

Other Services (except Public Admin.)

Public Administration

Arts, Entertainment, and Recreation

Retail Trade

Professional, Scientific, & Tech. Svcs.

Administrative and Support Services

Mining, Quarrying, Oil & Gas Extract.

Waste Management Services

Information

Management of Cos. and Enterprises

Utilities

Grand Total

2

12/31/23

Balances

$273,221

273,046

222,893

185,218

162,048

129,054

92,481

82,105

76,662

72,668

57,737

56,461

42,999

41,254

33,811

11,747

7,503

4,407

3,300

1,125

565

$1,830,305

% of Total

Loans

3.6 %

3.6 %

2.9 %

2.4 %

2.1 %

1.7 %

1.2 %

1.1 %

1.0 %

0.9 %

0.8 %

0.7 %

0.6 %

0.5 %

0.4 %

0.2 %

0.1 %

0.1 %

0.0 %

14

¹ Ex-PPP loan totals include purchase accounting, FASB, overdrafts, etc. | ² Difference in C&I balances from chart on left primarily attributable to one large technical overdraft that was

subsequently cleared on Jan. 2

12/31/23

Classified

Balances

$16,226

0

1,902

0

828

78

1,269

0

0

5,433

105

0

214

226

2,509

223

1,323

0

0.0 %

0.0 %

23.9 % $30,336

BView entire presentation