Jefferies Financial Group Investor Presentation Deck

A

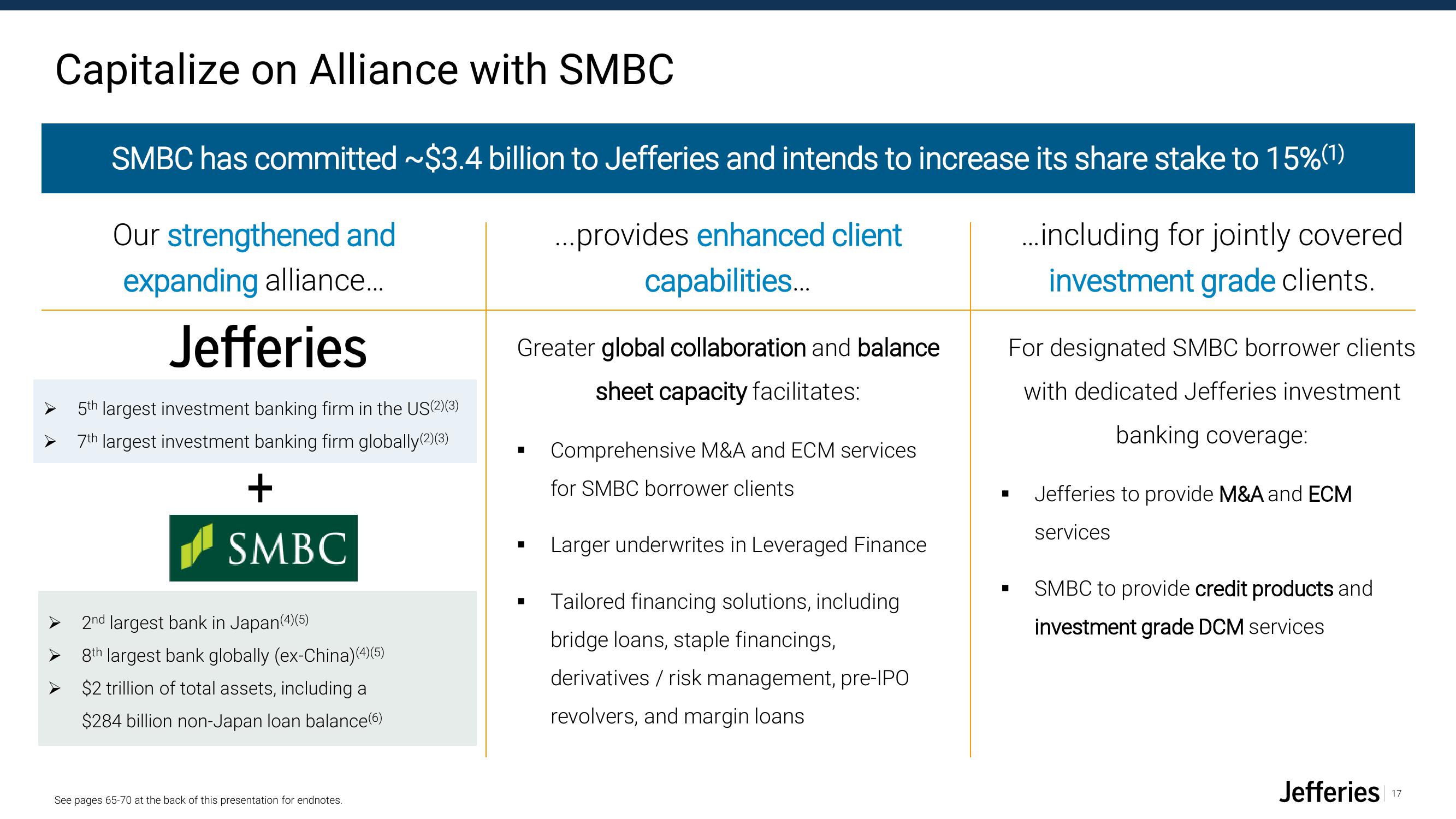

Capitalize on Alliance with SMBC

SMBC has committed ~$3.4 billion to Jefferies and intends to increase its share stake to 15%(1)

Our strengthened and

expanding alliance...

Jefferies

...provides enhanced client

capabilities...

...including for jointly covered

investment grade clients.

5th largest investment banking firm in the US(2)(3)

7th largest investment banking firm globally(2)(3)

+

SMBC

2nd largest bank in Japan(4)(5)

8th largest bank globally (ex-China)(4)(5)

$2 trillion of total assets, including a

$284 billion non-Japan loan balance(6)

See pages 65-70 at the back of this presentation for endnotes.

Greater global collaboration and balance

sheet capacity facilitates:

■

■

Comprehensive M&A and ECM services

for SMBC borrower clients

Larger underwrites in Leveraged Finance

Tailored financing solutions, including

bridge loans, staple financings,

derivatives / risk management, pre-IPO

revolvers, and margin loans.

For designated SMBC borrower clients

with dedicated Jefferies investment

banking coverage:

■ Jefferies to provide M&A and ECM

services

I

SMBC to provide credit products and

investment grade DCM services

Jefferies

17View entire presentation