Sonos Results Presentation Deck

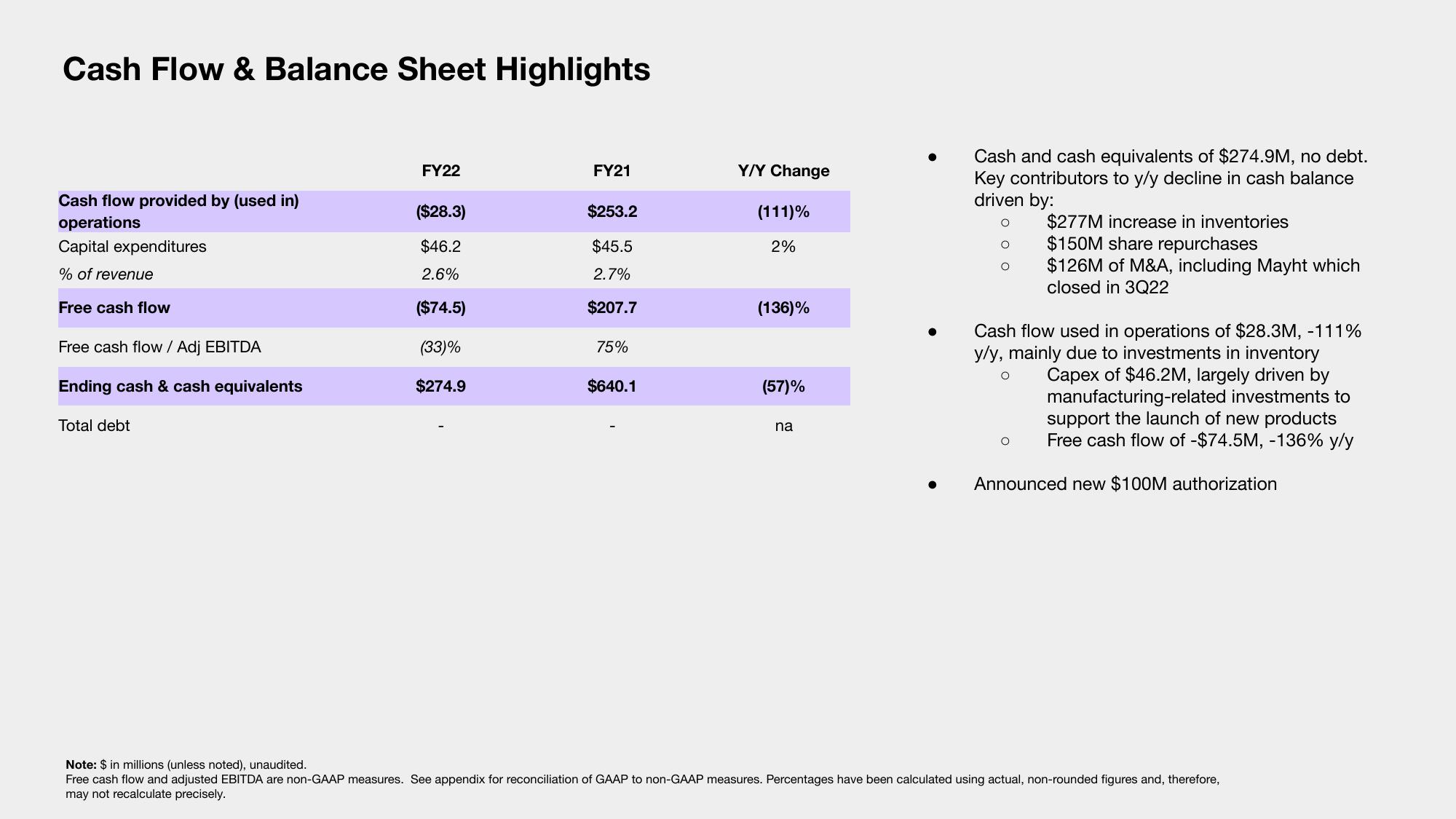

Cash Flow & Balance Sheet Highlights

Cash flow provided by (used in)

operations

Capital expenditures

% of revenue

Free cash flow

Free cash flow / Adj EBITDA

Ending cash & cash equivalents

Total debt

FY22

($28.3)

$46.2

2.6%

($74.5)

(33)%

$274.9

FY21

$253.2

$45.5

2.7%

$207.7

75%

$640.1

Y/Y Change

(111)%

2%

(136)%

(57)%

na

Cash and cash equivalents of $274.9M, no debt.

Key contributors to y/y decline in cash balance

driven by:

O

O

Cash flow used in operations of $28.3M, -111%

y/y, mainly due to investments in inventory

Capex of $46.2M, largely driven by

manufacturing-related investments to

support the launch of new products

Free cash flow of -$74.5M, -136% y/y

O

$277M increase in inventories

$150M share repurchases

$126M of M&A, including Mayht which

closed in 3Q22

O

Announced new $100M authorization

Note: $ in millions (unless noted), unaudited.

Free cash flow and adjusted EBITDA are non-GAAP measures. See appendix for reconciliation of GAAP non-GAAP measures. Percentages have been calculated using actual, non-rounded figures and, therefore,

may not recalculate precisely.View entire presentation