Citi Investment Banking Pitch Book

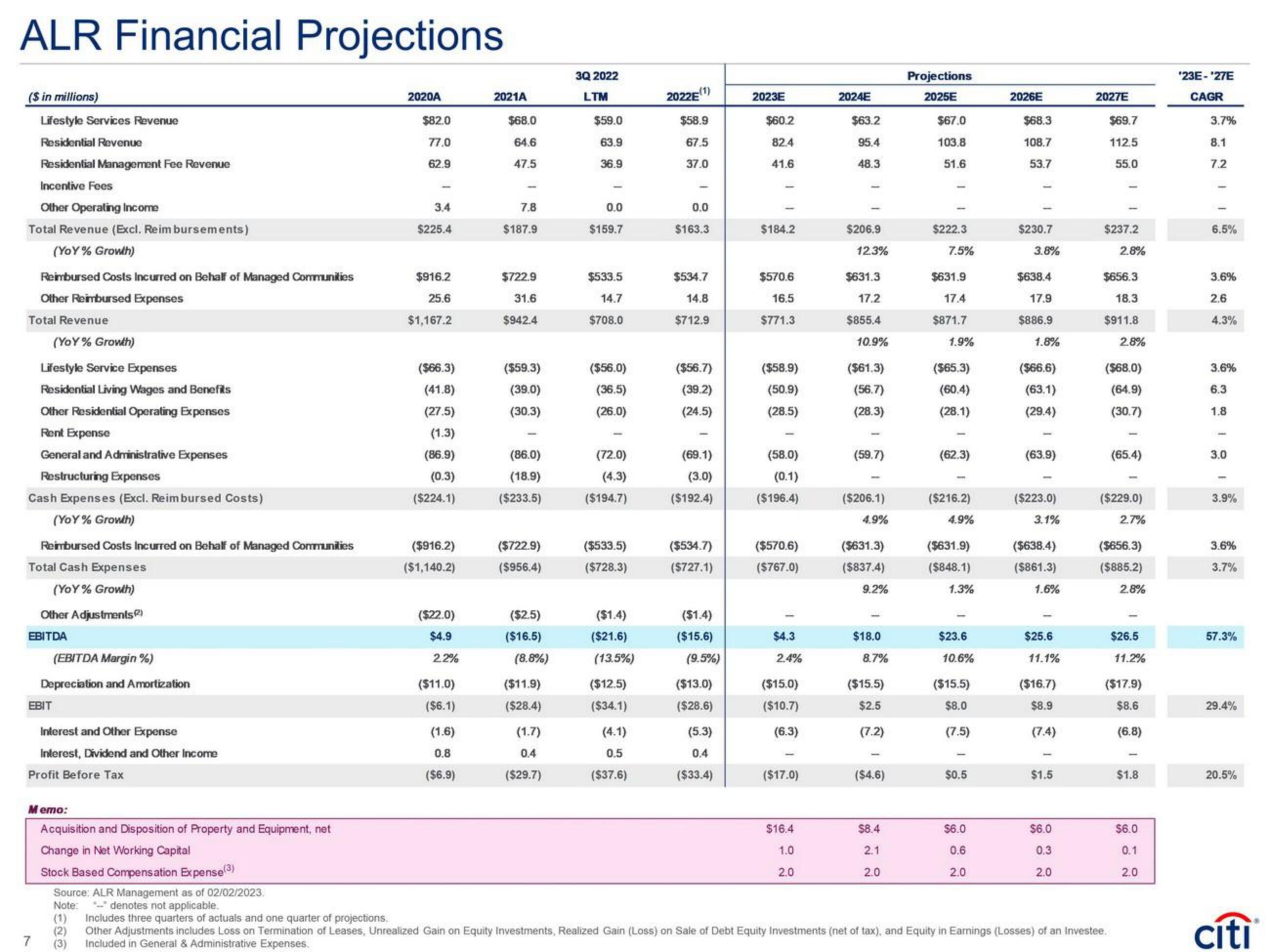

ALR Financial Projections

($ in millions)

Lifestyle Services Revenue

Residential Revenue

Residential Management Fee Revenue

Incentive Fees

Other Operating Income

Total Revenue (Excl. Reimbursements)

(YoY% Growth)

Reimbursed Costs Incurred on Behalf of Managed Communities

Other Reimbursed Expenses

Total Revenue

(Yo Y% Growth)

Lifestyle Service Expenses

Residential Living Wages and Benefits

Other Residential Operating Expenses

Rent Expense

General and Administrative Expenses

Restructuring Expenses

Cash Expenses (Excl. Reimbursed Costs)

(YoY% Growth)

Reimbursed Costs Incurred on Behalf of Managed Communities

Total Cash Expenses

(Yo Y% Growth)

Other Adjustments)

EBITDA

(EBITDA Margin %)

Depreciation and Amortization

EBIT

7

Interest and Other Expense

Interest, Dividend and Other Income

Profit Before Tax

Memo:

Acquisition and Disposition of Property and Equipment, net

Change in Net Working Capital

Stock Based Compensation Expense(3)

Source: ALR Management as of 02/02/2023.

Note:

- denotes not applicable.

2020A

$82.0

77.0

62.9

3.4

$225.4

$916.2

25.6

$1,167.2

($66.3)

(41.8)

(27.5)

(1.3)

(86.9)

(0.3)

($224.1)

($916.2)

($1,140.2)

($22.0)

$4.9

2.2%

($11.0)

($6.1)

(1.6)

0.8

($6.9)

2021A

$68.0

64.6

47.5

7.8

$187.9

$722.9

31.6

$942.4

($59.3)

(39.0)

(30.3)

(86.0)

(18.9)

($233.5)

($722.9)

($956.4)

($2.5)

($16.5)

(8.8%)

($11.9)

($28.4)

(1.7)

0.4

($29.7)

3Q 2022

LTM

$59.0

63.9

36.9

1

0.0

$159.7

$533.5

14.7

$708.0

($56.0)

(36.5)

(26.0)

(72.0)

(4.3)

($194.7)

($533.5)

($728.3)

($1.4)

($21.6)

(13.5%)

($12.5)

($34.1)

(4.1)

0.5

($37.6)

-(1)

2022E

$58.9

67.5

37.0

0.0

$163.3

$534.7

14.8

$712.9

($56.7)

(39.2)

(24.5)

(69.1)

(3.0)

($192.4)

($534.7)

($727.1)

($1.4)

($15.6)

(9.5%)

($13.0)

($28.6)

(5.3)

0.4

($33.4)

2023E

$60.2

82.4

41.6

$184.2

$570.6

16.5

$771.3

($58.9)

(50.9)

(28.5)

(58.0)

(0.1)

($196.4)

($570.6)

($767.0)

$4.3

2.4%

($15.0)

($10.7)

(6.3)

($17.0)

$16.4

1.0

2.0

2024E

$63.2

95.4

48.3

$206.9

12.3%

$631.3

17.2

$855.4

10.9%

($61.3)

(56.7)

(28.3)

(59.7)

($206.1)

4.9%

($631.3)

($837.4)

9.2%

$18.0

8.7%

($15.5)

$2.5

(7.2)

($4.6)

$8.4

2.1

2.0

Projections

2025E

$67.0

103.8

51.6

$222.3

7.5%

$631.9

17.4

$871.7

1.9%

($65.3)

(60.4)

(28.1)

(62.3)

($216.2)

4.9%

($631.9)

($848.1)

1.3%

$23.6

10.6%

($15.5)

$8.0

(7.5)

$0.5

$6.0

0.6

2.0

2026E

$68.3

108.7

53.7

$230.7

3.8%

$638.4

17.9

$886.9

1.8%

($66.6)

(63.1)

(29.4)

(63.9)

($223.0)

3.1%

($638.4)

($861.3)

1.6%

$25.6

11.1%

($16.7)

$8.9

(7.4)

$1.5

$6.0

0.3

2.0

2027E

$69.7

112.5

55.0

$237.2

2.8%

$656.3

18.3

$911.8

2.8%

($68.0)

(64.9)

(30.7)

(65.4)

($229.0)

(1) Includes three quarters of actuals and one quarter of projections.

(2) Other Adjustments includes Loss on Termination of Leases, Unrealized Gain on Equity Investments, Realized Gain (Loss) on Sale of Debt Equity Investments (net of tax), and Equity in Earnings (Losses) of an Investee.

(3) Included in General & Administrative Expenses.

2.7%

($656.3)

($885.2)

2.8%

$26.5

11.2%

($17.9)

$8.6

(6.8)

$1.8

$6.0

0.1

2.0

'23E-'27E

CAGR

3.7%

8.1

7.2

6.5%

3.6%

2.6

4.3%

3.6%

6.3

1.8

3.0

3.9%

3.6%

3.7%

57.3%

29.4%

20.5%

cítiView entire presentation