Plastiq SPAC Presentation Deck

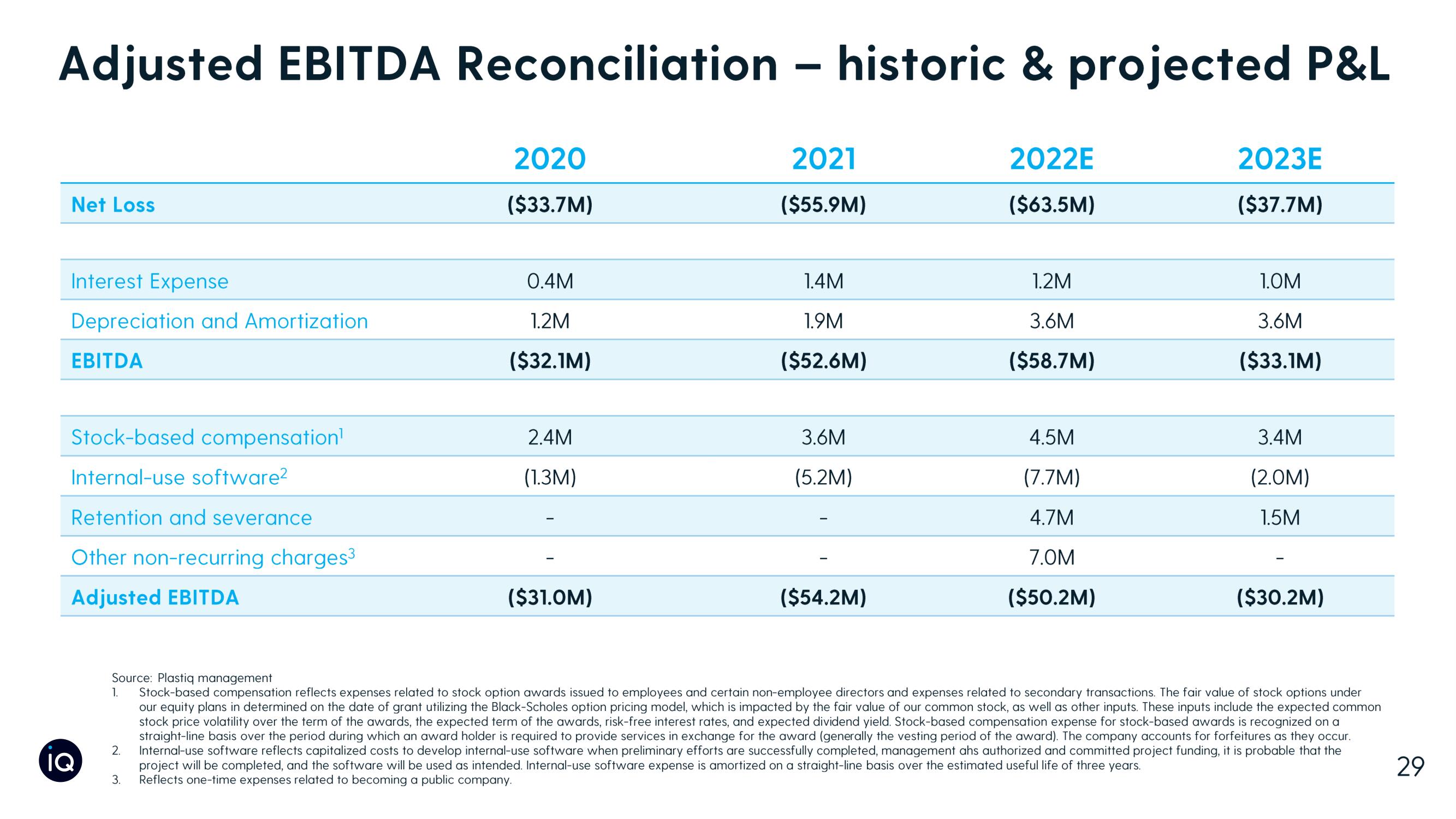

Adjusted EBITDA Reconciliation - historic & projected P&L

Net Loss

Interest Expense

Depreciation and Amortization

EBITDA

Stock-based compensation¹

Internal-use software²

Retention and severance

Other non-recurring charges³

Adjusted EBITDA

IQ

2020

($33.7M)

0.4M

1.2M

($32.1M)

3.

2.4M

(1.3M)

($31.0M)

2021

($55.9M)

1.4M

1.9M

($52.6M)

3.6M

(5.2M)

($54.2M)

2022E

($63.5M)

1.2M

3.6M

($58.7M)

4.5M

(7.7M)

4.7M

7.0M

($50.2M)

2023E

($37.7M)

1.0M

3.6M

($33.1M)

3.4M

(2.0M)

1.5M

($30.2M)

Source: Plastiq management

1. Stock-based compensation reflects expenses related to stock option awards issued to employees and certain non-employee directors and expenses related to secondary transactions. The fair value of stock options under

our equity plans in determined on the date of grant utilizing the Black-Scholes option pricing model, which is impacted by the fair value of our common stock, as well as other inputs. These inputs include the expected common

stock price volatility over the term of the awards, the expected term of the awards, risk-free interest rates, and expected dividend yield. Stock-based compensation expense for stock-based awards is recognized on a

straight-line basis over the period during which an award holder is required to provide services in exchange for the award (generally the vesting period of the award). The company accounts for forfeitures as they occur.

2. Internal-use software reflects capitalized costs to develop internal-use software when preliminary efforts are successfully completed, management ahs authorized and committed project funding, it is probable that the

project will be completed, and the software will be used as intended. Internal-use software expense is amortized on a straight-line basis over the estimated useful life of three years.

Reflects one-time expenses related to becoming a public company.

29View entire presentation