First Merchants Results Presentation Deck

Non-GAAP

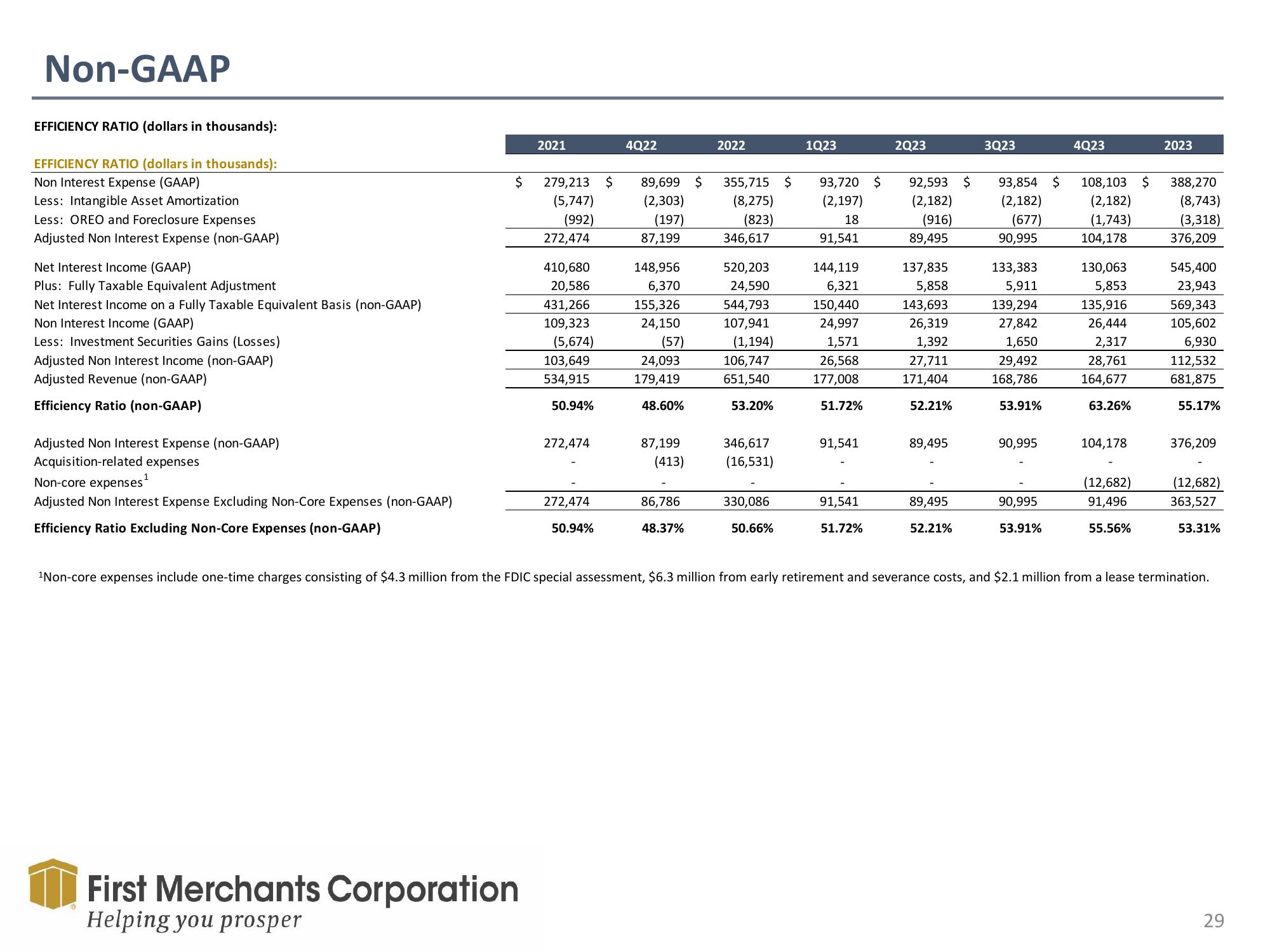

EFFICIENCY RATIO (dollars in thousands):

EFFICIENCY RATIO (dollars in thousands):

Non Interest Expense (GAAP)

Less: Intangible Asset Amortization

Less: OREO and Foreclosure Expenses

Adjusted Non Interest Expense (non-GAAP)

Net Interest Income (GAAP)

Plus: Fully Taxable Equivalent Adjustment

Net Interest Income on a Fully Taxable Equivalent Basis (non-GAAP)

Non Interest Income (GAAP)

Less: Investment Securities Gains (Losses)

Adjusted Non Interest Income (non-GAAP)

Adjusted Revenue (non-GAAP)

Efficiency Ratio (non-GAAP)

Adjusted Non Interest Expense (non-GAAP)

Acquisition-related expenses

Non-core expenses ¹

1

Adjusted Non Interest Expense Excluding Non-Core Expenses (non-GAAP)

Efficiency Ratio Excluding Non-Core Expenses (non-GAAP)

2021

$ 279,213 $

(5,747)

(992)

First Merchants Corporation

Helping you prosper

272,474

410,680

20,586

431,266

109,323

(5,674)

103,649

534,915

50.94%

272,474

272,474

50.94%

4Q22

89,699 $

(2,303)

(197)

87,199

148,956

6,370

155,326

24,150

(57)

24,093

179,419

48.60%

87,199

(413)

86,786

48.37%

2022

355,715

(8,275)

(823)

346,617

520,203

24,590

544,793

107,941

(1,194)

106,747

651,540

53.20%

346,617

(16,531)

330,086

50.66%

$

1Q23

93,720 $

(2,197)

18

91,541

144,119

6,321

150,440

24,997

1,571

26,568

177,008

51.72%

91,541

91,541

51.72%

2023

92,593 $

(2,182)

(916)

89,495

137,835

5,858

143,693

26,319

1,392

27,711

171,404

52.21%

89,495

89,495

52.21%

3Q23

93,854 $

(2,182)

(677)

90,995

133,383

5,911

139,294

27,842

1,650

29,492

168,786

53.91%

90,995

90,995

53.91%

4Q23

108,103 $

(2,182)

(1,743)

104,178

130,063

5,853

135,916

26,444

2,317

28,761

164,677

63.26%

104,178

(12,682)

91,496

55.56%

2023

388,270

(8,743)

(3,318)

376,209

545,400

23,943

569,343

105,602

6,930

112,532

681,875

55.17%

376,209

(12,682)

363,527

53.31%

¹Non-core expenses include one-time charges consisting of $4.3 million from the FDIC special assessment, $6.3 million from early retirement and severance costs, and $2.1 million from a lease termination.

29View entire presentation