jetBlue Mergers and Acquisitions Presentation Deck

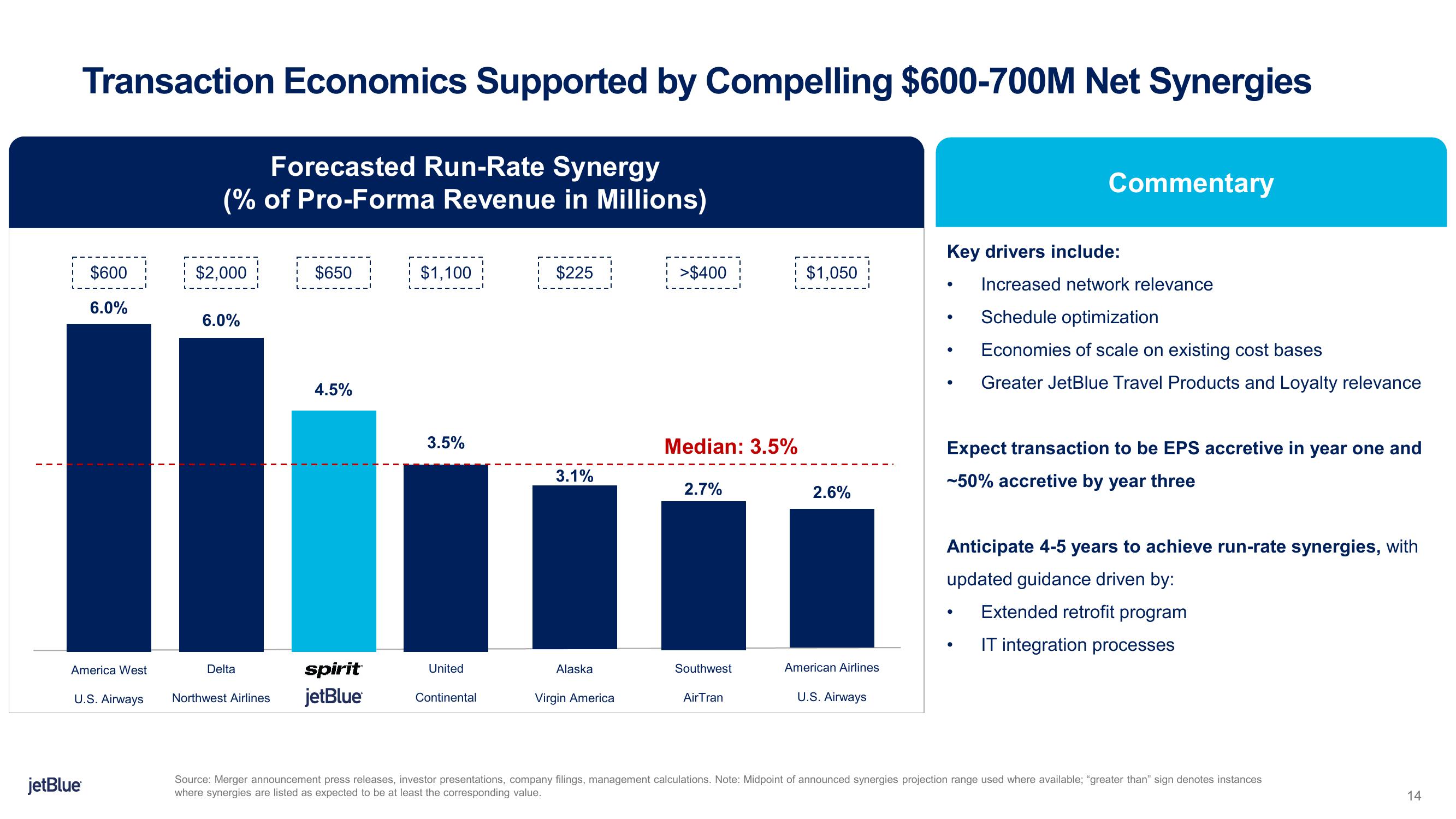

Transaction Economics Supported by Compelling $600-700M Net Synergies

$600

6.0%

America West

jetBlue

U.S. Airways

Forecasted Run-Rate Synergy

(% of Pro-Forma Revenue in Millions)

$2,000

6.0%

Delta

Northwest Airlines

$650

4.5%

spirit

jetBlue

$1,100

3.5%

United

Continental

$225

3.1%

Alaska

Virgin America

>$400

Median: 3.5%

2.7%

Southwest

Air Tran

$1,050

2.6%

American Airlines

U.S. Airways

Key drivers include:

●

●

●

Commentary

Increased network relevance

Schedule optimization

Economies of scale on existing cost bases

Greater JetBlue Travel Products and Loyalty relevance

Expect transaction to be EPS accretive in year one and

-50% accretive by year three

●

Anticipate 4-5 years to achieve run-rate synergies, with

updated guidance driven by:

Extended retrofit program

IT integration processes

Source: Merger announcement press releases, investor presentations, company filings, management calculations. Note: Midpoint of announced synergies projection range used where available; "greater than" sign denotes instances

where synergies are listed as expected to be at least the corresponding value.

14View entire presentation