Vici Investor Presentation

RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES

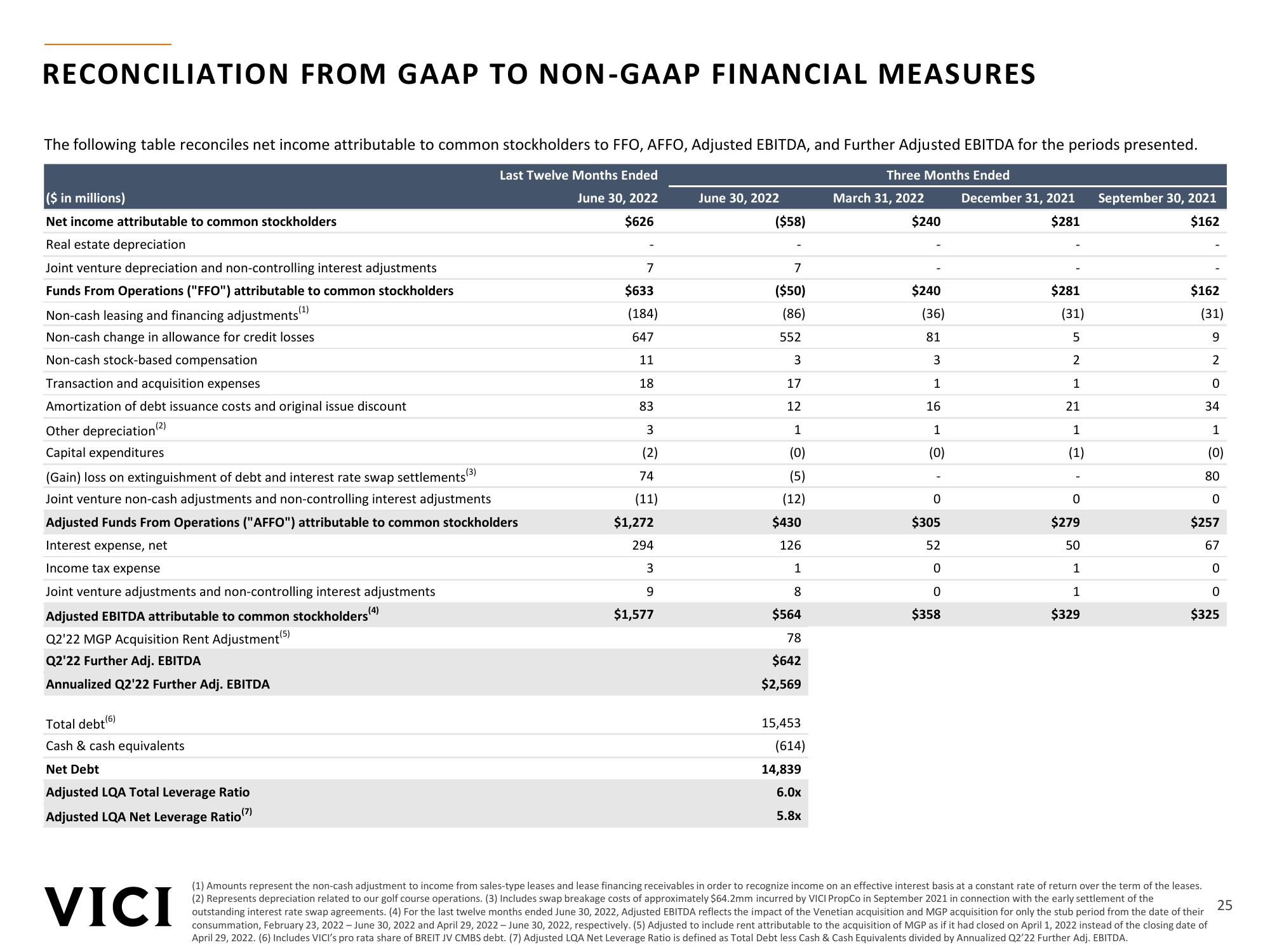

The following table reconciles net income attributable to common stockholders to FFO, AFFO, Adjusted EBITDA, and Further Adjusted EBITDA for the periods presented.

Last Twelve Months Ended

Three Months Ended

June 30, 2022

$626

($ in millions)

Net income attributable to common stockholders

Real estate depreciation

Joint venture depreciation and non-controlling interest adjustments

Funds From Operations ("FFO") attributable to common stockholders

(1)

Non-cash leasing and financing adjustments ¹¹

Non-cash change in allowance for credit losses

Non-cash stock-based compensation

Transaction and acquisition expenses

Amortization of debt issuance costs and original issue discount

Other depreciation (2)

Capital expenditures

(Gain) loss on extinguishment of debt and interest rate swap settlements (³)

Joint venture non-cash adjustments and non-controlling interest adjustments

Adjusted Funds From Operations ("AFFO") attributable to common stockholders

Interest expense, net

Income tax expense

Joint venture adjustments and non-controlling interest adjustments

Adjusted EBITDA attributable to common stockholders"

Q2'22 MGP Acquisition Rent Adjustment (5)

Q2'22 Further Adj. EBITDA

Annualized Q2'22 Further Adj. EBITDA

Total debt (6)

Cash & cash equivalents

Net Debt

Adjusted LQA Total Leverage Ratio

Adjusted LQA Net Leverage Ratio (7)

VICI

(4)

7

$633

(184)

647

11

18

83

3

(2)

74

(11)

$1,272

294

3

9

$1,577

June 30, 2022

($58)

-

7

($50)

(86)

552

3

17

12

1

(0)

(5)

(12)

$430

126

1

8

$564

78

$642

$2,569

15,453

(614)

14,839

6.0x

5.8x

March 31, 2022

$240

$240

(36)

81

3

1

16

1

(0)

0

$305

52

0

0

$358

December 31, 2021 September 30, 2021

$281

$162

$281

(31)

5

2

1

21

1

(1)

0

$279

50

1

1

$329

$162

(31)

9

2

0

34

1

(0)

80

0

$257

67

0

0

$325

(1) Amounts represent the non-cash adjustment to income from sales-type leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases.

(2) Represents depreciation related to our golf course operations. (3) Includes swap breakage costs of approximately $64.2mm incurred by VICI PropCo in September 2021 in connection with the early settlement of the

outstanding interest rate swap agreements. (4) For the last twelve months ended June 30, 2022, Adjusted EBITDA reflects the impact of the Venetian acquisition and MGP acquisition for only the stub period from the date of their

consummation, February 23, 2022 - June 30, 2022 and April 29, 2022 - June 30, 2022, respectively. (5) Adjusted to include rent attributable to the acquisition of MGP as if it had closed on April 1, 2022 instead of the closing date of

April 29, 2022. (6) Includes VICI's pro rata share of BREIT JV CMBS debt. (7) Adjusted LQA Net Leverage Ratio is defined as Total Debt less Cash & Cash Equivalents divided by Annualized Q2'22 Further Adj. EBITDA.

25View entire presentation