Fort Capital Investment Banking Pitch Book

Other Considerations

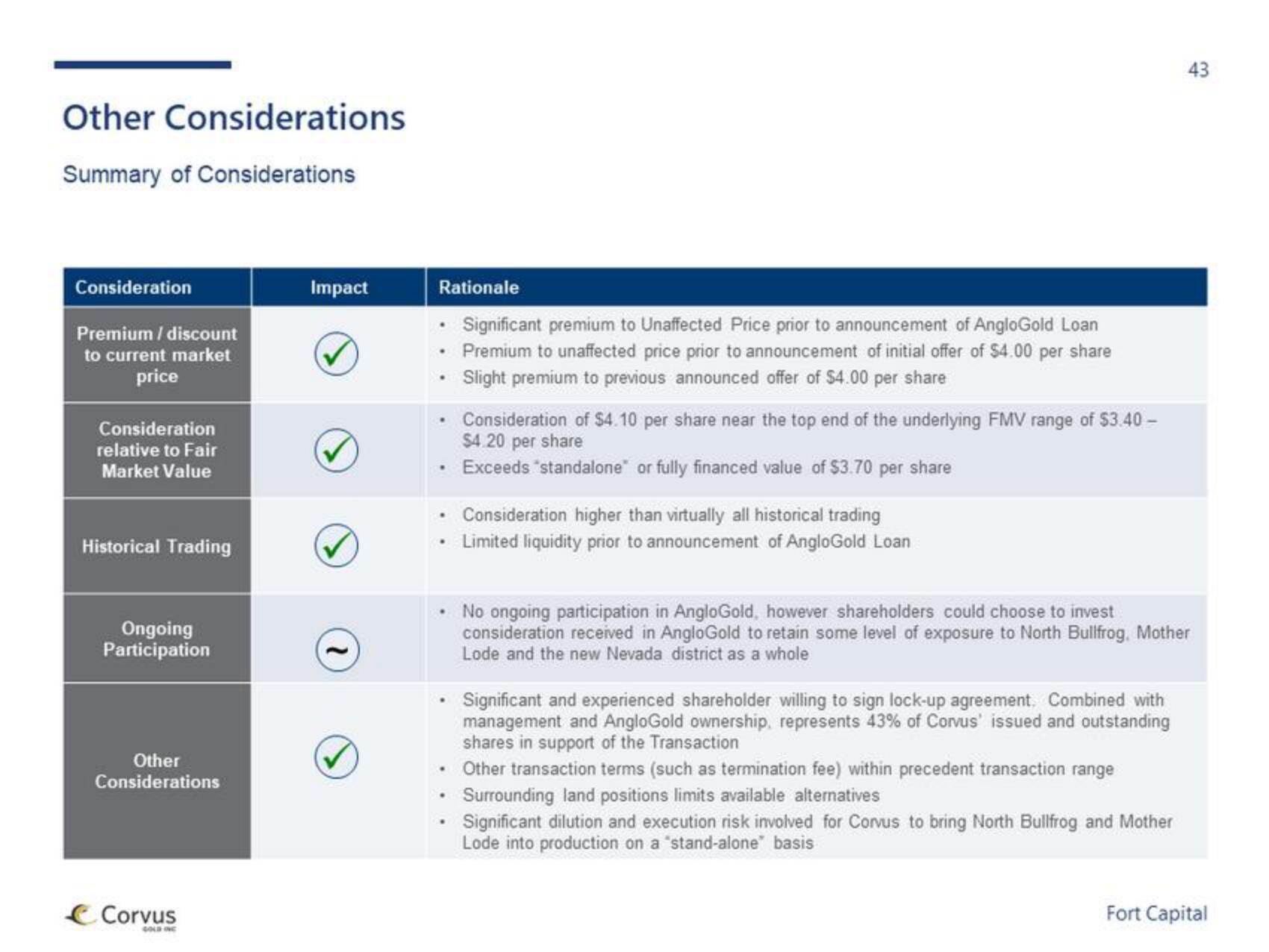

Summary of Considerations

Consideration

Premium / discount

to current market

price

Consideration

relative to Fair

Market Value

Historical Trading

Ongoing

Participation

Other

Considerations

Corvus

Impact

Rationale

.

.

.

.

Significant premium to Unaffected Price prior to announcement of AngloGold Loan

Premium to unaffected price prior to announcement of initial offer of $4.00 per share

Slight premium to previous announced offer of $4.00 per share

.

Consideration of $4.10 per share near the top end of the underlying FMV range of $3.40 -

$4.20 per share

Exceeds "standalone or fully financed value of $3.70 per share

Consideration higher than virtually all historical trading

Limited liquidity prior to announcement of AngloGold Loan

• No ongoing participation in AngloGold, however shareholders could choose to invest

consideration received in AngloGold to retain some level of exposure to North Bullfrog, Mother

Lode and the new Nevada district as a whole

Significant and experienced shareholder willing to sign lock-up agreement. Combined with

management and AngloGold ownership, represents 43% of Corvus' issued and outstanding

shares in support of the Transaction

Other transaction terms (such as termination fee) within precedent transaction range

Surrounding land positions limits available alternatives

43

Significant dilution and execution risk involved for Corvus to bring North Bullfrog and Mother

Lode into production on a "stand-alone" basis

Fort CapitalView entire presentation