UBS Results Presentation Deck

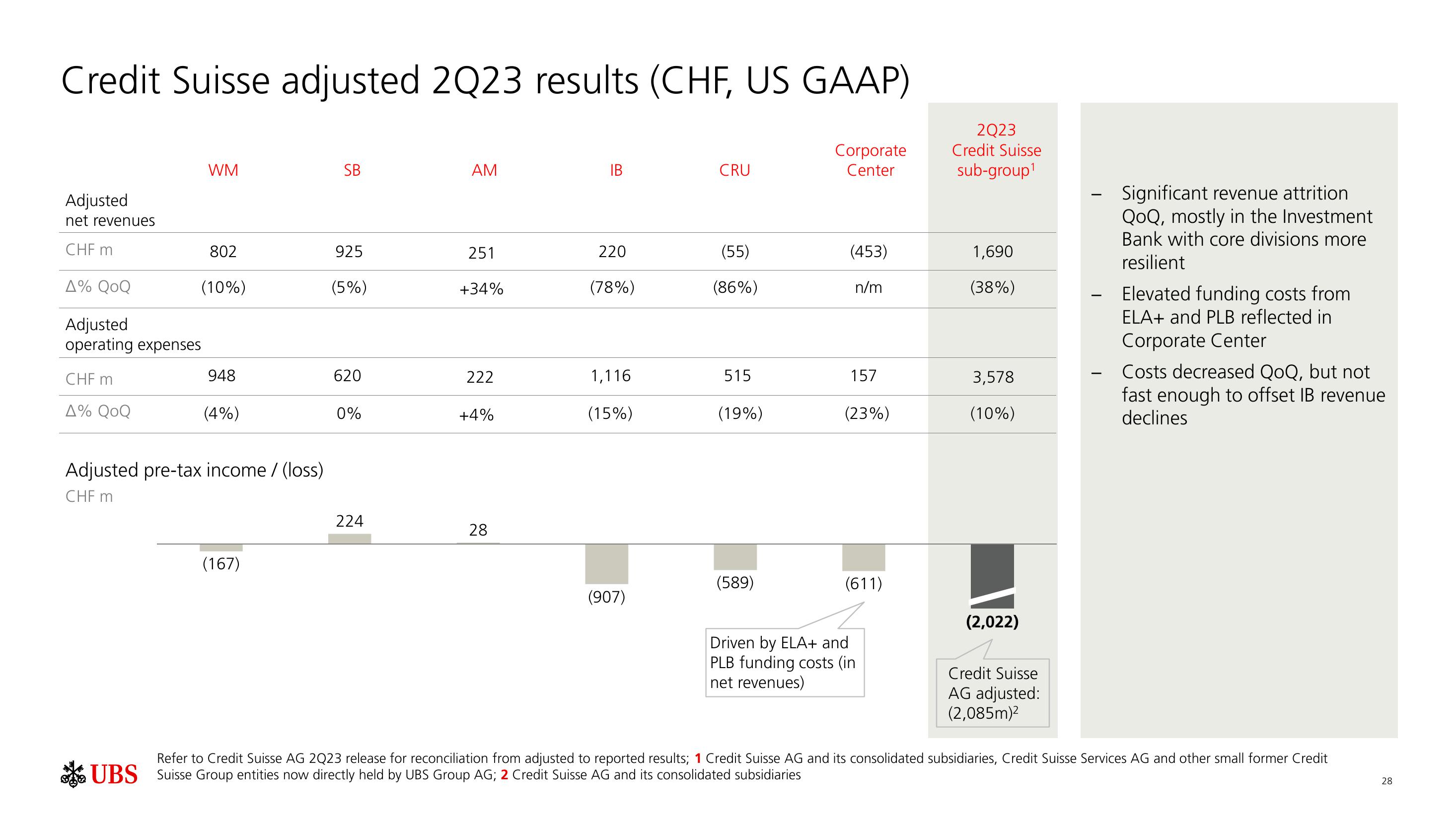

Credit Suisse adjusted 2Q23 results (CHF, US GAAP)

Corporate

Center

Adjusted

net revenues

CHF m

A% QOQ

WM

802

(10%)

Adjusted

operating expenses

CHF m

A% QOQ

948

(4%)

Adjusted pre-tax income / (loss)

CHF m

(167)

SB

925

(5%)

620

0%

224

AM

251

+34%

222

+4%

28

IB

220

(78%)

1,116

(15%)

(907)

CRU

(55)

(86%)

515

(19%)

(589)

(453)

n/m

157

(23%)

(611)

Driven by ELA+ and

PLB funding costs (in

net revenues)

2Q23

Credit Suisse

sub-group¹

1,690

(38%)

3,578

(10%)

(2,022)

Credit Suisse

AG adjusted:

(2,085m)²

Significant revenue attrition

QoQ, mostly in the Investment

Bank with core divisions more

resilient

Elevated funding costs from

ELA+ and PLB reflected in

Corporate Center

Costs decreased QoQ, but not

fast enough to offset IB revenue

declines

Refer to Credit Suisse AG 2Q23 release for reconciliation from adjusted to reported results; 1 Credit Suisse AG and its consolidated subsidiaries, Credit Suisse Services AG and other small former Credit

UBS Suisse Group entities now directly held by UBS Group AG; 2 Credit Suisse AG and its consolidated subsidiaries

28View entire presentation