Near SPAC Presentation Deck

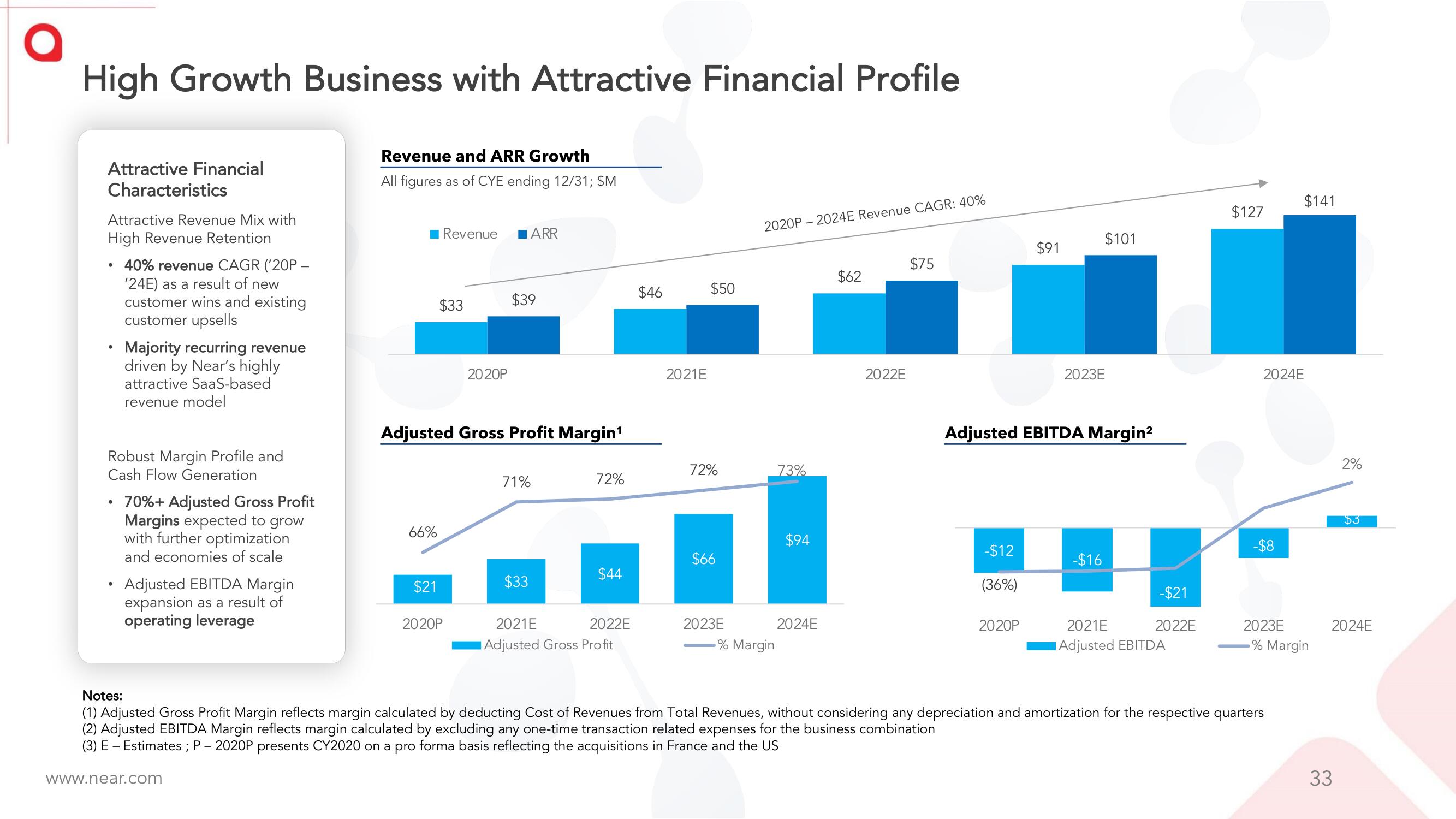

High Growth Business with Attractive Financial Profile

Attractive Financial

Characteristics

Attractive Revenue Mix with

High Revenue Retention

●

●

40% revenue CAGR ('20P -

'24E) as a result of new

customer wins and existing

customer upsells

●

Majority recurring revenue

driven by Near's highly

attractive SaaS-based

revenue model

Robust Margin Profile and

Cash Flow Generation

70%+ Adjusted Gross Profit

Margins expected to grow

with further optimization

and economies of scale

Adjusted EBITDA Margin

expansion as a result of

operating leverage

Revenue and ARR Growth

All figures as of CYE ending 12/31; $M

www.near.com

66%

$21

Revenue

$33

2020P

20 20P

Adjusted Gross Profit Margin¹

$39

ARR

71%

$33

72%

$44

2021E

2022E

Adjusted Gross Profit

$46

2021E

$50

72%

$66

2020P2024E Revenue CAGR: 40%

2023E

-% Margin

73%

$94

2024E

$62

2022E

$75

-$12

(36%)

$91

2020P

2023E

Adjusted EBITDA Margin²

$101

-$16

-$21

2022E

2021E

Adjusted EBITDA

$127

2024E

-$8

$141

Notes:

(1) Adjusted Gross Profit Margin reflects margin calculated by deducting Cost of Revenues from Total Revenues, without considering any depreciation and amortization for the respective quarters

(2) Adjusted EBITDA Margin reflects margin calculated by excluding any one-time transaction related expenses for the business combination

(3) E - Estimates ; P - 2020P presents CY2020 on a pro forma basis reflecting the acquisitions in France and the US

2023E

% Margin

2%

33

$3

2024EView entire presentation