Babylon Investor Presentation Deck

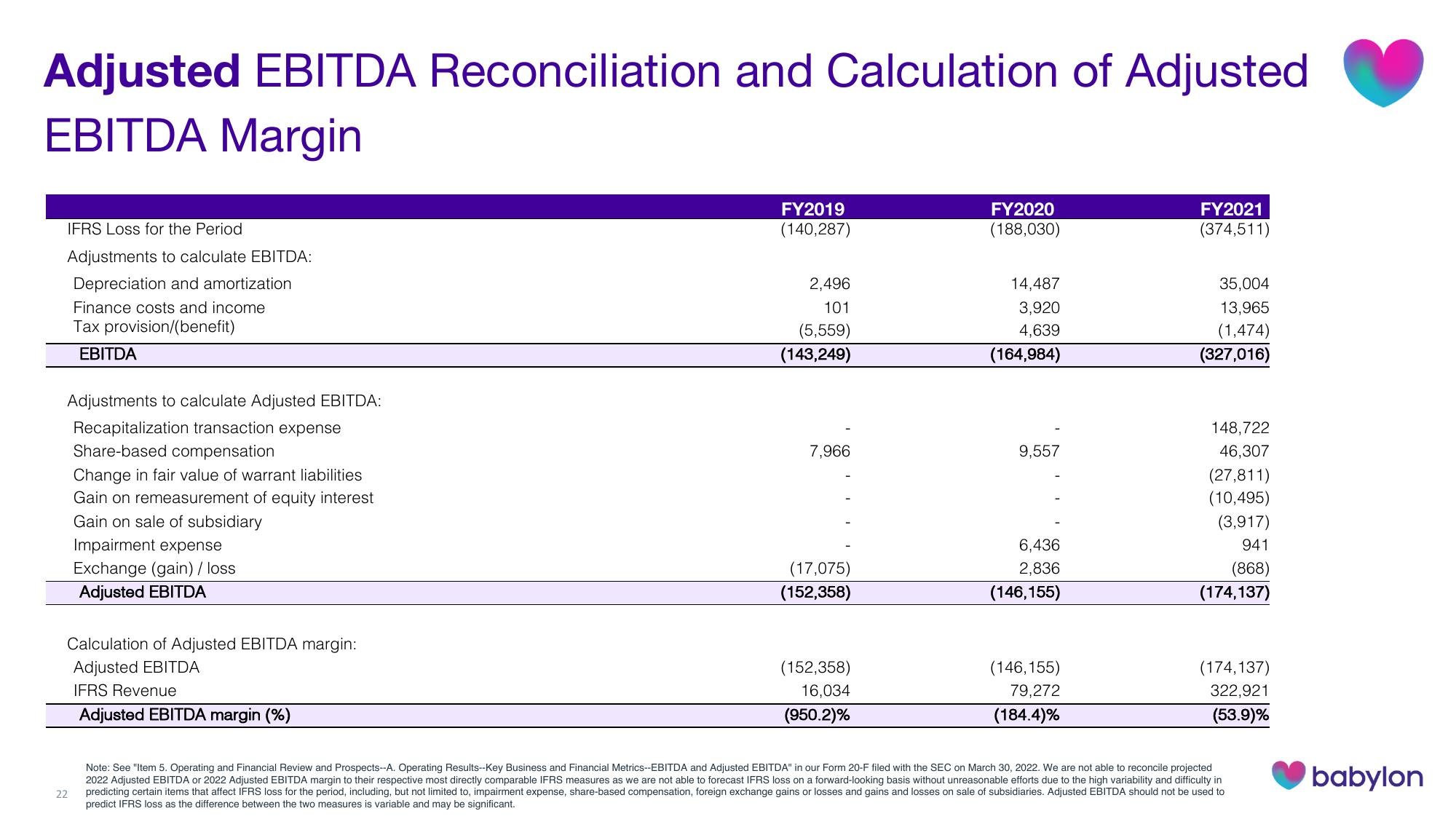

Adjusted EBITDA Reconciliation and Calculation of Adjusted

EBITDA Margin

IFRS Loss for the Period

Adjustments to calculate EBITDA:

Depreciation and amortization

Finance costs and income

Tax provision/(benefit)

EBITDA

Adjustments to calculate Adjusted EBITDA:

Recapitalization transaction expense

Share-based compensation

Change in fair value of warrant liabilities.

Gain on remeasurement of equity interest

Gain on sale of subsidiary

Impairment expense

Exchange (gain) / loss

Adjusted EBITDA

Calculation of Adjusted EBITDA margin:

Adjusted EBITDA

IFRS Revenue

Adjusted EBITDA margin (%)

22

FY2019

(140,287)

2,496

101

(5,559)

(143,249)

7,966

(17,075)

(152,358)

(152,358)

16,034

(950.2)%

FY2020

(188,030)

14,487

3,920

4,639

(164,984)

9,557

6,436

2,836

(146,155)

(146,155)

79,272

(184.4)%

FY2021

(374,511)

35,004

13,965

(1,474)

(327,016)

148,722

46,307

(27,811)

(10,495)

(3,917)

941

(868)

(174,137)

(174,137)

322,921

(53.9)%

Note: See "Item 5. Operating and Financial Review and Prospects--A. Operating Results--Key Business and Financial Metrics--EBITDA and Adjusted EBITDA" in our Form 20-F filed with the SEC on March 30, 2022. We are not able to reconcile projected

2022 Adjusted EBITDA or 2022 Adjusted EBITDA margin to their respective most directly comparable IFRS measures as we are not able to forecast IFRS loss on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in

predicting certain items that affect IFRS loss for the period, including, but not limited to, impairment expense, share-based compensation, foreign exchange gains or losses and gains and losses on sale of subsidiaries. Adjusted EBITDA should not be used to

predict IFRS loss as the difference between the two measures is variable and may be significant.

babylonView entire presentation