Main Street Capital Investor Day Presentation Deck

Lower Middle Market (LMM) Investments Overview

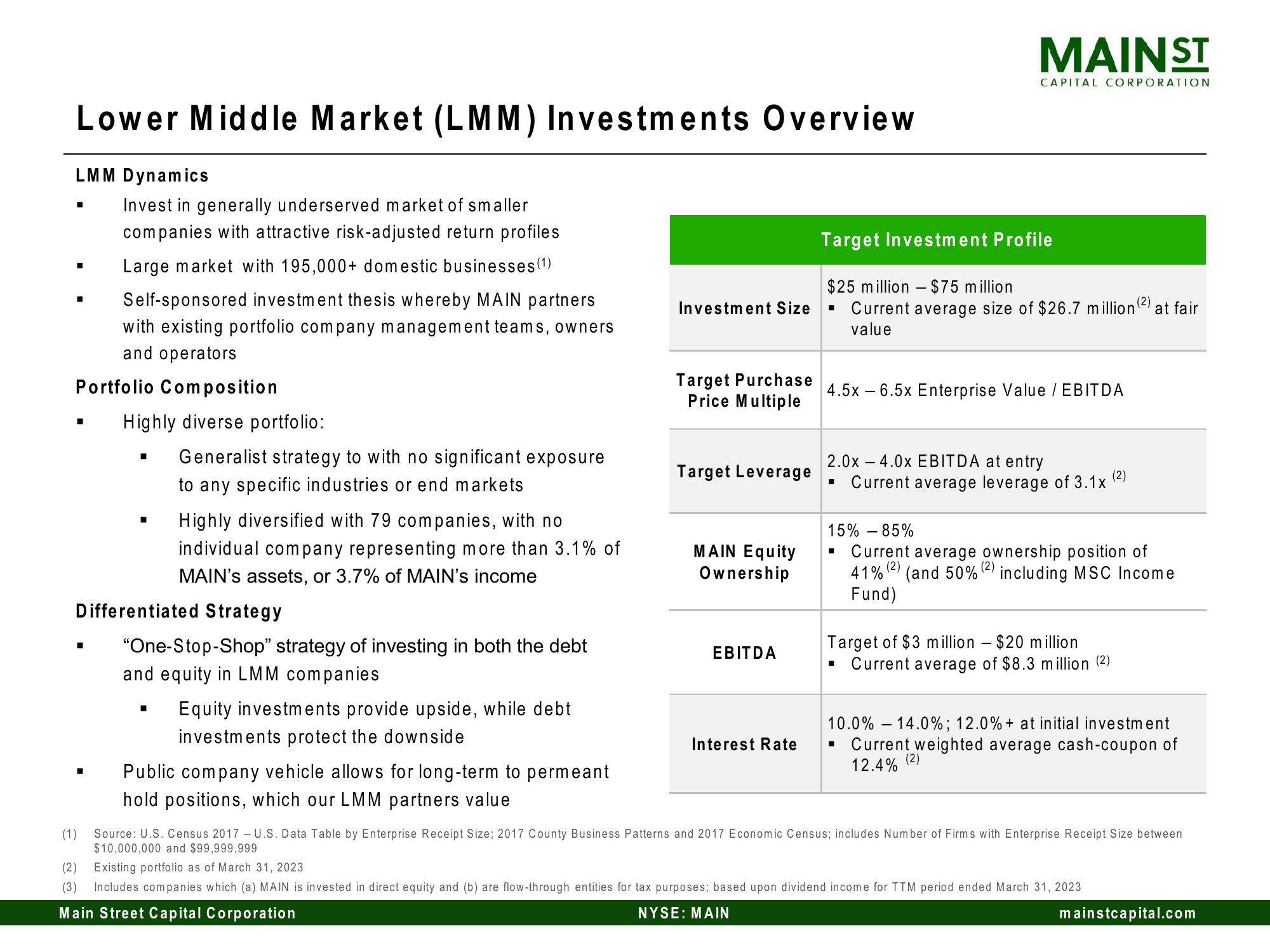

LMM Dynamics

■

■

■

Invest in generally underserved market of smaller

companies with attractive risk-adjusted return profiles

Large market with 195,000+ domestic businesses (1)

Portfolio Composition

■

Self-sponsored investment thesis whereby MAIN partners

with existing portfolio company management teams, owners

and operators

(1)

Highly diverse portfolio:

■

Differentiated Strategy

Generalist strategy to with no significant exposure

to any specific industries or end markets

Highly diversified with 79 companies, with no

individual company representing more than 3.1% of

MAIN's assets, or 3.7% of MAIN's income

I

"One-Stop-Shop" strategy of investing in both the debt

and equity in LMM companies

Equity investments provide upside, while debt

investments protect the downside

Public company vehicle allows for long-term to permeant

hold positions, which our LMM partners value

Investment Size

Target Purchase

Price Multiple

Target Leverage

MAIN Equity

Ownership

EBITDA

Interest Rate

Target Investment Profile

$25 million $75 million

Current average size of $26.7 million

value

■

MAINST

-

4.5x6.5x Enterprise Value / EBITDA

CAPITAL CORPORATION

-

2.0x 4.0x EBITDA at entry

(2)

Current average leverage of 3.1x

I

-

Target of $3 million $20 million

Current average of $8.3 million (2)

15% - 85%

(2)

Current average ownership position of

41% (2)

(and 50% including MSC Income

Fund)

(2)

at fair

10.0% - 14.0%; 12.0%+ at initial investment

Current weighted average cash-coupon of

(2)

12.4%

(2)

Existing portfolio as of March 31, 2023

(3) Includes companies which (a) MAIN is invested in direct equity and (b) are flow-through entities for tax purposes; based upon dividend income for TTM period ended March 31, 2023

Main Street Capital Corporation

NYSE: MAIN

Source: U.S. Census 2017 - U.S. Data Table by Enterprise Receipt Size; 2017 County Business Patterns and 2017 Economic Census; includes Number of Firms with Enterprise Receipt Size between

$10,000,000 and $99,999,999

mainstcapital.comView entire presentation