Nestle Investor Event Presentation Deck

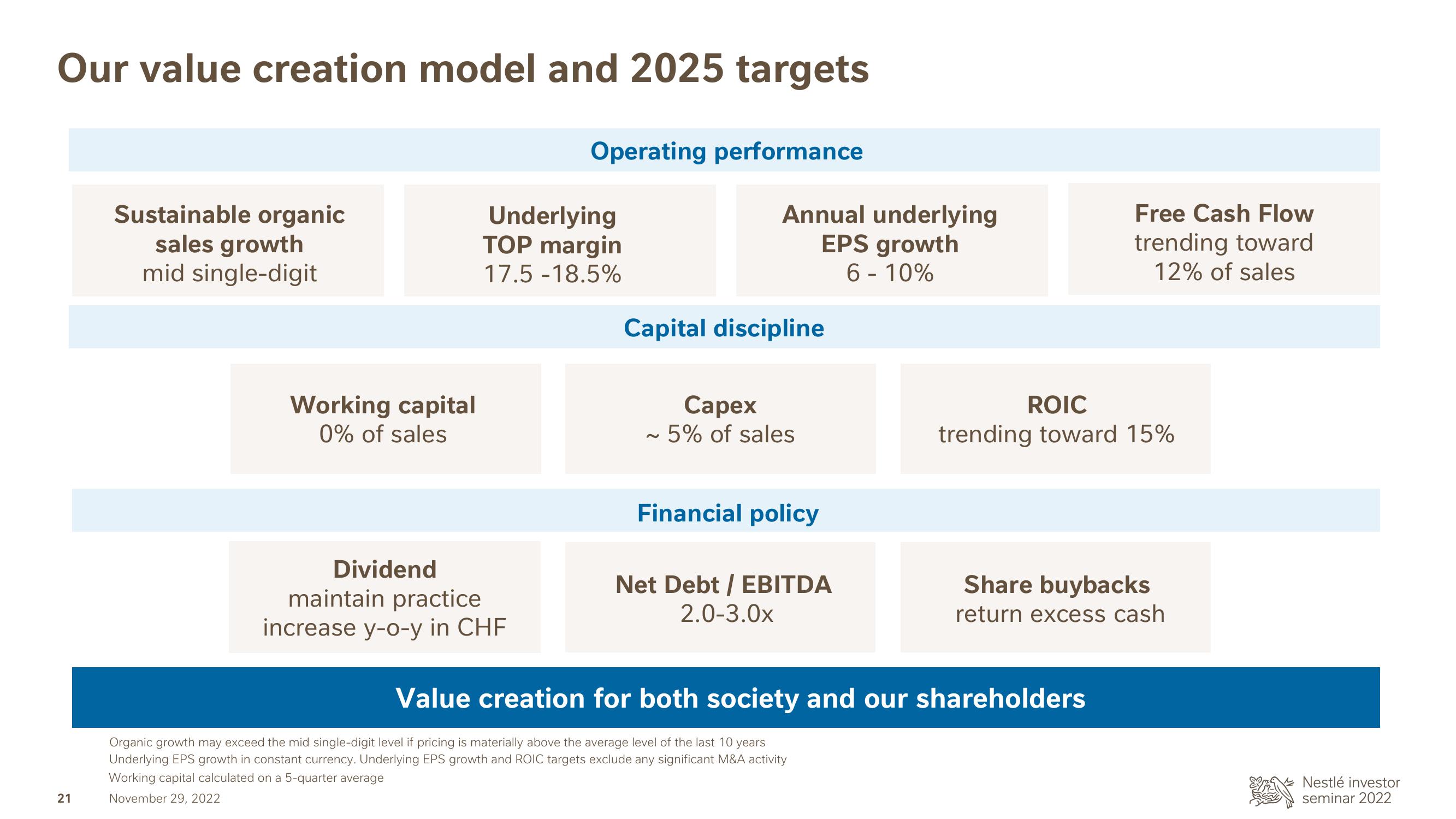

Our value creation model and 2025 targets

21

Sustainable organic

sales growth

mid single-digit

Working capital

0% of sales

Dividend

Operating performance

Underlying

TOP margin

17.5 -18.5%

maintain practice

increase y-o-y in CHF

Annual underlying

EPS growth

6 - 10%

Capital discipline

Capex

~ 5% of sales

Financial policy

Net Debt / EBITDA

2.0-3.0x

Organic growth may exceed the mid single-digit level if pricing is materially above the average level of the last 10 years

Underlying EPS growth in constant currency. Underlying EPS growth and ROIC targets exclude any significant M&A activity

Working capital calculated on a 5-quarter average

November 29, 2022

Free Cash Flow

trending toward

12% of sales

ROIC

trending toward 15%

Value creation for both society and our shareholders

Share buybacks

return excess cash

Nestlé investor

seminar 2022View entire presentation