OnesSpaWorld SPAC

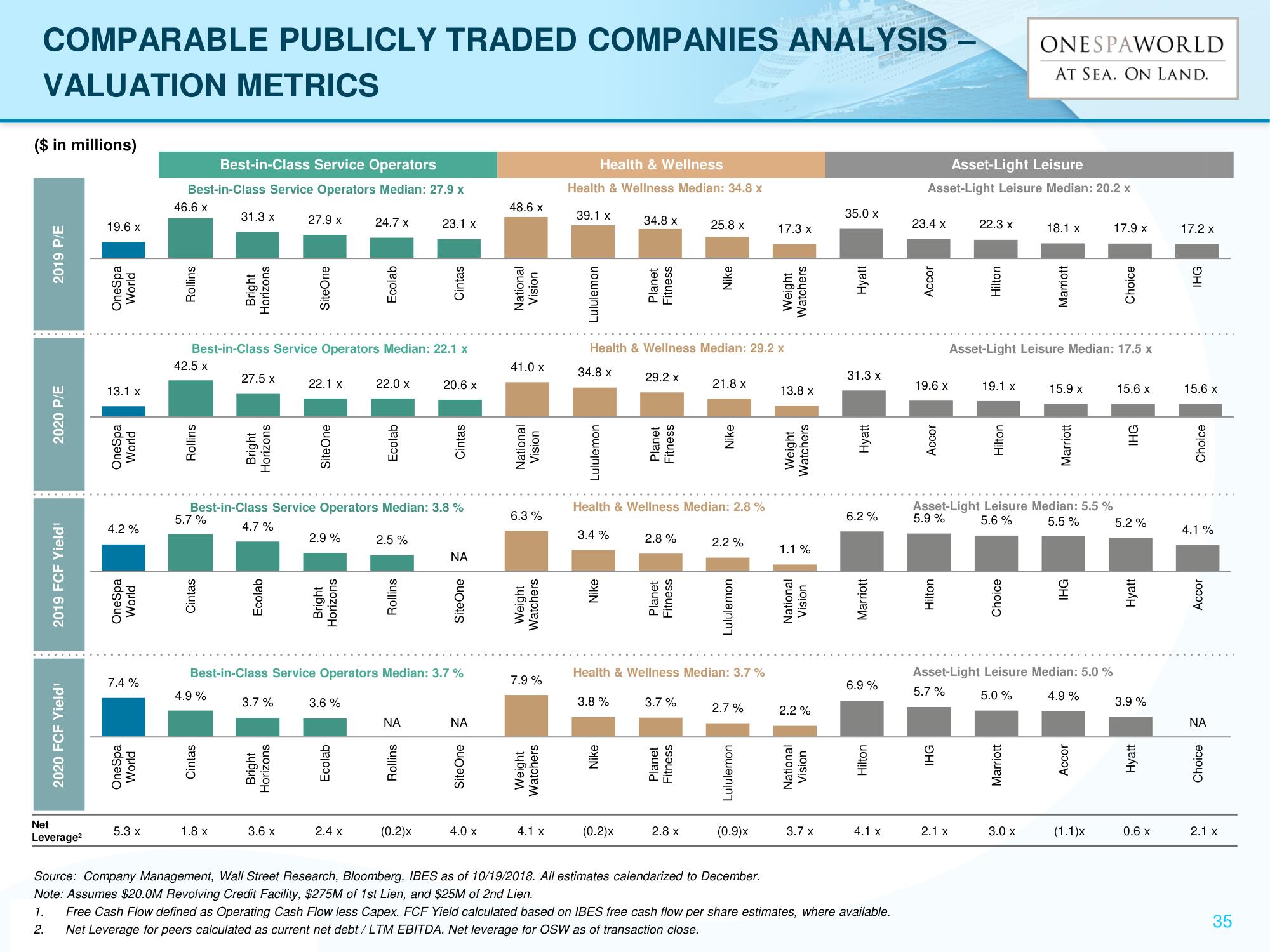

COMPARABLE PUBLICLY TRADED COMPANIES ANALYSIS

VALUATION METRICS

($ in millions)

2019 P/E

2020 P/E

2019 FCF Yield¹

2020 FCF Yield¹

Net

Leverage²

19.6 x

OneSpa

World

13.1 x

OneSpa

World

4.2%

OneSpa

World

7.4%

OneSpa

World

5.3 x

Best-in-Class Service Operators

Best-in-Class Service Operators Median: 27.9 x

46.6 x

Rollins

42.5 X

Rollins

5.7%

Cintas

31.3 x

4.9 %

Bright

Horizons

Best-in-Class Service Operators Median: 22.1 x

Cintas

1.8 x

27.5 x

Bright

Horizons

4.7%

Ecolab

27.9 x

3.7%

SiteOne

Bright

Horizons

3.6 x

22.1 x

Best-in-Class Service Operators Median: 3.8 %

SiteOne

2.9%

Bright

Horizons

24.7 x

3.6 %

Ecolab

Ecolab

2.4 x

22.0 x

Ecolab

Best-in-Class Service Operators Median: 3.7 %

2.5%

Rollins

23.1 x

ΝΑ

Cintas

Rollins

(0.2)x

20.6 x

Cintas

ΝΑ

SiteOne

ΝΑ

SiteOne

4.0 X

48.6 x

National

Vision

41.0 X

National

Vision

6.3 %

Weight

Watchers

7.9%

Weight

Watchers

4.1 X

Health & Wellness

Health & Wellness Median: 34.8 x

39.1 x

Lululemon

Lululemon

3.4%

Nike

34.8 x

Health & Wellness Median: 29.2 x

34.8 x

3.8%

Planet

Fitness

Nike

(0.2)x

29.2 x

Planet

Fitness

Health & Wellness Median: 2.8 %

2.8%

Planet

Fitness

25.8 x

3.7%

Nike

Planet

Fitness

Health & Wellness Median: 3.7 %

2.8 x

21.8 x

Nike

2.2%

Lululemon

2.7%

Lululemon

(0.9)x

17.3 x

Source: Company Management, Wall Street Research, Bloomberg, IBES as of 10/19/2018. All estimates calendarized to December.

Note: Assumes $20.0M Revolving Credit Facility, $275M of 1st Lien, and $25M of 2nd Lien.

Weight

Watchers

13.8 x

Weight

Watchers

1.1 %

National

Vision

2.2 %

National

Vision

3.7 x

35.0 x

Hyatt

31.3 x

Hyatt

6.2 %

Marriott

6.9 %

Hilton

4.1 x

1. Free Cash Flow defined as Operating Cash Flow less Capex. FCF Yield calculated based on IBES free cash flow per share estimates, where available.

Net Leverage for peers calculated as current net debt / LTM EBITDA. Net leverage for OSW as of transaction close.

2.

23.4 x

Asset-Light Leisure

Asset-Light Leisure Median: 20.2 x

Accor

19.6 x

Accor

Hilton

-

IHG

22.3 x

Hilton

2.1 x

19.1 x

Hilton

Asset-Light Leisure Median: 17.5 x

ONESPAWORLD

AT SEA. ON LAND.

Choice

%

Asset-Light Leisure Median: 5.5

5.6%

5.9 %

5.5%

18.1 x

Marriott

Marriott

3.0 x

15.9 x

Asset-Light Leisure Median: 5.0 %

4.9%

5.7 %

5.0 %

Marriott

IHG

Accor

17.9 x

(1.1)x

Choice

15.6 x

IHG

5.2 %

Hyatt

3.9%

Hyatt

0.6 X

17.2 x

IHG

15.6 x

Choice

4.1 %

Accor

ΝΑ

Choice

2.1 X

35View entire presentation