Forte's Value Destruction Analysis

About Forte Biosciences

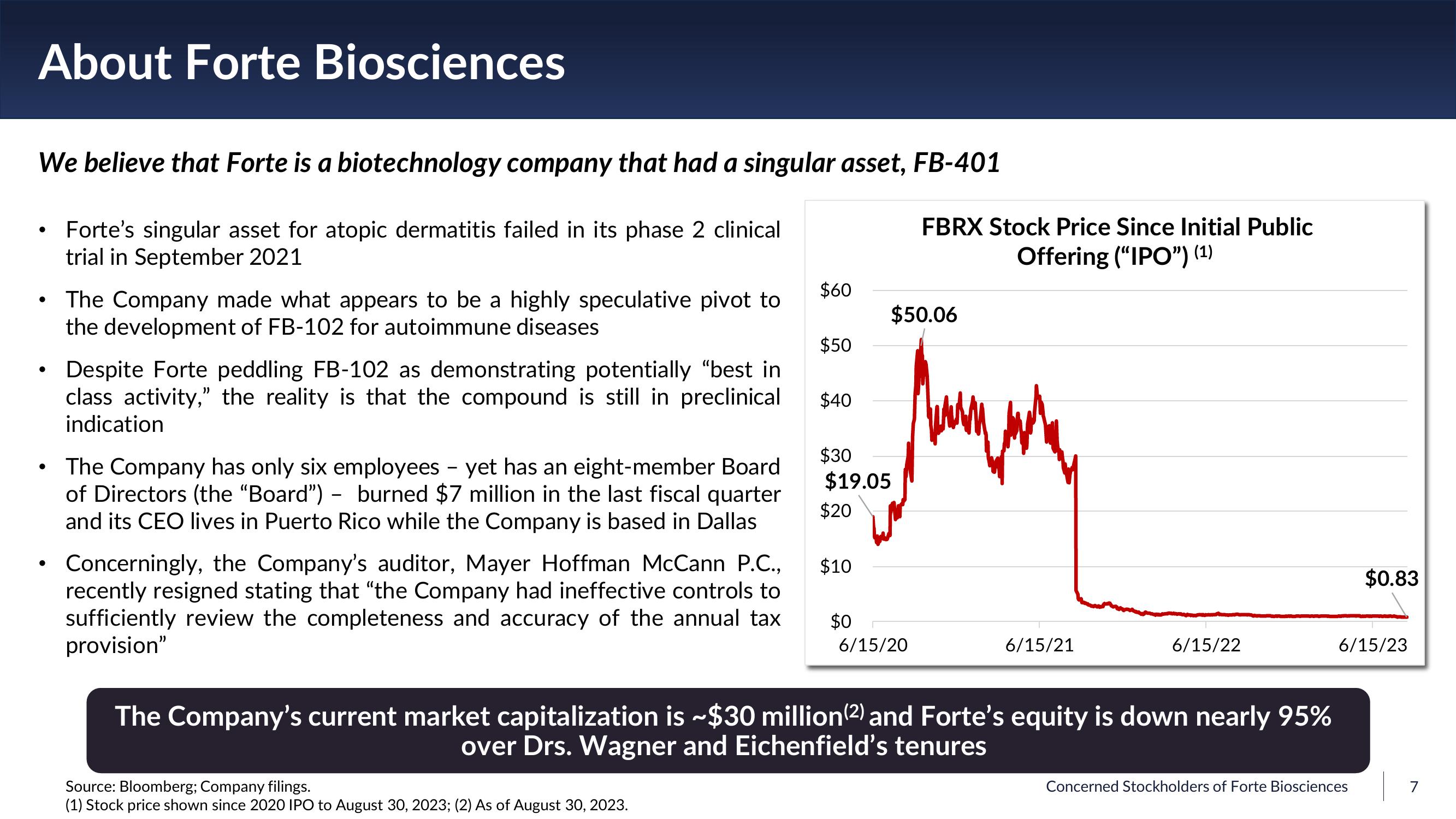

We believe that Forte is a biotechnology company that had a singular asset, FB-401

Forte's singular asset for atopic dermatitis failed in its phase 2 clinical

trial in September 2021

●

●

●

●

●

The Company made what appears to be a highly speculative pivot to

the development of FB-102 for autoimmune diseases

Despite Forte peddling FB-102 as demonstrating potentially "best in

class activity," the reality is that the compound is still in preclinical

indication

The Company has only six employees - yet has an eight-member Board

of Directors (the "Board") - burned $7 million in the last fiscal quarter

and its CEO lives in Puerto Rico while the Company is based in Dallas

Concerningly, the Company's auditor, Mayer Hoffman McCann P.C.,

recently resigned stating that "the Company had ineffective controls to

sufficiently review the completeness and accuracy of the annual tax

provision"

$60

Source: Bloomberg; Company filings.

(1) Stock price shown since 2020 IPO to August 30, 2023; (2) As of August 30, 2023.

$50

$40

$30

$19.05

$20

$10

$50.06

FBRX Stock Price Since Initial Public

Offering ("IPO”") (1)

$0

6/15/20

6/15/21

6/15/22

The Company's current market capitalization is ~$30 million (2) and Forte's equity is down nearly 95%

over Drs. Wagner and Eichenfield's tenures

$0.83

6/15/23

Concerned Stockholders of Forte Biosciences

7View entire presentation