ICG Strategic Partnership Presentation to State of Connecticut Retirement Plans and Trust Funds (CRPTF)

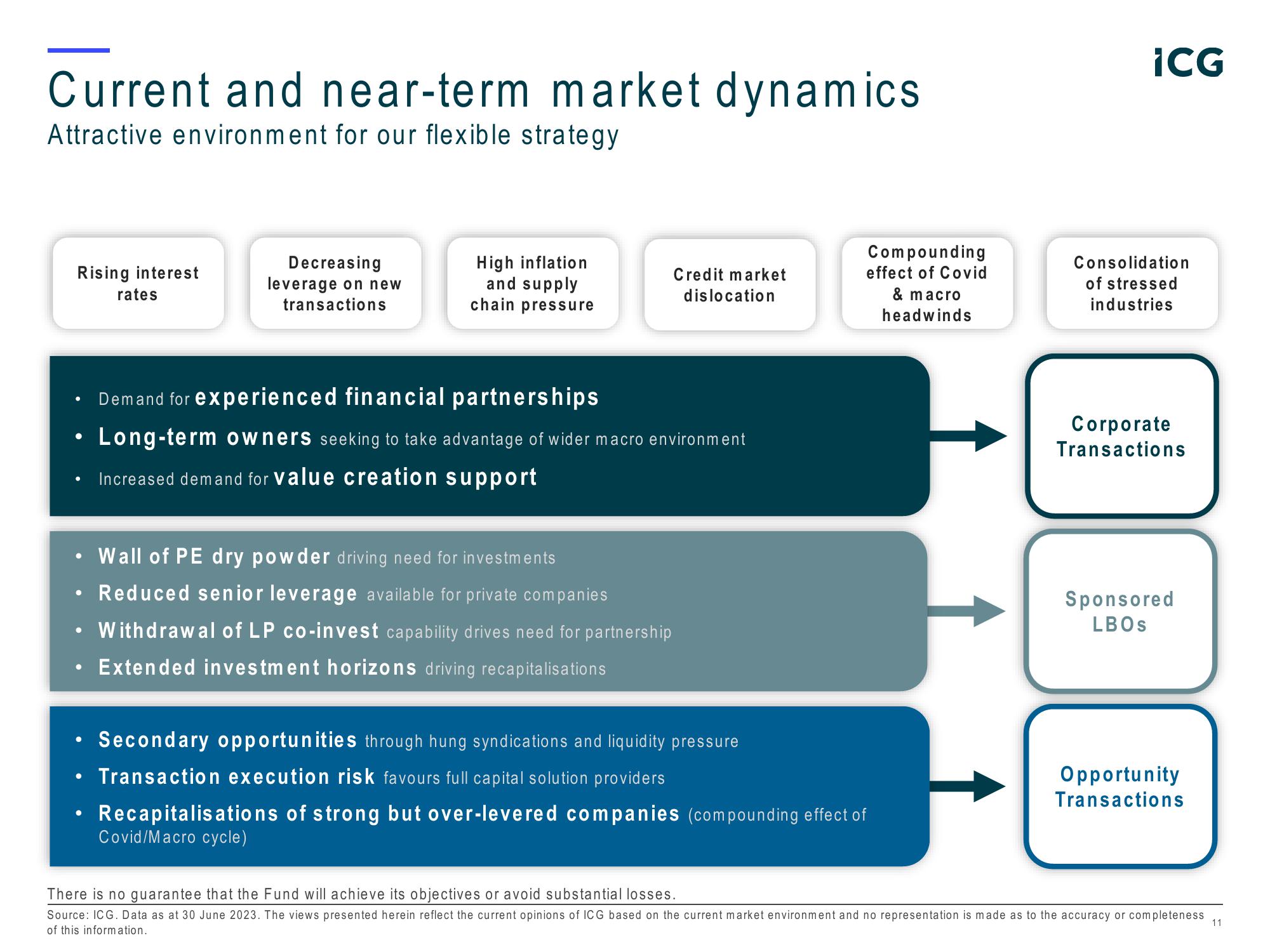

Current and near-term market dynamics.

Attractive environment for our flexible strategy

Rising interest

●

●

●

●

●

●

●

●

rates

Decreasing

leverage on new

transactions

High inflation

and supply

chain pressure

Credit market

dislocation

Demand for experienced financial partnerships

Long-term owners seeking to take advantage of wider macro environment

Increased demand for value creation support

Wall of PE dry powder driving need for investments

Reduced senior leverage available for private companies

Withdrawal of LP co-invest capability drives need for partnership

Extended investment horizons driving recapitalisations

Compounding

effect of Covid

& macro

headwinds

Secondary opportunities through hung syndications and liquidity pressure

Transaction execution risk favours full capital solution providers

Recapitalisations of strong but over-levered companies (compounding effect of

Covid/Macro cycle)

¡CG

Consolidation

of stressed

industries

Corporate

Transactions

Sponsored

LBOS

Opportunity

Transactions

There is no guarantee that the Fund will achieve its objectives or avoid substantial losses.

Source: ICG. Data as at 30 June 2023. The views presented herein reflect the current opinions of ICG based on the current market environment and no representation is made as to the accuracy or completeness 11

of this information.View entire presentation