ProSomnus SPAC Presentation Deck

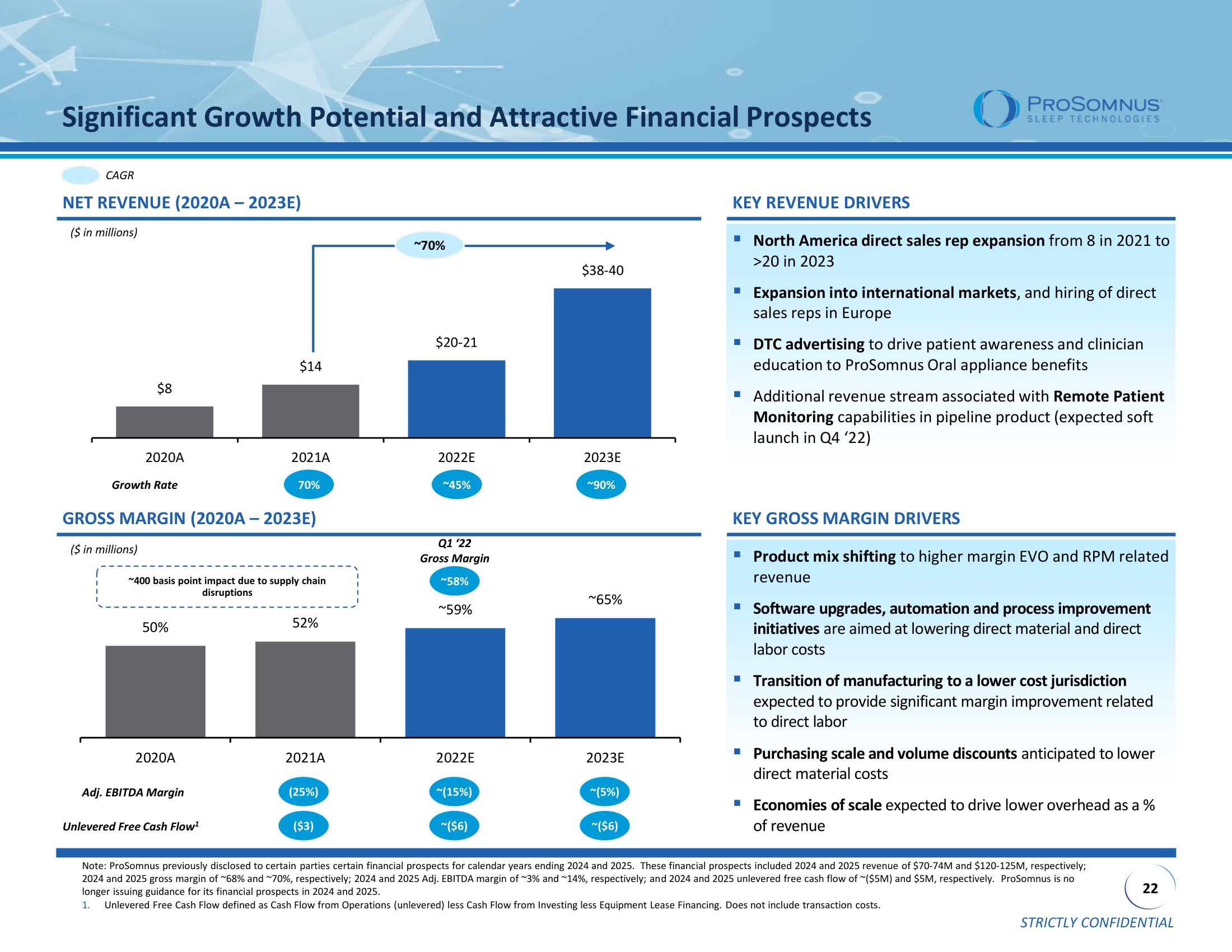

Significant Growth Potential and Attractive Financial Prospects

CAGR

NET REVENUE (2020A - 2023E)

($ in millions)

$8

2020A

Growth Rate

50%

GROSS MARGIN (2020A - 2023E)

($ in millions)

2020A

$14

~400 basis point impact due to supply chain

disruptions

Adj. EBITDA Margin

2021A

Unlevered Free Cash Flow¹

70%

52%

2021A

(25%)

($3)

~70%

$20-21

2022E

~45%

Q1 '22

Gross Margin

~58%

~59%

2022E

~(15%)

~($6)

$38-40

2023E

~90%

~65%

2023E

~(5%)

~($6)

KEY REVENUE DRIVERS

PROSOMNUS

SLEEP TECHNOLOGIES

▪ North America direct sales rep expansion from 8 in 2021 to

>20 in 2023

▪ Expansion into international markets, and hiring of direct

sales reps in Europe

▪ DTC advertising to drive patient awareness and clinician

education to ProSomnus Oral appliance benefits

■ Additional revenue stream associated with Remote Patient

Monitoring capabilities in pipeline product (expected soft

launch in Q4 '22)

KEY GROSS MARGIN DRIVERS

■ Product mix shifting to higher margin EVO and RPM related

revenue

▪ Software upgrades, automation and process improvement

initiatives are aimed at lowering direct material and direct

labor costs

■ Transition of manufacturing to a lower cost jurisdiction

expected to provide significant margin improvement related

to direct labor

■ Purchasing scale and volume discounts anticipated to lower

direct material costs

■ Economies of scale expected to drive lower overhead as a %

of revenue

Note: ProSomnus previously disclosed to certain parties certain financial prospects for calendar years ending 2024 and 2025. These financial prospects included 2024 and 2025 revenue of $70-74M and $120-125M, respectively;

2024 and 2025 gross margin of ~68% and ~70%, respectively; 2024 and 2025 Adj. EBITDA margin of ~3% and ~14%, respectively; and 2024 and 2025 unlevered free cash flow of ($5M) and $5M, respectively. ProSomnus is no

longer issuing guidance for its financial prospects in 2024 and 2025.

1. Unlevered Free Cash Flow defined as Cash Flow from Operations (unlevered) less Cash Flow from Investing less Equipment Lease Financing. Does not include transaction costs.

22

STRICTLY CONFIDENTIALView entire presentation