Meta Results Presentation Deck

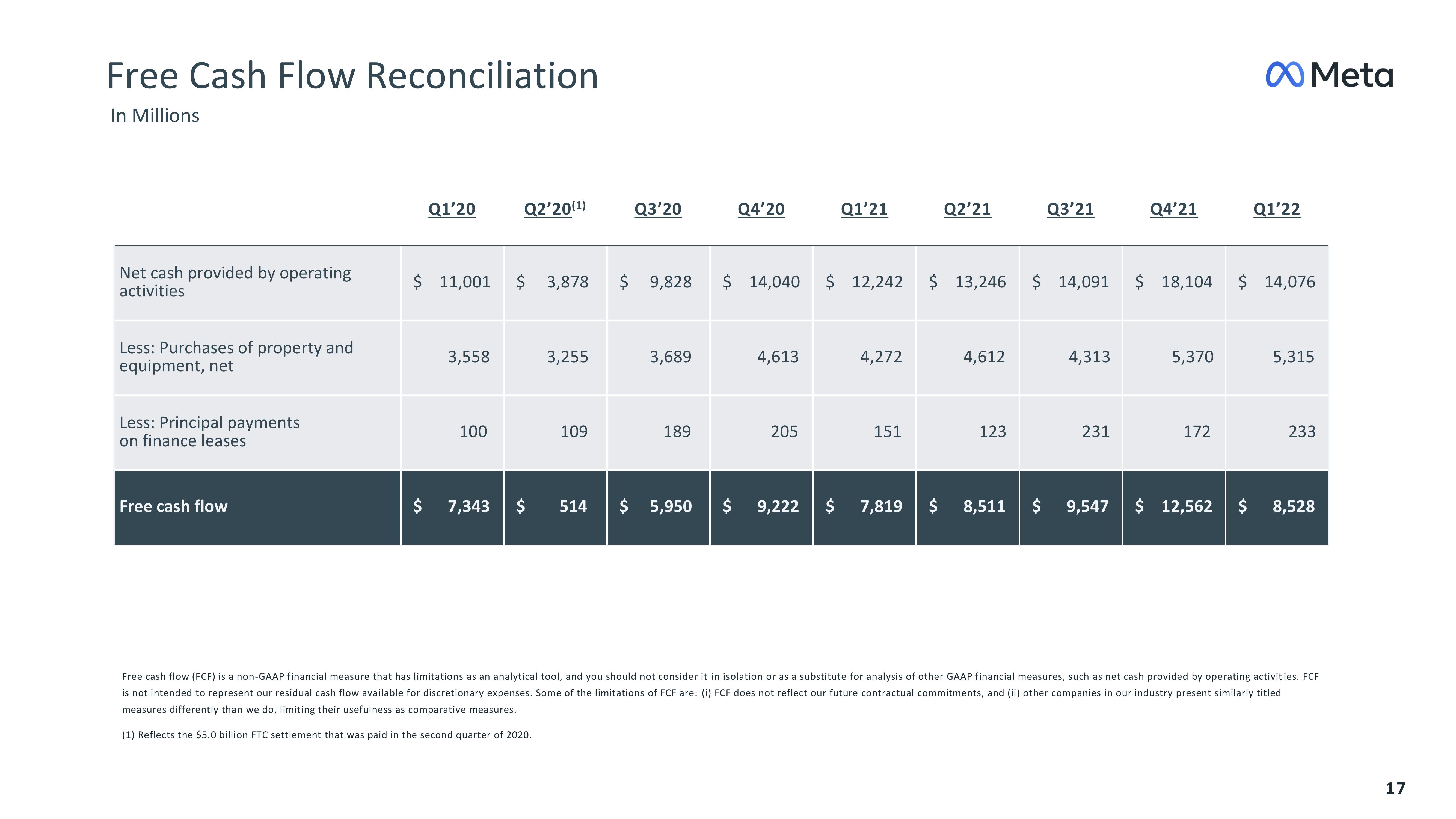

Free Cash Flow Reconciliation

In Millions

Net cash provided by operating

activities

Less: Purchases of property and

equipment, net

Less: Principal payments

on finance leases

Free cash flow

Q1'20

$ 11,001 $ 3,878

3,558

100

Q2'20(¹)

$ 7,343

3,255

109

$ 514

Q3'20

3,689

189

Q4'20

$ 9,828 $ 14,040 $ 12,242 $ 13,246

$ 5,950

4,613

Q1'21

205

4,272

151

Q2'21

$ 9,222 $ 7,819

4,612

123

Q3'21

$ 14,091

4,313

231

$ 8,511 $ 9,547

Q4'21

$ 18,104

5,370

172

Q1'22

Meta

$ 14,076

5,315

233

$ 12,562 $ 8,528

Free cash flow (FCF) is a non-GAAP financial measure that has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of other GAAP financial measures, such as net cash provided by operating activities. FCF

is not intended to represent our residual cash flow available for discretionary expenses. Some of the limitations of FCF are: (i) FCF does not reflect our future contractual commitments, and (ii) other companies in our industry present similarly titled

measures differently than we do, limiting their usefulness as comparative measures.

(1) Reflects the $5.0 billion FTC settlement that was paid in the second quarter of 2020.

17View entire presentation