Clover Health SPAC Presentation Deck

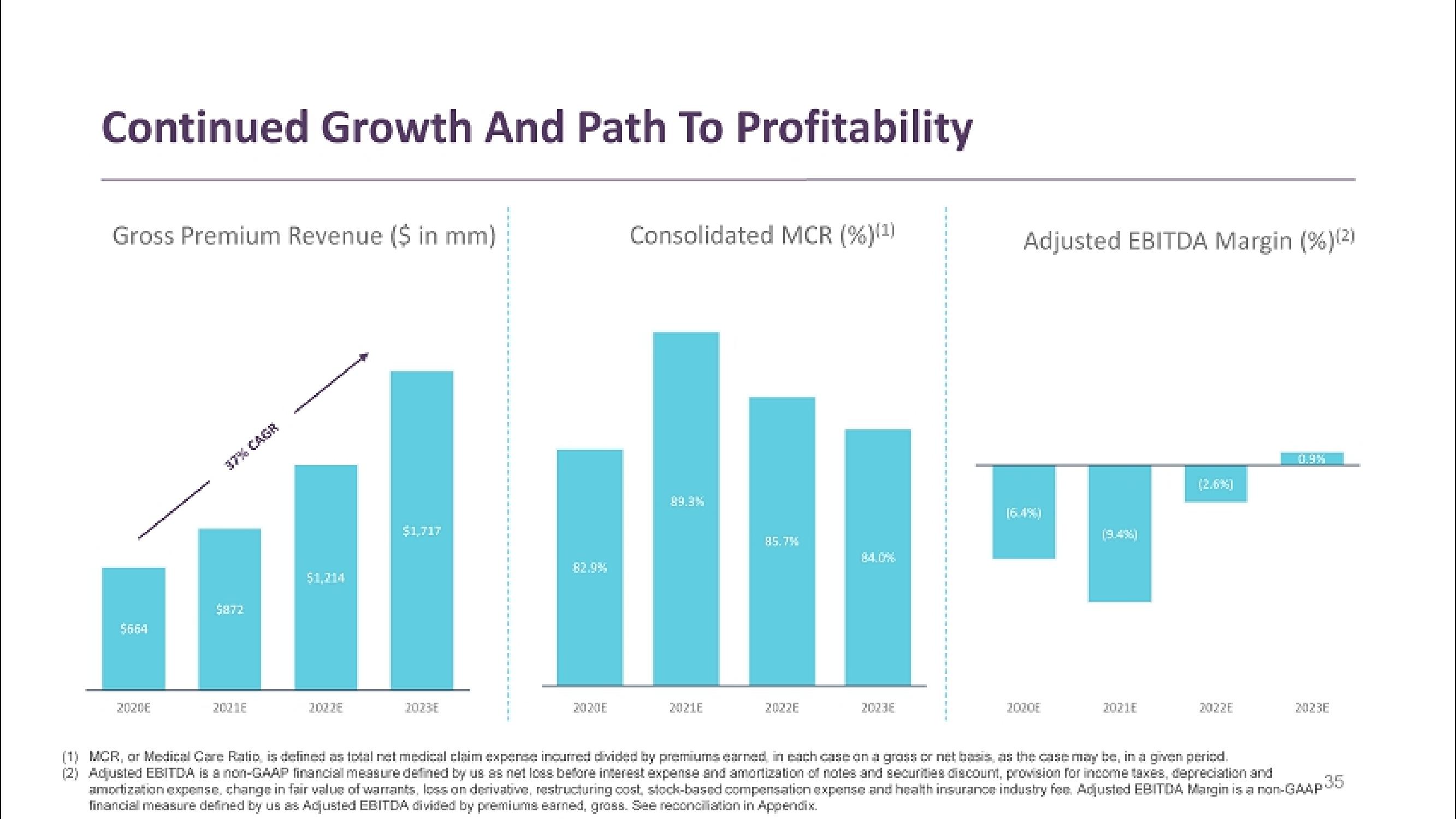

Continued Growth And Path To Profitability

Gross Premium Revenue ($ in mm)

NA

$664

2020F

$872

2021E

$1,214

2022€

$1,717

3023E

82.9%

2020F

Consolidated MCR (%)(¹)

89.3%

2021E

85.7%

2022E

84.0%

2003E

Adjusted EBITDA Margin (%) (2)

[6.4%)

2020E

(9.4%)

2021E

2022E

2023E

(1) MCR, or Medical Care Ratio, is defined as total net medical claim expense incurred divided by premiums earned, in each case on a grass or net basis, as the case may be, in a given period.

(2) Adjusted

EBITDA is a non-GAAP financial measure defined by us as net loss before interest expense and amortization of notes and securities discount, provision for income taxes, depreciation and

amortization expense, change in fair value of warrants, loss on derivative, restructuring cost, stock-based compensation expense and health insurance industry fee: Adjusted EBITDA Margin is a non-GAAP 35

financial measure defined by us as Adjusted EBITDA divided by premiums earned, gross. See reconciliation in Appendix.View entire presentation