Cooper Standard Third Quarter 2023 Earnings Presentation

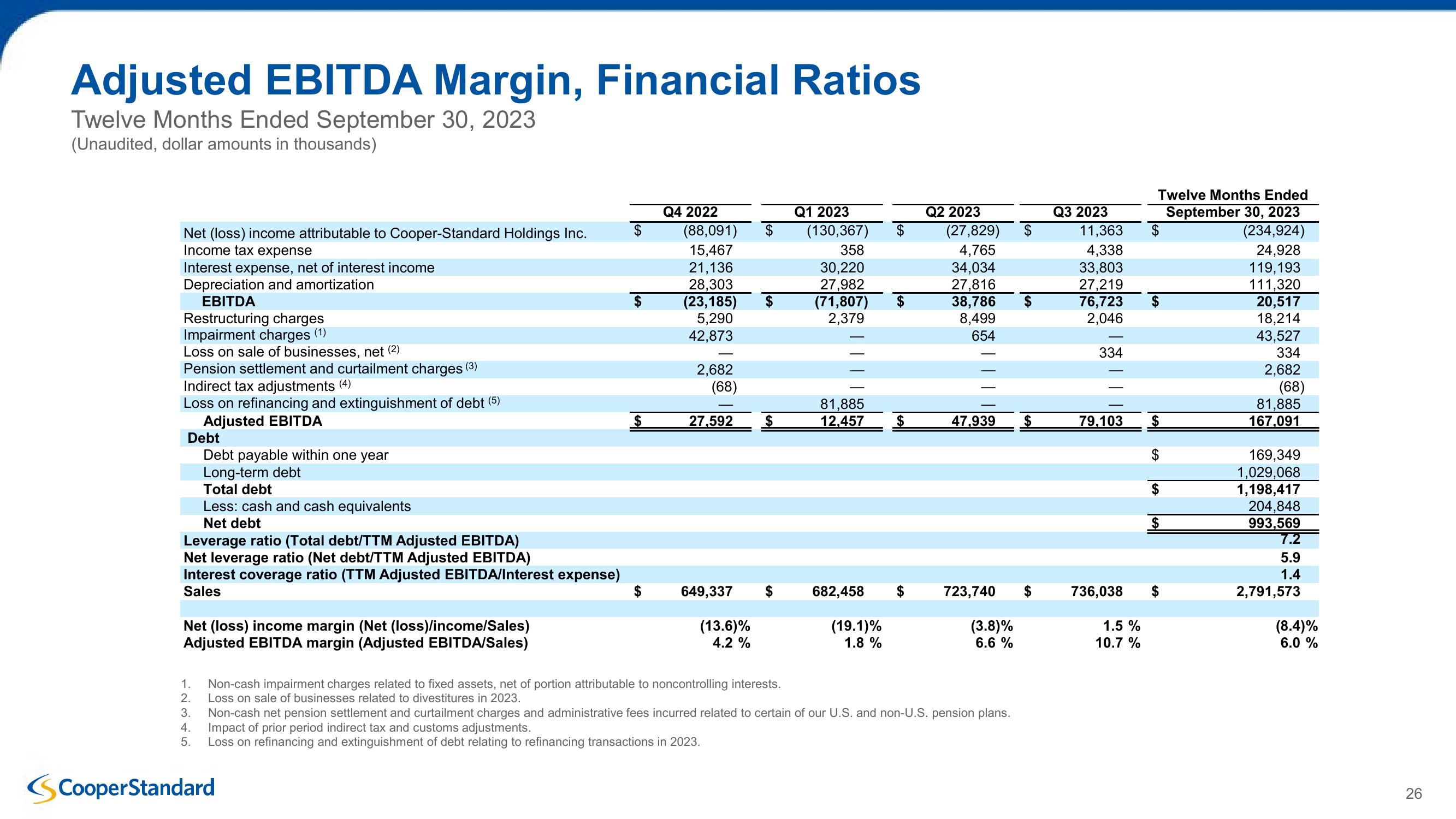

Adjusted EBITDA Margin, Financial Ratios

Twelve Months Ended September 30, 2023

(Unaudited, dollar amounts in thousands)

Net (loss) income attributable to Cooper-Standard Holdings Inc.

Income tax expense

Interest expense, net of interest income

Depreciation and amortization

EBITDA

Restructuring charges

Impairment charges (1)

Loss on sale of businesses, net (2)

Pension settlement and curtailment charges (3)

Indirect tax adjustments (4)

Loss on refinancing and extinguishment of debt (5)

Adjusted EBITDA

Debt

Debt payable within one year

Long-term debt

Total debt

Less: cash and cash equivalents

Q4 2022

(88,091)

Q1 2023

(130,367)

358

Q2 2023

(27,829)

4,765

SA

Q3 2023

15,467

21,136

30,220

34,034

28,303

27,982

27,816

(23,185)

(71,807)

38,786

5,290

2,379

8,499

42,873

654

2,682

11,363

$

SA

Twelve Months Ended

September 30, 2023

(234,924)

4,338

24,928

33,803

27,219

119,193

111,320

76,723 S

20,517

2,046

18,214

43,527

334

334

2,682

(68)

(68)

27.592

$

81,885

12,457

81,885

47,939

$

79,103

167,091

$

169,349

1,029,068

1,198,417

204,848

Net debt

$

993,569

Leverage ratio (Total debt/TTM Adjusted EBITDA)

7.2

Net leverage ratio (Net debt/TTM Adjusted EBITDA)

5.9

Interest coverage ratio (TTM Adjusted EBITDA/Interest expense)

Sales

1.4

649,337

682,458

723,740

736,038

2,791,573

Net (loss) income margin (Net (loss)/income/Sales)

Adjusted EBITDA margin (Adjusted EBITDA/Sales)

(13.6)%

4.2 %

(19.1)%

1.8 %

(3.8)%

6.6 %

1.5 %

10.7 %

(8.4)%

6.0 %

12345

1.

2.

Non-cash impairment charges related to fixed assets, net of portion attributable to noncontrolling interests.

Loss on sale of businesses related to divestitures in 2023.

3.

Non-cash net pension settlement and curtailment charges and administrative fees incurred related to certain of our U.S. and non-U.S. pension plans.

Impact of prior period indirect tax and customs adjustments.

5. Loss on refinancing and extinguishment of debt relating to refinancing transactions in 2023.

CooperStandard

26

26View entire presentation