Evercore Investment Banking Pitch Book

Executive Summary

Introduction

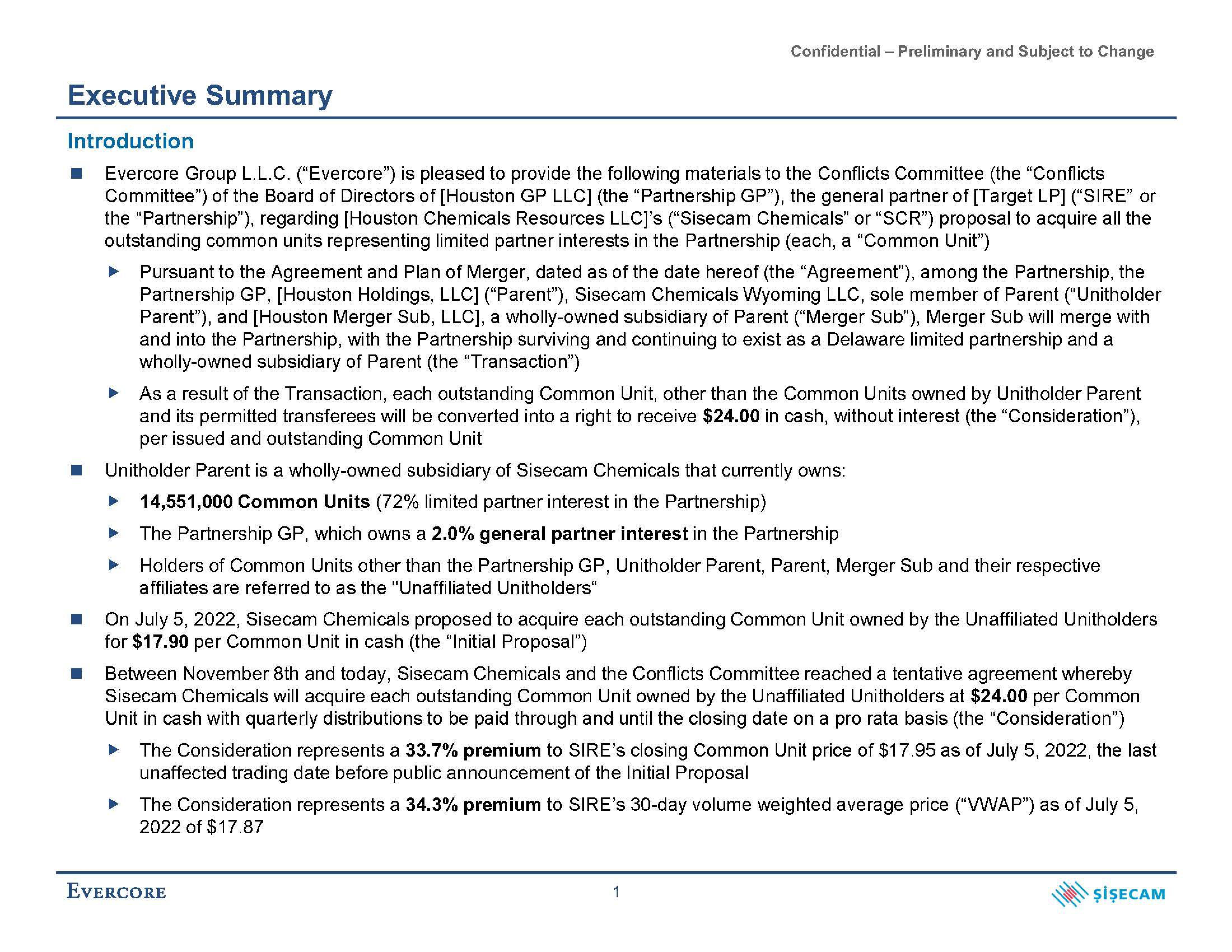

Evercore Group L.L.C. ("Evercore") is pleased to provide the following materials to the Conflicts Committee (the "Conflicts

Committee") of the Board of Directors of [Houston GP LLC] (the "Partnership GP"), the general partner of [Target LP] ("SIRE" or

the "Partnership"), regarding [Houston Chemicals Resources LLC]'s ("Sisecam Chemicals" or "SCR") proposal to acquire all the

outstanding common units representing limited partner interests in the Partnership (each, a "Common Unit")

Confidential - Preliminary and Subject to Change

Pursuant to the Agreement and Plan of Merger, dated as of the date hereof (the "Agreement"), among the Partnership, the

Partnership GP, [Houston Holdings, LLC] ("Parent"), Sisecam Chemicals Wyoming LLC, sole member of Parent ("Unitholder

Parent"), and [Houston Merger Sub, LLC], a wholly-owned subsidiary of Parent ("Merger Sub"), Merger Sub will merge with

and into the Partnership, with the Partnership surviving and continuing to exist as a Delaware limited partnership and a

wholly-owned subsidiary of Parent (the "Transaction")

As a result of the Transaction, each outstanding Common Unit, other than the Common Units owned by Unitholder Parent

and its permitted transferees will be converted into a right to receive $24.00 in cash, without interest (the "Consideration"),

per issued and outstanding Common Unit

Unitholder Parent is a wholly-owned subsidiary of Sisecam Chemicals that currently owns:

14,551,000 Common Units (72% limited partner interest in the Partnership)

The Partnership GP, which owns a 2.0% general partner interest in the Partnership

Holders of Common Units other than the Partnership GP, Unitholder Parent, Parent, Merger Sub and their respective

affiliates are referred to as the "Unaffiliated Unitholders"

On July 5, 2022, Sisecam Chemicals proposed to acquire each outstanding Common Unit owned by the Unaffiliated Unitholders

for $17.90 per Common Unit in cash (the "Initial Proposal")

Between November 8th and today, Sisecam Chemicals and the Conflicts Committee reached a tentative agreement whereby

Sisecam Chemicals will acquire each outstanding Common Unit owned by the Unaffiliated Unitholders at $24.00 per Common

Unit in cash with quarterly distributions to be paid through and until the closing date on a pro rata basis (the "Consideration")

The Consideration represents a 33.7% premium to SIRE's closing Common Unit price of $17.95 as of July 5, 2022, the last

unaffected trading date before public announcement of the Initial Proposal

The Consideration represents a 34.3% premium to SIRE's 30-day volume weighted average price ("VWAP") as of July 5,

2022 of $17.87

EVERCORE

1

ŞİŞECAMView entire presentation