Bank of America Investment Banking Pitch Book

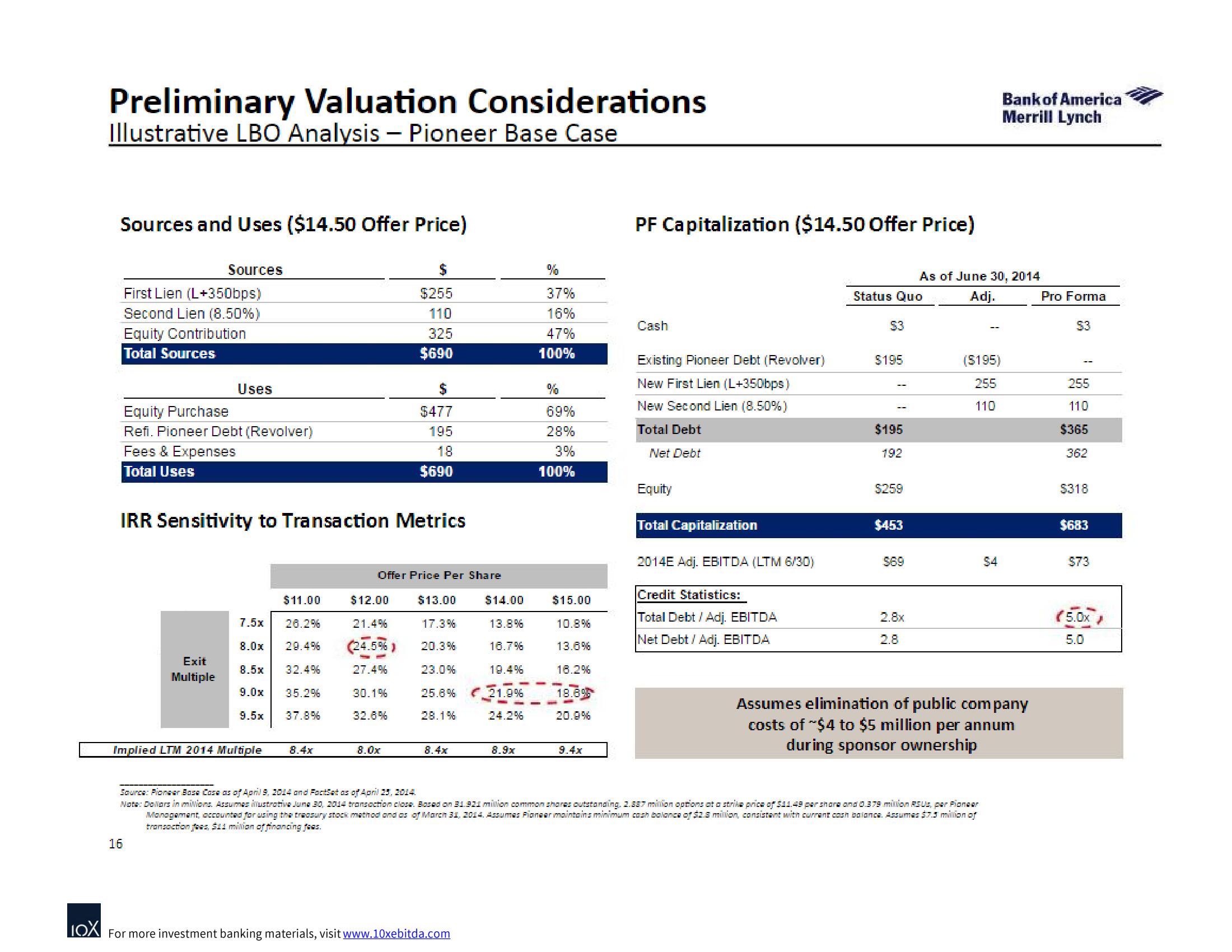

Preliminary Valuation Considerations

Illustrative LBO Analysis - Pioneer Base Case

Sources and Uses ($14.50 Offer Price)

Sources

First Lien (L+350bps)

Second Lien (8.50%)

Equity Contribution

Total Sources

16

Uses

Equity Purchase

Refi. Pioneer Debt (Revolver)

Fees & Expenses

Total Uses

Exit

Multiple

IRR Sensitivity to Transaction Metrics

9.5x

Implied LTM 2014 Multiple

$255

110

325

$690

$11.00

$12.00

21.4%

$13.00

17.3%

7.5x 26.2%

8.0x 29.4% (24.5%) 20.3%

8.5x 32.4%

9.0x 35.2%

37.8%

23.0%

27.4%

30.1%

32.6%

25.8% €21.9%

28.1%

24.2%

8.4x

$

$477

195

18

$690

Offer Price Per Share

8.0x

8.4x

$14.00

13.8%

16.7%

19.4%

LOX For more investment banking materials, visit www.10xebitda.com

8.9x

%

37%

16%

47%

100%

%

69%

28%

3%

100%

$15.00

10.8%

13.6%

18.2%

18.8%

20.9%

9.4x

PF Capitalization ($14.50 Offer Price)

Cash

Existing Pioneer Debt (Revolver)

New First Lien (L+350bps)

New Second Lien (8.50%)

Total Debt

Net Debt

Equity

Total Capitalization

2014E Adj. EBITDA (LTM 6/30)

Credit Statistics:

Total Debt / Adj. EBITDA

Net Debt / Adj. EBITDA

Status Quo

53

$195

$195

192

$259

$453

$69

2.8x

2.8

As of June 30, 2014

Adj.

($195)

255

110

Source: Pioneer Bosa Cosa as of April 9, 2014 and FactSet as of April 25, 2014.

Note: Dollars in milions. Assumes illustrative June 30, 2014 transaction close. Based on 31.921 million common shares outstanding. 2.837 million options at a strike price of $11.49 per share and 0.379 million RSUS, per Pioneer

Management, occounted for using the treasury stock method and as of March 31, 2014. Assumes Pioneer maintains minimum cash balance of $2.8 million, consistent with current cash balance. Assumes $7.3 million of

transaction fees, $11 million of financing fees.

Bank of America

Merrill Lynch

$4

Assumes elimination of public company

costs of $4 to $5 million per annum

during sponsor ownership

Pro Forma

53

255

110

$365

362

$318

$683

$73

(5.0x/

5.0View entire presentation