Trian Partners Activist Presentation Deck

Experience Revitalizing Consumer Brands, Including Multi-Nationals

Snapple

Investment: 1997-2000

A Harvard Business

School Case Study:

"How Snapple Got

Its Juice Back"

Heinz

Investment: 2006-2012

●

●

●

●

●

Select Case Studies

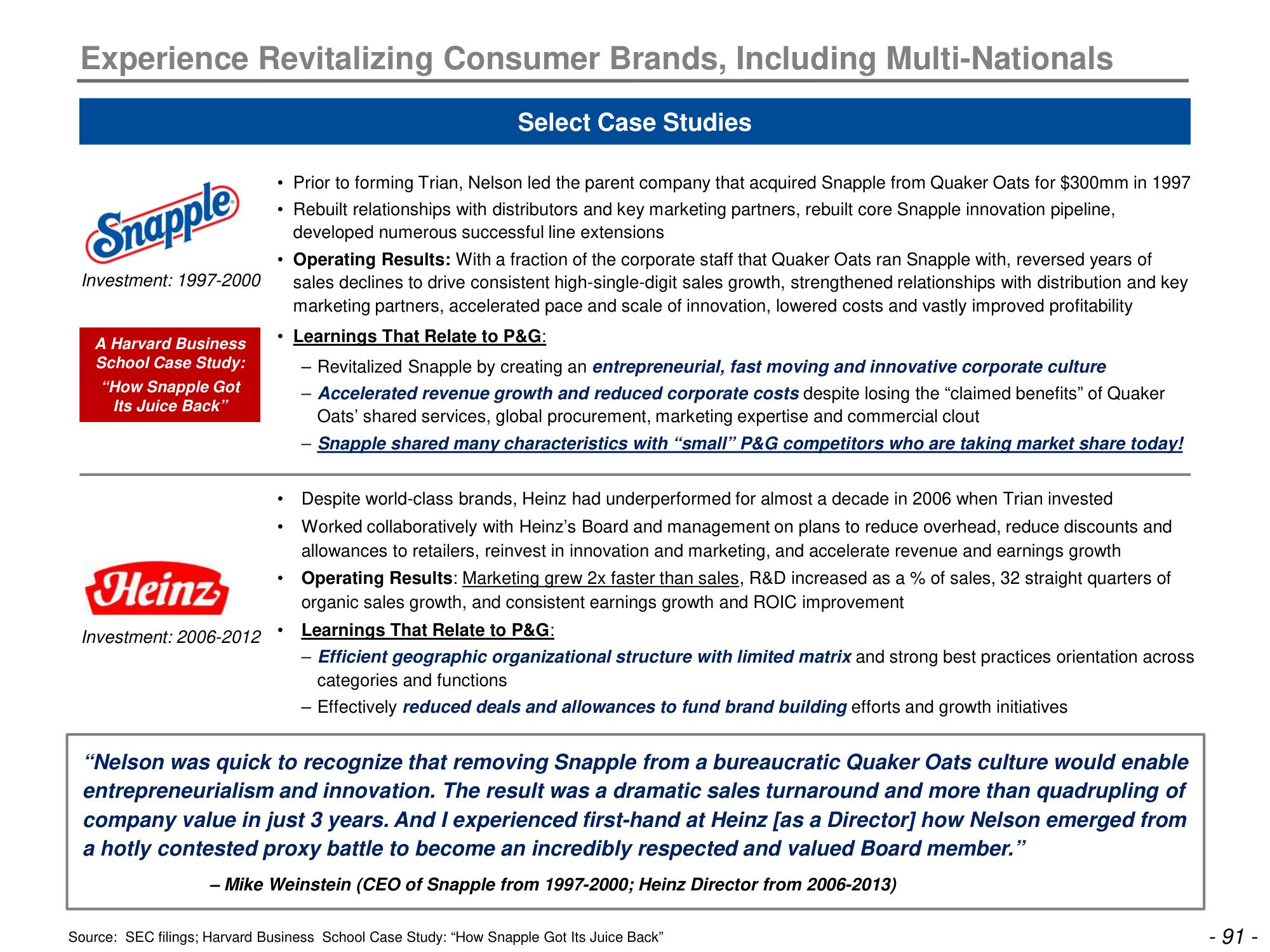

Prior to forming Trian, Nelson led the parent company that acquired Snapple from Quaker Oats for $300mm in 1997

Rebuilt relationships with distributors and key marketing partners, rebuilt core Snapple innovation pipeline,

developed numerous successful line extensions

Operating Results: With a fraction of the corporate staff that Quaker Oats ran Snapple with, reversed years of

sales declines to drive consistent high-single-digit sales growth, strengthened relationships with distribution and key

marketing partners, accelerated pace and scale of innovation, lowered costs and vastly improved profitability

Learnings That Relate to P&G:

- Revitalized Snapple by creating an entrepreneurial, fast moving and innovative corporate culture

Accelerated revenue growth and reduced corporate costs despite losing the "claimed benefits" of Quaker

Oats' shared services, global procurement, marketing expertise and commercial clout

Snapple shared many characteristics with "small” P&G competitors who are taking market share today!

Despite world-class brands, Heinz had underperformed for almost a decade in 2006 when Trian invested

Worked collaboratively with Heinz's Board and management on plans to reduce overhead, reduce discounts and

allowances to retailers, reinvest in innovation and marketing, and accelerate revenue and earnings growth

Operating Results: Marketing grew 2x faster than sales, R&D increased as a % of sales, 32 straight quarters of

organic sales growth, and consistent earnings growth and ROIC improvement

Learnings That Relate to P&G:

- Efficient geographic organizational structure with limited matrix and strong best practices orientation across

categories and functions

- Effectively reduced deals and allowances to fund brand building efforts and growth initiatives

"Nelson was quick to recognize that removing Snapple from a bureaucratic Quaker Oats culture would enable

entrepreneurialism and innovation. The result was a dramatic sales turnaround and more than quadrupling of

company value in just 3 years. And I experienced first-hand at Heinz [as a Director] how Nelson emerged from

a hotly contested proxy battle to become an incredibly respected and valued Board member."

- Mike Weinstein (CEO of Snapple from 1997-2000; Heinz Director from 2006-2013)

Source: SEC filings; Harvard Business School Case Study: "How Snapple Got Its Juice Back"

- 91 -View entire presentation