BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

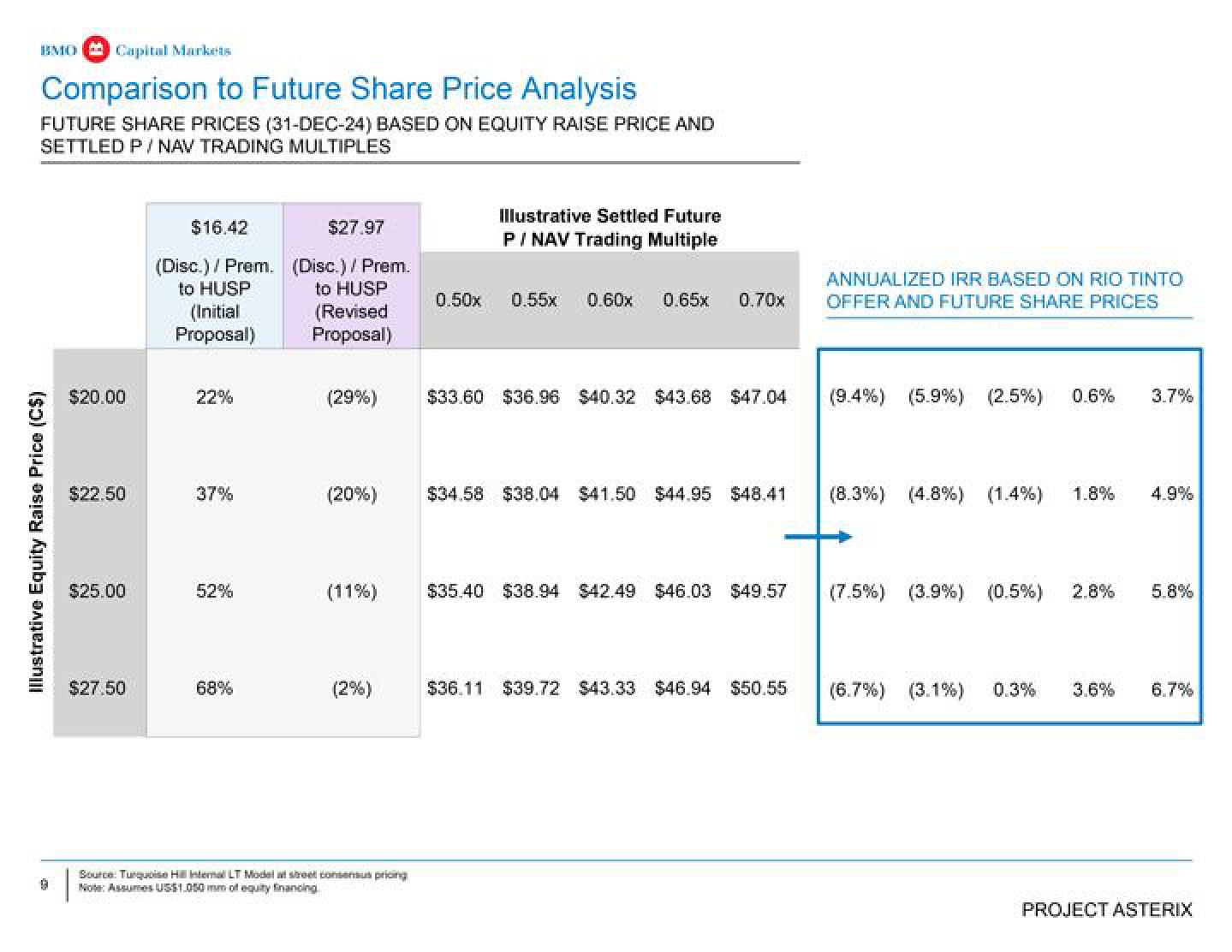

Comparison to Future Share Price Analysis

FUTURE SHARE PRICES (31-DEC-24) BASED ON EQUITY RAISE PRICE AND

SETTLED P/ NAV TRADING MULTIPLES

Illustrative Equity Raise Price (C$)

$20.00

$22.50

$25.00

$27.50

$16.42

(Disc.) / Prem.

to HUSP

(Initial

Proposal)

22%

37%

52%

68%

$27.97

(Disc.) / Prem.

to HUSP

(Revised

Proposal)

Illustrative Settled Future

P/NAV Trading Multiple

(29%) $33.60 $36.96 $40.32 $43.68 $47.04

0.50x 0.55x 0.60x 0.65x 0.70x

(20%) $34.58 $38.04 $41.50 $44.95 $48.41

(2%)

(11%) $35.40 $38.94 $42.49 $46.03 $49.57

Source: Turquoise Hill Internal LT Model at street consensus pricing

Note: Assumes US$1.050 mm of equity financing

$36.11 $39.72 $43.33 $46.94 $50.55

ANNUALIZED IRR BASED ON RIO TINTO

OFFER AND FUTURE SHARE PRICES

(9.4%) (5.9%) (2.5%) 0.6% 3.7

(8.3%) (4.8%) (1.4%) 1.8%

4.9%

(7.5%) (3.9%) (0.5%) 2.8% 5.8%

(6.7%) (3.1%)

0.3% 3.6% 6.7%

PROJECT ASTERIXView entire presentation