FCX Conference Call 1st Quarter 2022 Results

1Q22 Highlights

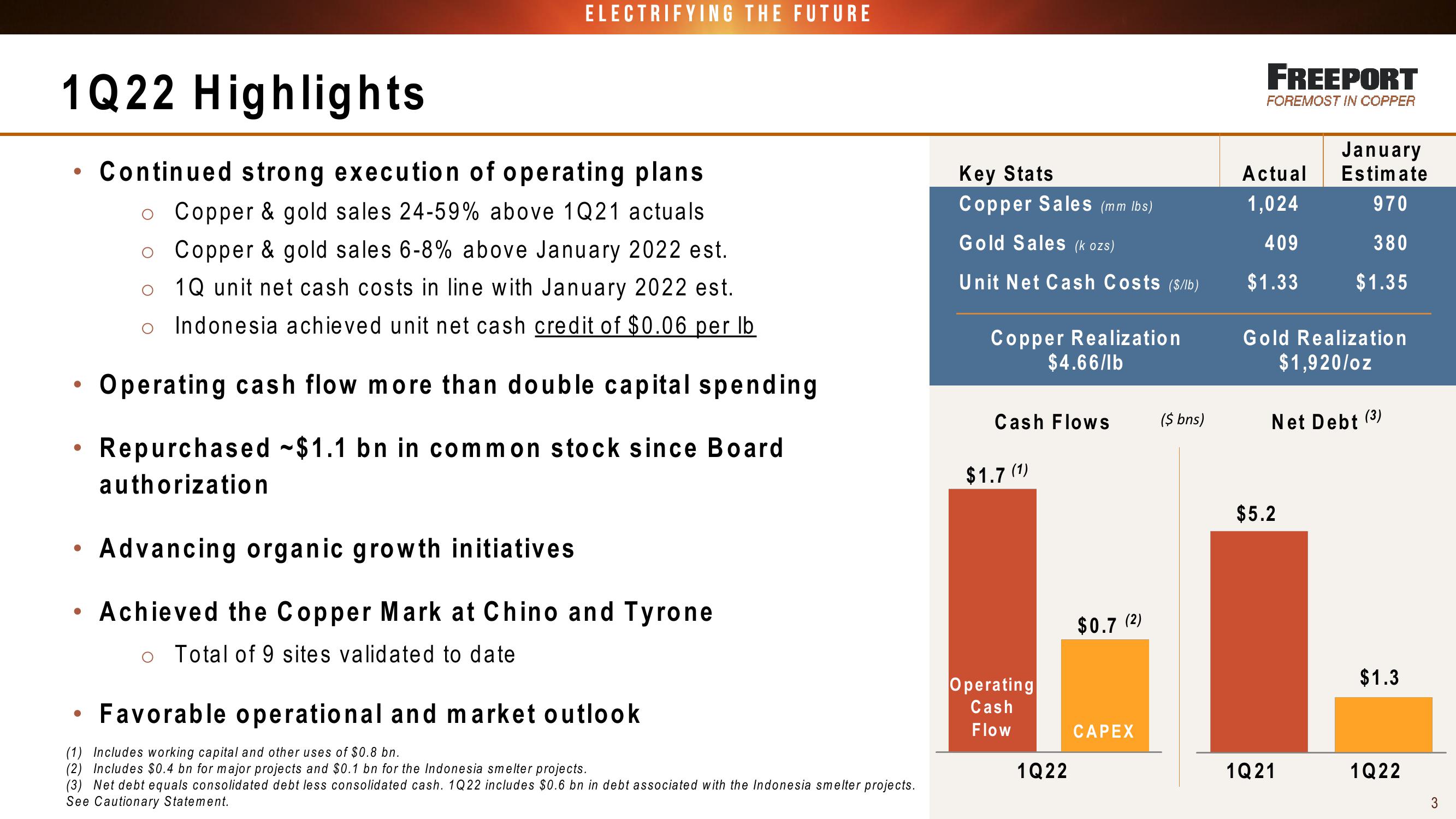

Continued strong execution of operating plans.

Copper & gold sales 24-59% above 1Q21 actuals

o Copper & gold sales 6-8% above January 2022 est.

1Q unit net cash costs in line with January 2022 est.

o Indonesia achieved unit net cash credit of $0.06 per lb

Operating cash flow more than double capital spending

Repurchased -$1.1 bn in common stock since Board

authorization

●

●

●

ELECTRIFYING THE FUTURE

●

Advancing organic growth initiatives.

Achieved the Copper Mark at Chino and Tyrone

o Total of 9 sites validated to date

• Favorable operational and market outlook

(1) Includes working capital and other uses of $0.8 bn.

(2) Includes $0.4 bn for major projects and $0.1 bn for the Indonesia smelter projects.

(3) Net debt equals consolidated debt less consolidated cash. 1Q22 includes $0.6 bn in debt associated with the Indonesia smelter projects.

See Cautionary Statement.

Key Stats

Copper Sales (mm lbs)

Gold Sales (k ozs)

Unit Net Cash Costs ($/lb)

Copper Realization

$4.66/lb

Cash Flows

$1.7 (1)

Operating

Cash

Flow

1Q22

$0.7 (2)

CAPEX

($ bns)

FREEPORT

FOREMOST IN COPPER

Actual

1,024

409

$1.33

Gold Realization

$1,920/oz

January

Estimate

970

380

$1.35

Net Debt (3)

$5.2

1Q21

$1.3

1Q22

3View entire presentation