SmileDirectClub Investor Presentation Deck

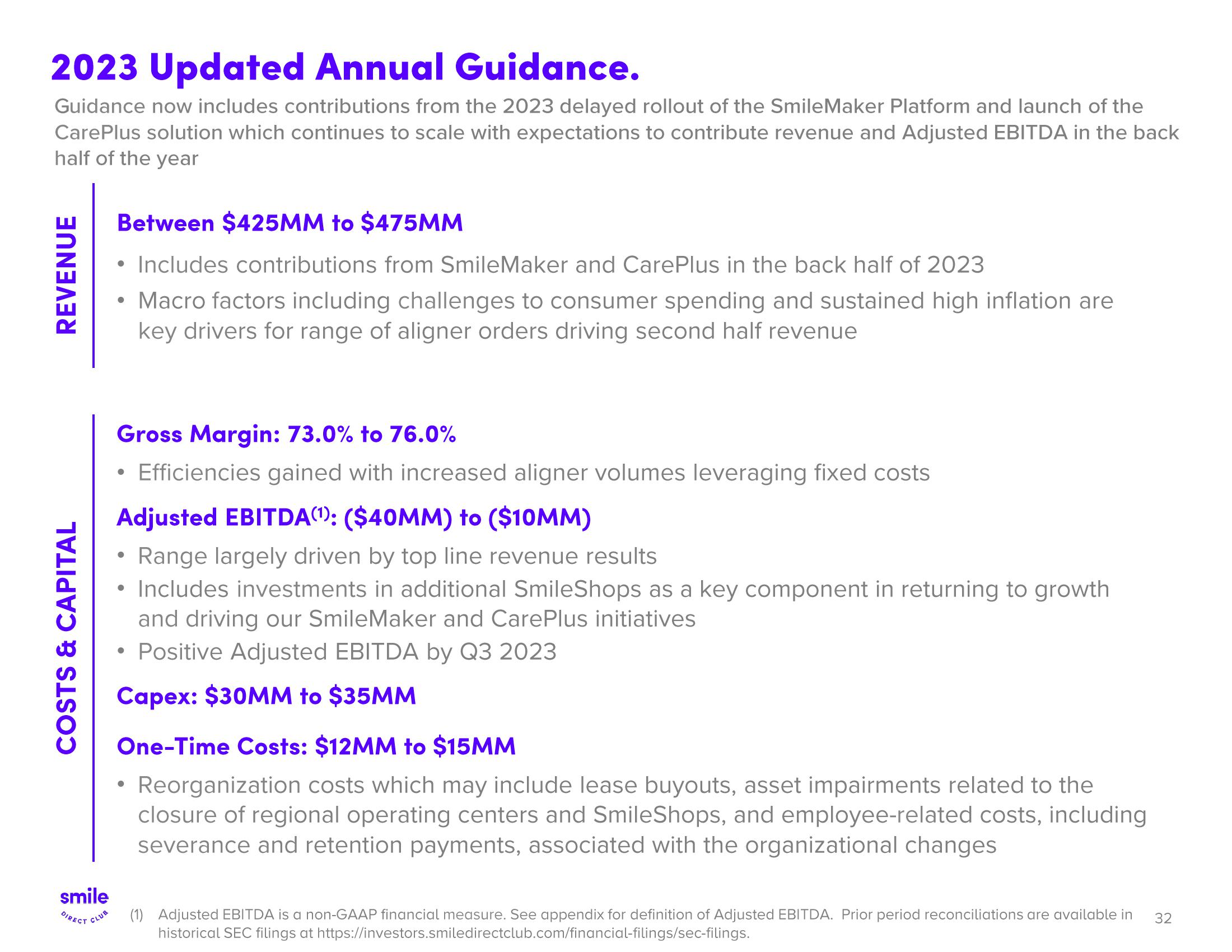

2023 Updated Annual Guidance.

Guidance now includes contributions from the 2023 delayed rollout of the SmileMaker Platform and launch of the

CarePlus solution which continues to scale with expectations to contribute revenue and Adjusted EBITDA in the back

half of the year

REVENUE

COSTS & CAPITAL

smile

DIRECT CLUB

Between $425MM to $475MM

Includes contributions from SmileMaker and CarePlus in the back half of 2023

• Macro factors including challenges to consumer spending and sustained high inflation are

key drivers for range of aligner orders driving second half revenue

Gross Margin: 73.0% to 76.0%

• Efficiencies gained with increased aligner volumes leveraging fixed costs

Adjusted EBITDA(¹): ($40MM) to ($10MM)

Range largely driven by top line revenue results

• Includes investments in additional SmileShops as a key component in returning to growth

and driving our SmileMaker and CarePlus initiatives

Positive Adjusted EBITDA by Q3 2023

Capex: $30MM to $35MM

●

One-Time Costs: $12MM to $15MM

Reorganization costs which may include lease buyouts, asset impairments related to the

closure of regional operating centers and SmileShops, and employee-related costs, including

severance and retention payments, associated with the organizational changes

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA. Prior period reconciliations are available in

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.

32View entire presentation