Masterworks Investor Presentation Deck

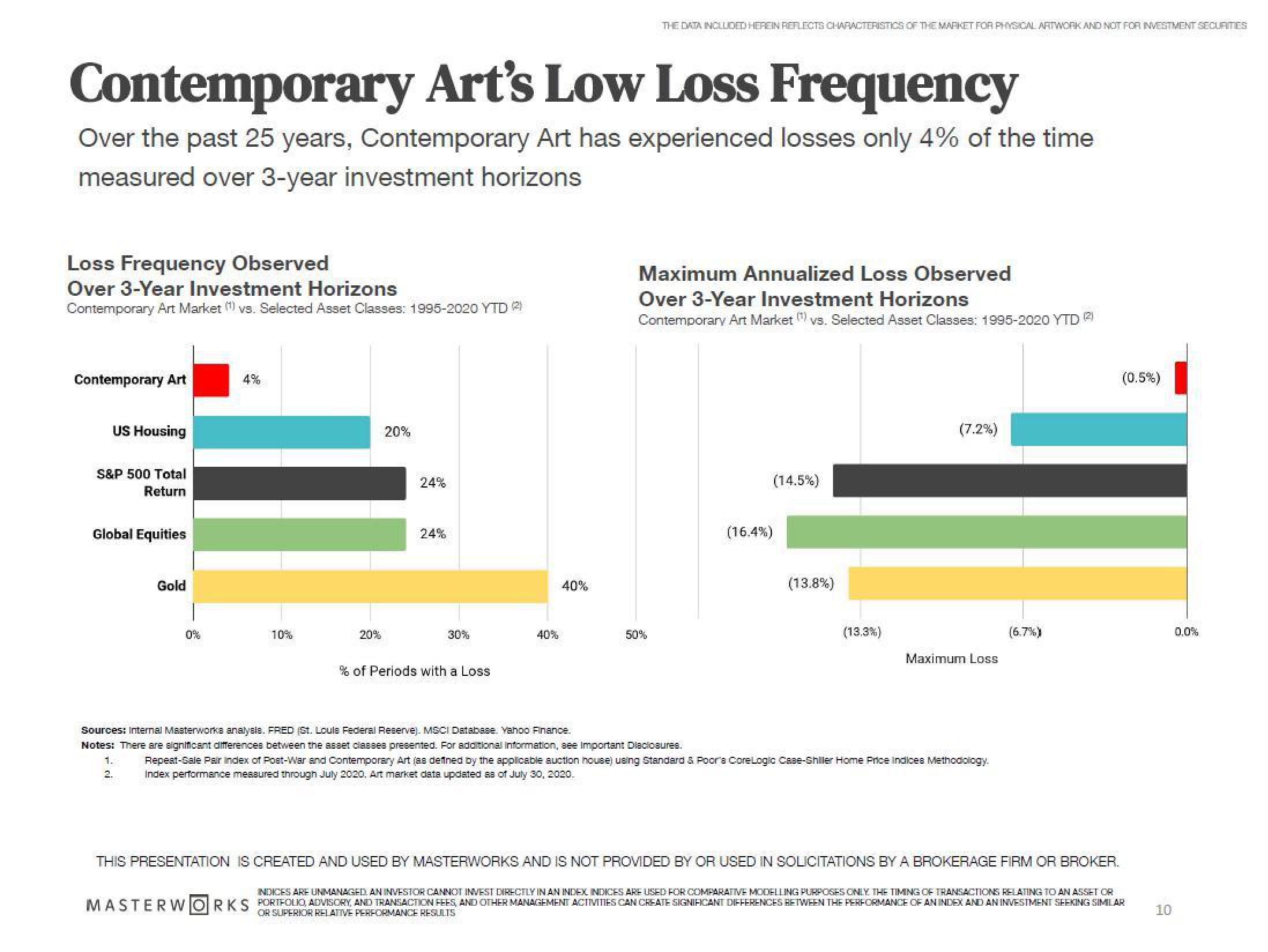

Contemporary Art's Low Loss Frequency

Over the past 25 years, Contemporary Art has experienced losses only 4% of the time

measured over 3-year investment horizons

Loss Frequency Observed

Over 3-Year Investment Horizons

Contemporary Art Market (1) vs. Selected Asset Classes: 1995-2020 YTD 2)

Contemporary Art

US Housing

S&P 500 Total

Return

Global Equities

Gold

1.

2.

4%

10%

20%

20%

24%

24%

30%

% of Periods with a Loss

40%

40%

THE DATA INCLUDED HEREIN REFLECTS CHARACTERISTICS OF THE MARKET FOR PHYSICAL ARTWORK AND NOT FOR INVESTMENT SECURITIES

Maximum Annualized Loss Observed

Over 3-Year Investment Horizons

Contemporary Art Market (¹) vs. Selected Asset Classes: 1995-2020 YTD2²

50%

(14.5%)

(16.4%)

(13.8%)

(13.3 %)

(7.2%)

Maximum Loss

Sources: Internal Masterworks analysis. FRED (St. Louls Federal Reserve). MSCI Database. Yahoo Finance.

Notes: There are significant differences between the asset classes presented. For additional information, see Important Diaclosures.

Repeat-Sale Pair Index of Post-War and Contemporary Art (as defined by the applicable auction house) using Standard & Poor'a Core Logic Case-Shiller Home Price Indices Methodology.

Index performance measured through July 2020. Art market data updated as of July 30, 2020.

(6.7%)

THIS PRESENTATION IS CREATED AND USED BY MASTERWORKS AND IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A BROKERAGE FIRM OR BROKER.

(0.5%)

INDICES ARE UNMANAGED AN INVESTOR CANNOT INVEST DIRECTLY IN AN INDEX INDICES ARE USED FOR COMPARATIVE MODELLING PURPOSES ONLY THE TIMING OF TRANSACTIONS RELATING TO AN ASSET OR

MASTERWORKS PORTFOLIO, ADVISORY, AND TRANSACTION FEES, AND OTHER MANAGEMENT ACTIVITIES CAN CREATE SIGNIFICANT DIFFERENCES BETWEEN THE PERFORMANCE OF AN INDEX AND AN INVESTMENT SEEKING SIMILAR

OR SUPERIOR RELATIVE PERFORMANCE RESULTS

10

0,0%View entire presentation