Comcast Results Presentation Deck

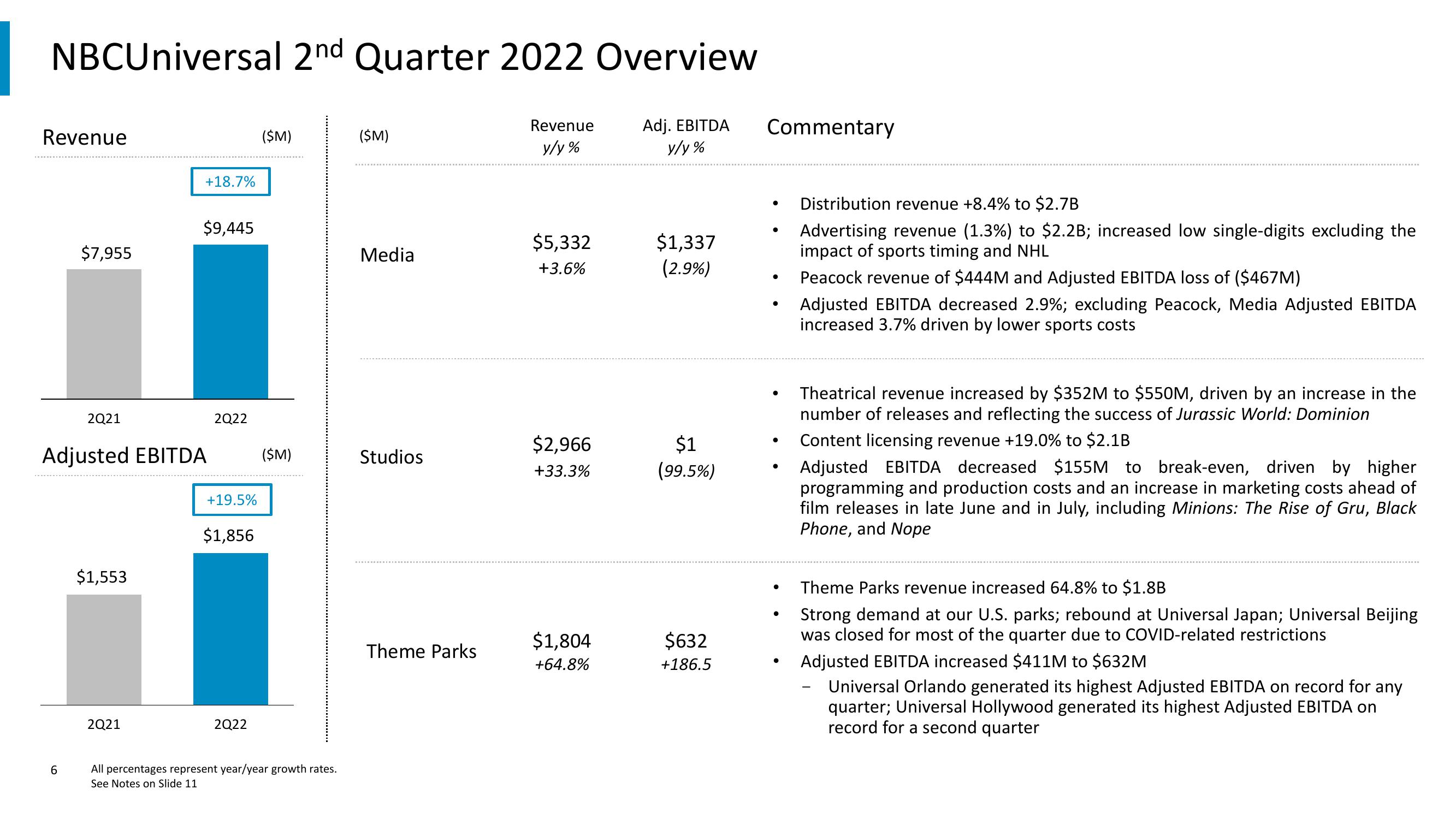

NBCUniversal 2nd Quarter 2022 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$7,955

6

2Q21

$1,553

+18.7%

2Q21

$9,445

Adjusted EBITDA ($M)

2Q22

+19.5%

$1,856

($M)

2Q22

All percentages represent year/year growth rates.

See Notes on Slide 11

($M)

Media

Studios

Theme Parks

$5,332

+3.6%

$2,966

+33.3%

$1,804

+64.8%

$1,337

(2.9%)

$1

(99.5%)

$632

+186.5

Commentary

●

●

Distribution revenue +8.4% to $2.7B

Advertising revenue (1.3%) to $2.2B; increased low single-digits excluding the

пра of sports timing and NHL

Peacock revenue of $444M and Adjusted EBITDA loss of ($467M)

Adjusted EBITDA decreased 2.9%; excluding Peacock, Media Adjusted EBITDA

increased 3.7% driven by lower sports costs

Theatrical revenue increased by $352M to $550M, driven by an increase in the

number of releases and reflecting the success of Jurassic World: Dominion

Content licensing revenue +19.0% to $2.1B

Adjusted EBITDA decreased $155M to break-even, driven by higher

programming and production costs and an increase in marketing costs ahead of

film releases in late June and in July, including Minions: The Rise of Gru, Black

Phone, and Nope

Theme Parks revenue increased 64.8% to $1.8B

Strong demand at our U.S. parks; rebound at Universal Japan; Universal Beijing

was closed for most of the quarter due to COVID-related restrictions

Adjusted EBITDA increased $411M to $632M

Universal Orlando generated its highest Adjusted EBITDA on record for any

quarter; Universal Hollywood generated its highest Adjusted EBITDA on

record for a second quarterView entire presentation