Silicon Valley Bank Results Presentation Deck

Non-GAAP reconciliation

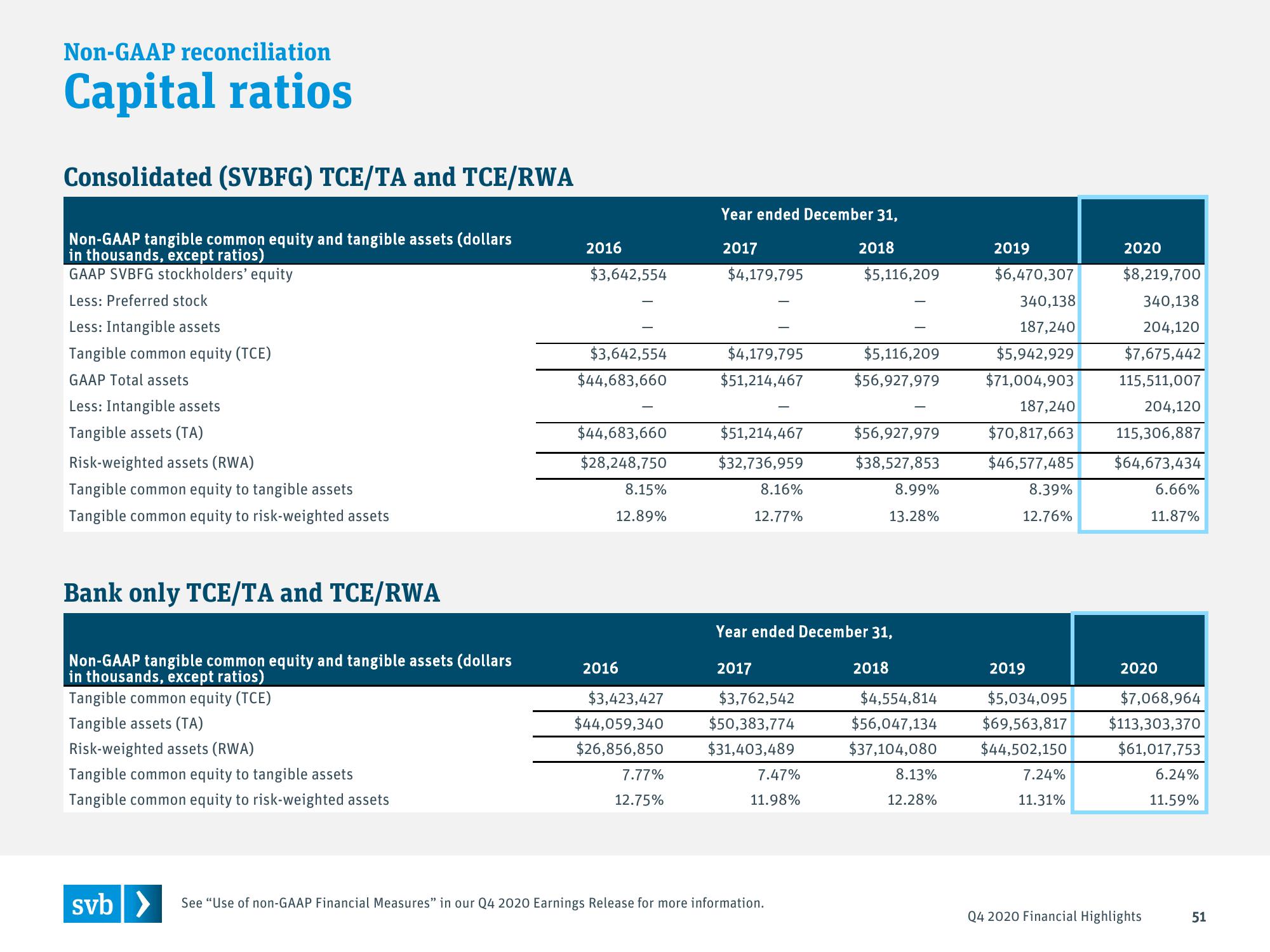

Capital ratios

Consolidated (SVBFG) TCE/TA and TCE/RWA

Non-GAAP tangible common equity and tangible assets (dollars

in thousands, except ratios)

GAAP SVBFG stockholders' equity

Less: Preferred stock

Less: Intangible assets

Tangible common equity (TCE)

GAAP Total assets

Less: Intangible assets

Tangible assets (TA)

Risk-weighted assets (RWA)

Tangible common equity to tangible assets

Tangible common equity to risk-weighted assets

Bank only TCE/TA and TCE/RWA

Non-GAAP tangible common equity and tangible assets (dollars

in thousands, except ratios)

Tangible common equity (TCE)

Tangible assets (TA)

Risk-weighted assets (RWA)

Tangible common equity to tangible assets

Tangible common equity to risk-weighted assets

2016

$3,642,554

$3,642,554

$44,683,660

$44,683,660

$28,248,750

8.15%

12.89%

2016

$3,423,427

$44,059,340

$26,856,850

7.77%

12.75%

Year ended December 31,

2017

$4,179,795

$4,179,795

$51,214,467

$51,214,467

$32,736,959

8.16%

12.77%

2017

$3,762,542

$50,383,774

$31,403,489

7.47%

11.98%

2018

svb > See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release for more information.

$5,116,209

$5,116,209

$56,927,979

Year ended December 31,

$56,927,979

$38,527,853

8.99%

13.28%

2018

$4,554,814

$56,047,134

$37,104,080

8.13%

12.28%

2019

$6,470,307

340,138

187,240

$5,942,929

$71,004,903

187,240

$70,817,663

$46,577,485

8.39%

12.76%

2019

$5,034,095

$69,563,817

$44,502,150

7.24%

11.31%

2020

$8,219,700

340,138

204,120

$7,675,442

115,511,007

204,120

115,306,887

$64,673,434

6.66%

11.87%

2020

$7,068,964

$113,303,370

$61,017,753

Q4 2020 Financial Highlights

6.24%

11.59%

51View entire presentation