Repay SPAC

Who We Are

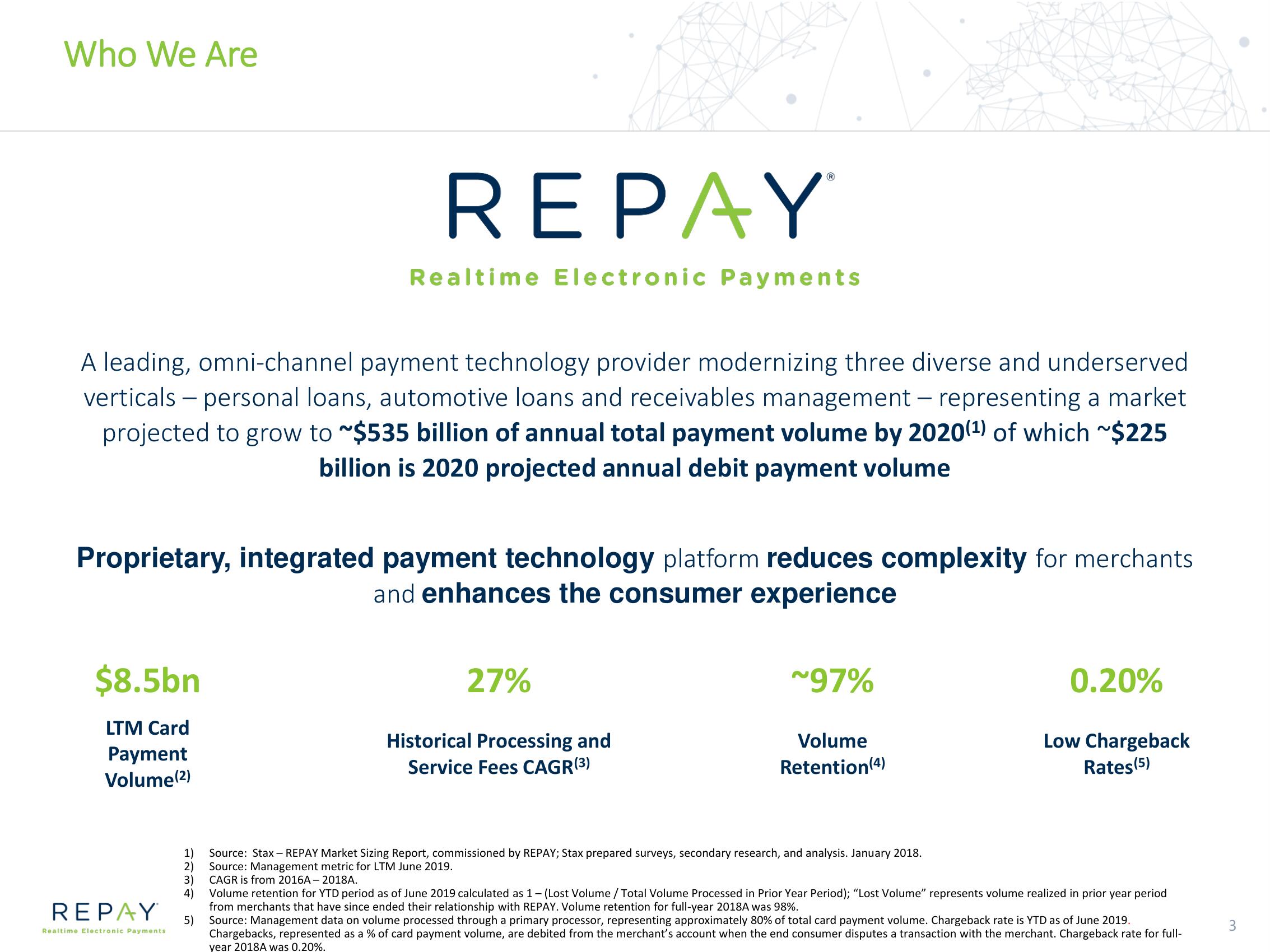

A leading, omni-channel payment technology provider modernizing three diverse and underserved

verticals - personal loans, automotive loans and receivables management - representing a market

projected to grow to ~$535 billion of annual total payment volume by 2020 (¹) of which ~$225

billion is 2020 projected annual debit payment volume

$8.5bn

REPAY

Realtime Electronic Payments

Proprietary, integrated payment technology platform reduces complexity for merchants

and enhances the consumer experience

LTM Card

Payment

Volume(2)

REPAY

Realtime Electronic Payments

Ⓡ

27%

Historical Processing and

Service Fees CAGR (³)

~97%

Volume

Retention (4)

1) Source: Stax - REPAY Market Sizing Report, commissioned by REPAY; Stax prepared surveys, secondary research, and analysis. January 2018.

Source: Management metric for LTM June 2019.

2)

3)

CAGR is from 2016A-2018A.

4)

0.20%

Low Chargeback

Rates (5)

Volume retention for YTD period as of June 2019 calculated as 1- (Lost Volume/Total Volume Processed in Prior Year Period); "Lost Volume" represents volume realized in prior year period

from merchants that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%.

5) Source: Management data on volume processed through a primary processor, representing approximately 80% of total card payment volume. Chargeback rate is YTD as of June 2019.

Chargebacks, represented as a % of card payment volume, are debited from the merchant's account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-

year 2018A was 0.20%.

3View entire presentation