Barclays Investment Banking Pitch Book

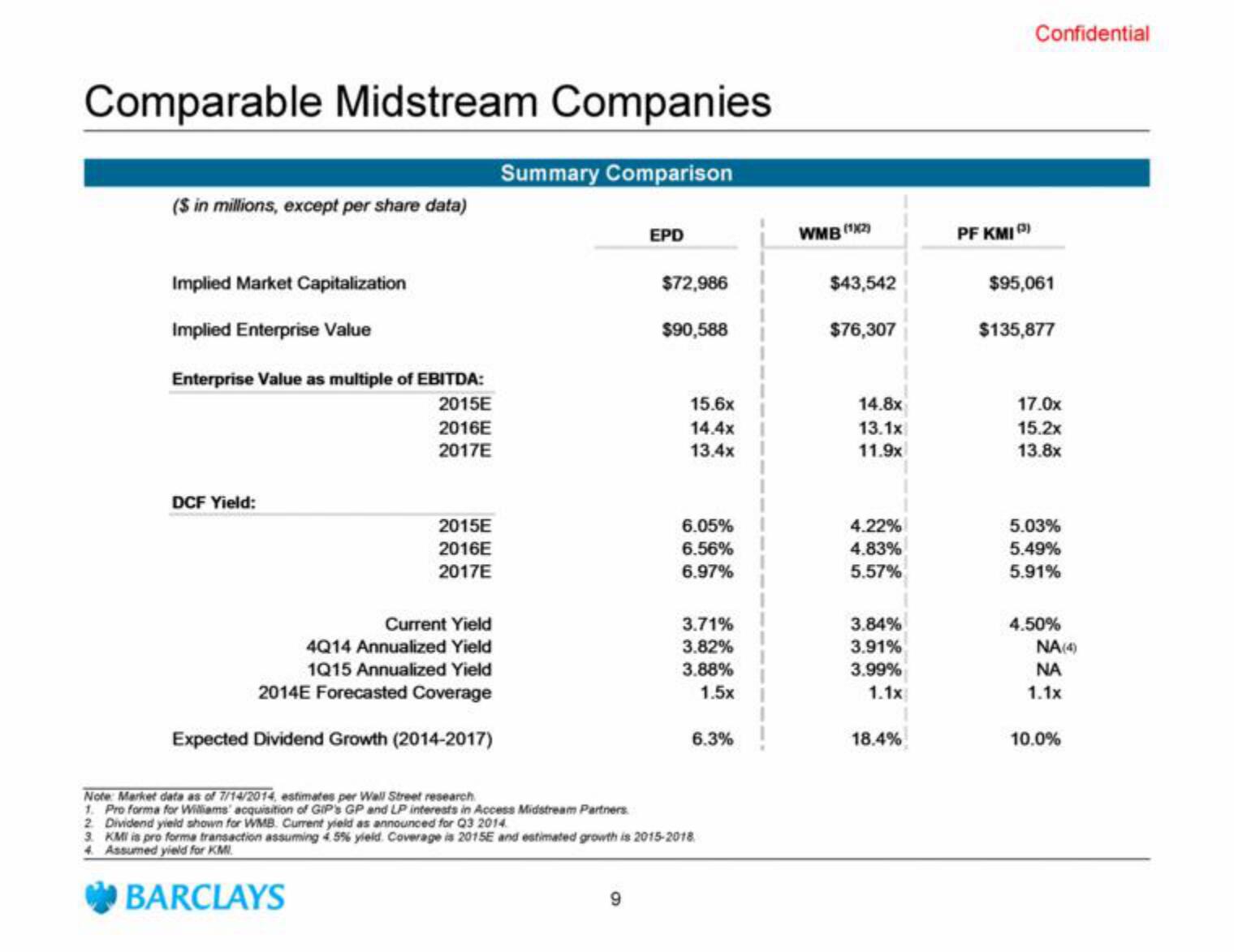

Comparable Midstream Companies

Summary Comparison

($ in millions, except per share data)

Implied Market Capitalization

Implied Enterprise Value

Enterprise Value as multiple of EBITDA:

2015E

2016E

2017E

DCF Yield:

2015E

2016E

2017E

Current Yield

4Q14 Annualized Yield

1Q15 Annualized Yield

2014E Forecasted Coverage

Expected Dividend Growth (2014-2017)

EPD

9

$72,986

$90,588

15.6x

14.4x

13.4x

6.05%

6.56%

6.97%

3.71%

3.82%

3.88%

1.5x

6.3%

Note: Market data as of 7/14/2014, estimates per Wall Street research

1. Pro forma for Williams' acquisition of GIP's GP and LP interests in Access Midstream Partners

2. Dividend yield shown for WMB. Current yield as announced for Q3 2014.

3. KMI is pro forma transaction assuming 4.5% yield. Coverage is 2015E and estimated growth is 2015-2018.

4. Assumed yield for KM

BARCLAYS

WMB (12)

$43,542

$76,307

14.8x

13.1x

11.9x

4.22%

4.83%

5.57%

3.84%

3.91%

3.99%

1.1x

18.4%

PF KMI)

Confidential

$95,061

$135,877

17.0x

15.2x

13.8x

5.03%

5.49%

5.91%

4.50%

NA (4)

ΝΑ

1.1x

10.0%View entire presentation