Selina SPAC

Summary Risk Factors

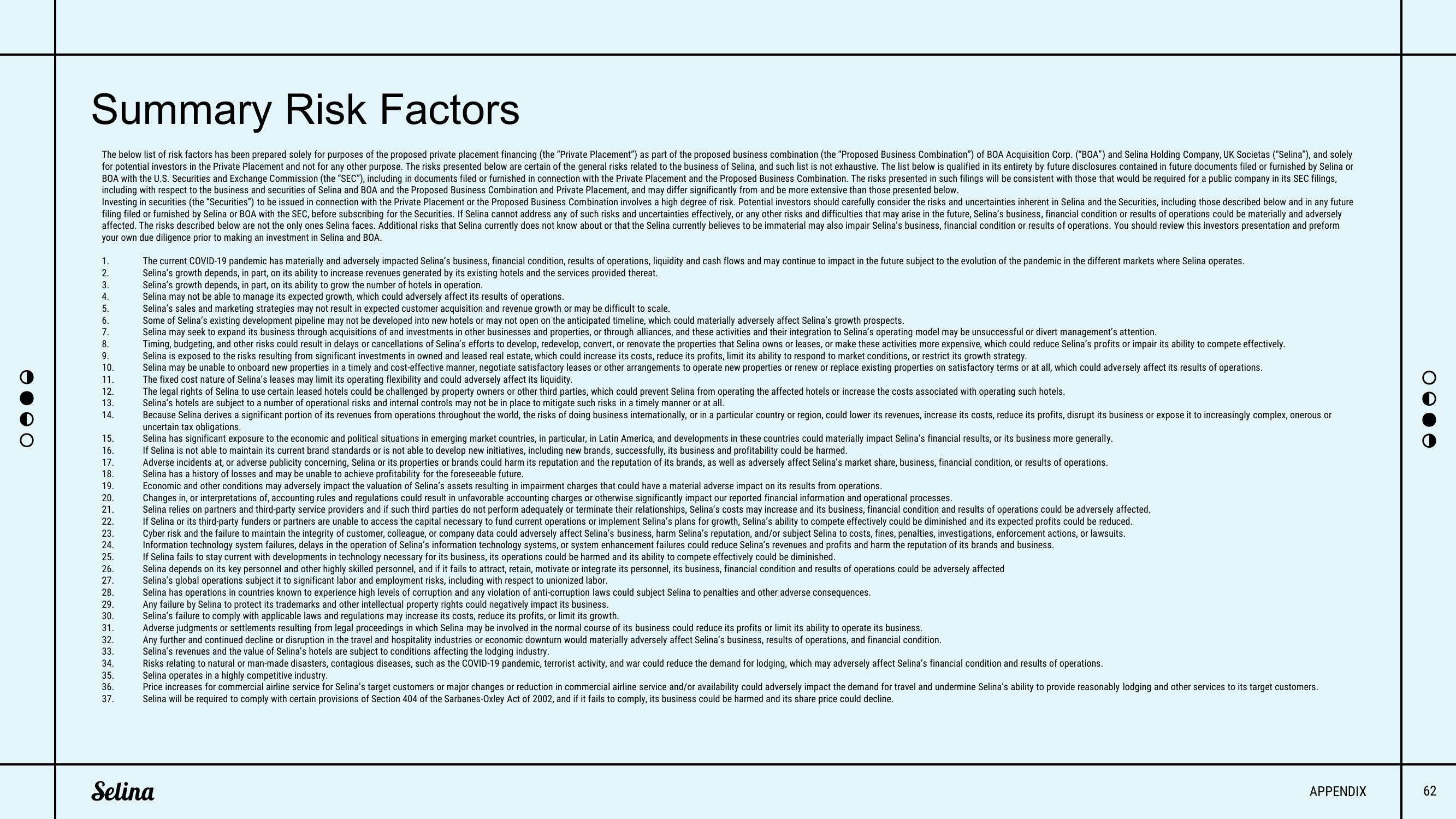

The below list of risk factors has been prepared solely for purposes of the proposed private placement financing (the "Private Placement") as part of the proposed business combination (the "Proposed Business Combination") of BOA Acquisition Corp. ("BOA") and Selina Holding Company, UK Societas ("Selina"), and solely

for potential investors in the Private Placement and not for any other purpose. The risks presented below are certain of the general risks related to the business of Selina, and such list is not exhaustive. The list below is qualified in its entirety by future disclosures contained in future documents filed or furnished by Selina or

BOA with the U.S. Securities and Exchange Commission (the "SEC"), including in documents filed or furnished in connection with the Private Placement and the Proposed Business Combination. The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings,

including with respect to the business and securities of Selina and BOA and the Proposed Business Combination and Private Placement, and may differ significantly from and be more extensive than those presented below.

Investing in securities (the "Securities") to be issued in connection with the Private Placement or the Proposed Business Combination involves a high degree of risk. Potential investors should carefully consider the risks and uncertainties inherent in Selina and the Securities, including those described below and in any future

filing filed or furnished by Selina or BOA with the SEC, before subscribing for the Securities. If Selina cannot address any of such risks and uncertainties effectively, or any other risks and difficulties that may arise in the future, Selina's business, financial condition or results of operations could be materially and adversely

affected. The risks described below are not the only ones Selina faces. Additional risks that Selina currently does not know about or that the Selina currently believes to be immaterial may also impair Selina's business, financial condition or results of operations. You should review this investors presentation and preform

your own due diligence prior to making an investment in Selina and BOA.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

The current COVID-19 pandemic has materially and adversely impacted Selina's business, financial condition, results of operations, liquidity and cash flows and may continue to impact in the future subject to the evolution of the pandemic in the different markets where Selina operates.

Selina's growth depends, in part, on its ability to increase revenues generated by its existing hotels and the services provided thereat.

Selina's growth depends, in part, on its ability to grow the number of hotels in operation.

Selina may not be able to manage its expected growth, which could adversely affect its results of operations.

Selina's sales and marketing strategies may not result in expected customer acquisition and revenue growth or may be difficult to scale.

Some of Selina's existing development pipeline may not be developed into new hotels or may not open on the anticipated timeline, which could materially adversely affect Selina's growth prospects.

Selina may seek to expand its business through acquisitions of and investments in other businesses and properties, or through alliances, and these activities and their integration to Selina's operating model may be unsuccessful or divert management's attention.

Timing, budgeting, and other risks could result in delays or cancellations of Selina's efforts to develop, redevelop, convert, or renovate the properties that Selina owns or leases, or make these activities more expensive, which could reduce Selina's profits or impair its ability to compete effectively.

Selina is exposed to the risks resulting from significant investments in owned and leased real estate, which could increase its costs, reduce its profits, limit its ability to respond to market conditions, or restrict its growth strategy.

Selina may be unable to onboard new properties in a timely and cost-effective manner, negotiate satisfactory leases or other arrangements to operate new properties or renew or replace existing properties on satisfactory terms or at all, which could adversely affect its results of operations.

The fixed cost nature of Selina's leases may limit its operating flexibility and could adversely affect its liquidity.

The legal rights of Selina to use certain leased hotels could be challenged by property owners or other third parties, which could prevent Selina from operating the affected hotels or increase the costs associated with operating such hotels.

Selina's hotels are subject to a number of operational risks and internal controls may not be in place to mitigate such risks in a timely manner or at all.

Because Selina derives a significant portion of its revenues from operations throughout the world, the risks of doing business internationally, or in a particular country or region, could lower its revenues, increase its costs, reduce its profits, disrupt its business or expose it to increasingly complex, onerous or

uncertain tax obligations.

Selina has significant exposure to the economic and political situations in emerging market countries, in particular, in Latin America, and developments in these countries could materially impact Selina's financial results, or its business more generally.

If Selina is not able to maintain its current brand standards or is not able to develop new initiatives, including new brands, successfully, its business and profitability could be harmed.

Adverse incidents at, or adverse publicity concerning, Selina or its properties or brands could harm its reputation and the reputation of its brands, as well as adversely affect Selina's market share, business, financial condition, or results of operations.

Selina has a history of losses and may be unable to achieve profitability for the foreseeable future.

Economic and other conditions may adversely impact the valuation of Selina's assets resulting in impairment charges that could have a material adverse impact on its results from operations.

Changes in, or interpretations of, accounting rules and regulations could result in unfavorable accounting charges or otherwise significantly impact our reported financial information and operational processes.

Selina relies on partners and third-party service providers and if such third parties do not perform adequately or terminate their relationships, Selina's costs may increase and its business, financial condition and results of operations could be adversely affected.

If Selina or its third-party funders or partners are unable to access the capital necessary to fund current operations or implement Selina's plans for growth, Selina's ability to compete effectively could be diminished and its expected profits could be reduced.

Cyber risk and the failure to maintain the integrity of customer, colleague, or company data could adversely affect Selina's business, harm Selina's reputation, and/or subject Selina to costs, fines, penalties, investigations, enforcement actions, or lawsuits.

Information technology system failures, delays in the operation of Selina's information technology systems, or system enhancement failures could reduce Selina's revenues and profits and harm the reputation of its brands and business.

If Selina fails to stay current with developments in technology necessary for its business, its operations could be harmed and its ability to compete effectively could be diminished.

Selina depends on its key personnel and other highly skilled personnel, and if it fails to attract, retain, motivate or integrate its personnel, its business, financial condition and results of operations could be adversely affected

Selina's global operations subject it to significant labor and employment risks, including with respect to unionized labor.

Selina has operations in countries known to experience high levels of corruption and any violation of anti-corruption laws could subject Selina to penalties and other adverse consequences.

Any failure by Selina to protect its trademarks and other intellectual property rights could negatively impact its business.

Selina's failure to comply with applicable laws and regulations may increase its costs, reduce its profits, or limit its growth.

Adverse judgments or settlements resulting from legal proceedings in which Selina may be involved in the normal course of its business could reduce its profits or limit its ability to operate its business.

Any further and continued decline or disruption in the travel and hospitality industries or economic downturn would materially adversely affect Selina's business, results of operations, and financial condition.

Selina's revenues and the value of Selina's hotels are subject to conditions affecting the lodging industry.

Risks relating to natural or man-made disasters, contagious diseases, such as the COVID-19 pandemic, terrorist activity, and war could reduce the demand for lodging, which may adversely affect Selina's financial condition and results of operations.

Selina operates in a highly competitive industry.

Price increases for commercial airline service for Selina's target customers or major changes or reduction in commercial airline service and/or availability could adversely impact the demand for travel and undermine Selina's ability to provide reasonably lodging and other services to its target customers.

Selina will be required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002, and if it fails to comply, its business could be harmed and its share price could decline.

Selina

APPENDIX

62View entire presentation