J.P.Morgan Investment Banking

APPENDIX

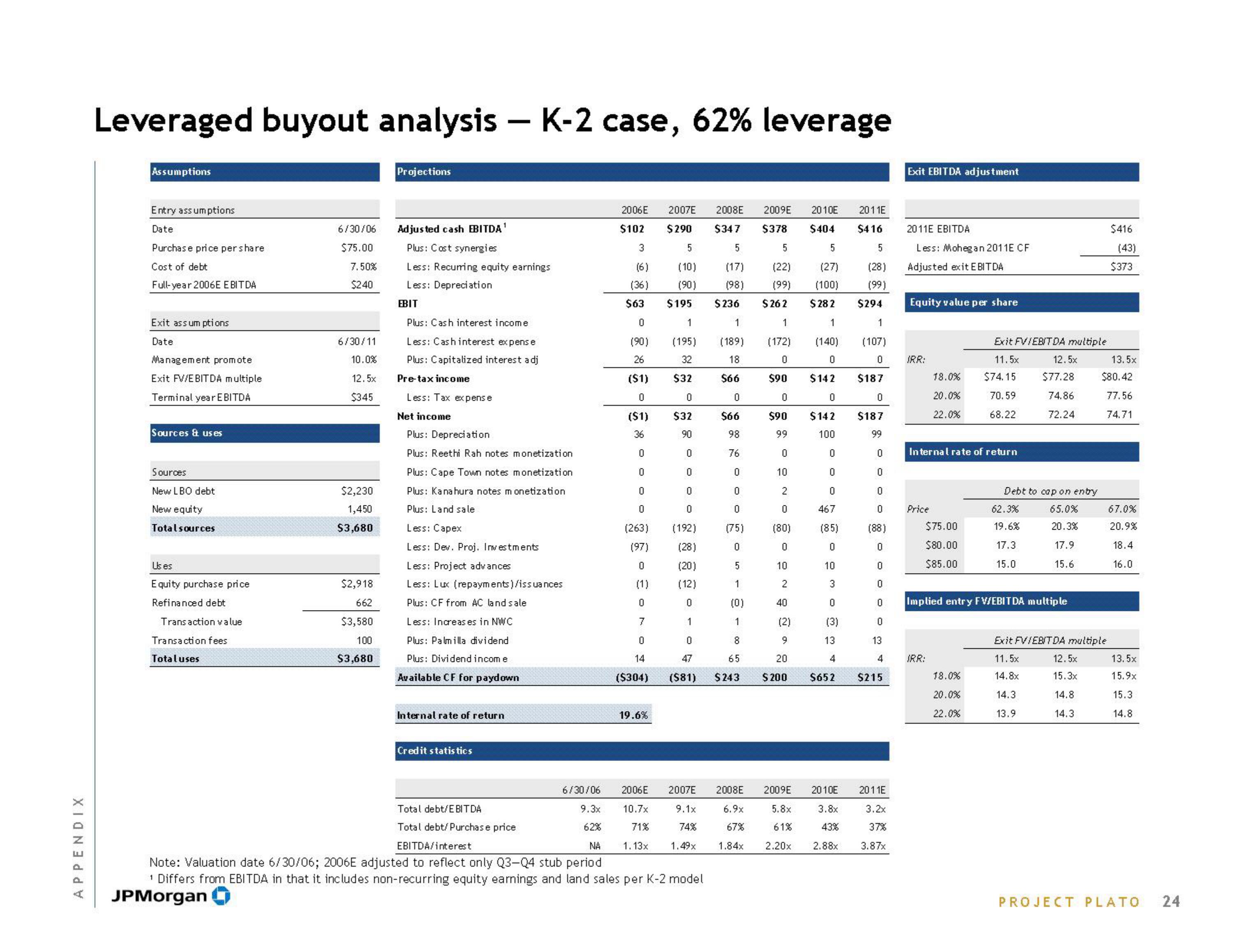

Leveraged buyout analysis - K-2 case, 62% leverage

Assumptions

Entry assumptions

Date

Purchase price per share

Cost of debt

Full-year 2006E EBITDA

Exit ass um ptions

Date

Management promote

Exit FV/EBITDA multiple

Terminal year EBITDA

Sources & us es

Sources

New LBO debt

New equity

Total sources

Us es

Equity purchase price

Refinanced debt

Transaction value

Transaction fees

Totaluses

6/30/06

$75.00

7.50%

$240

6/30/11

10.0%

12.5x

$345

$2,230

1,450

$3,680

$2,918

662

$3,580

100

$3,680

Projections

Adjusted cash EBITDA¹

Plus: Cost synergies

Less: Recurring equity earnings

Less: Depreciation

EBIT

Plus: Cash interest income

Less: Cash interest expense

Plus: Capitalized interest adj

Pre-tax income

Less: Tax expens e

Net income

Plus: Depreciation

Plus: Reethi Rah notes monetization

Plus: Cape Town notes monetization

Plus: Kana hura notes monetization

Plus: Land sale

Less: Capex

Less: Dev. Proj. Investments

Less: Project advances

Less: Lux (repayments)/issuances

Plus: CF from AC land sale

Less: Increases in NWC

Plus: Palmilla dividend

Plus: Dividend income

Available CF for paydown

Internal rate of return

Credit statistics

2010E

2011E

$102

$416

5

2006E 2007E 2008E 2009E

$290 $347 $378 $404

5

5

5

5

(10) (17) (22) (27) (28)

(90) (98)

(99)

(100) (99)

$195 $236 $262 $282 $294

1

1

(195) (189) (172)

1

1

(140)

0

1

(107)

0

18

$66

0

$90

32

$32

0

$32

0

0

$90

99

$142 $187

0

0

$142 $187

100

99

90

0

0

0

0

0

0

0

0

0

0

0

(88)

0

0

0

0

0

13

Total debt/EBITDA

Total debt/Purchase price

3

(6)

(36

$63

0

(90)

26

($1)

0

($1)

36

0

0

0

0

(263)

(97)

0

(1)

0

7

0

14

(192)

(28)

(20)

(12)

0

1

19.6%

$66

98

76

6/30/06

9.3x

62%

EBITDA/interest

NA

Note: Valuation date 6/30/06; 2006E adjusted to reflect only Q3-Q4 stub period

¹ Differs from EBITDA in that it includes non-recurring equity earnings and land sales per K-2 model

JPMorgan

0

0

0

(75)

0

(0)

1

0

8

47

65

($304) ($81) $243

5

1

10

2

0

(80)

0

10

2

10

3

0

(3)

13

20

4

$200 $652 $215

40

0

467

(2)

9

(85)

0

2006E

2007E 2008E 2009E 2010E

9.1x 6.9x

5.8x

3.8x

10.7x

71%

1.13x 1.49x

74%

67%

61%

43%

1.84x

2.20x

2.88x

4

2011E

3.2x

37%

3.87x

Exit EBITDA adjustment

2011E EBITDA

Less: Mohegan 2011E CF

Adjusted exit EBITDA

Equity value per share

IRR:

Price

18.0%

20.0%

22.0%

Internal rate of return

$75.00

$80.00

$85.00

IRR:

Exit FVIEBITDA multiple

11.5×

$74.15

70.59

68.22

18.0%

20.0%

22.0%

12.5

$77.28

74.86

72.24

Debt to cap on entry

65.0%

20.3%

17.9

15.6

62.3%

19.6%

17.3

15.0

Implied entry FW/EBITDA multiple

Exit FVIEBITDA multiple

11.5x

14.8x

14.3

13.9

12.5x

15.3x

14.8

14.3

$416

(43)

$373

13.5x

$80.42

77.56

74.71

67.0%

20.9%

18.4

16.0

13.5x

15.9x

15.3

14.8

PROJECT PLATO 24View entire presentation