Deutsche Bank Fixed Income Presentation Deck

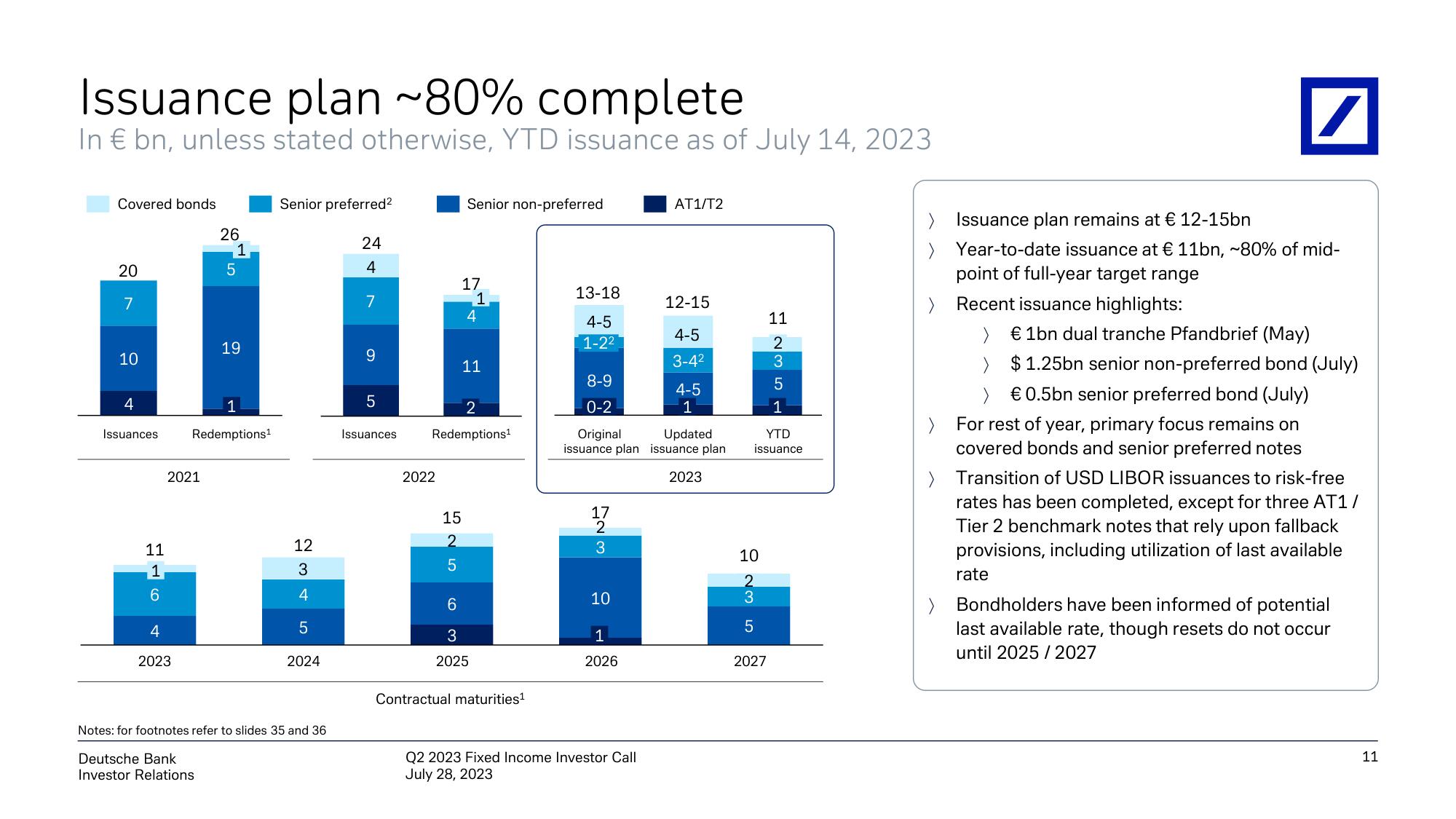

Issuance plan ~80% complete

In € bn, unless stated otherwise, YTD issuance as of July 14, 2023

Covered bonds

20

7

10

4

Issuances

11

1

6

2021

4

2023

26

1

5

19

1

Redemptions¹

Senior preferred²

12

3

4

5

2024

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

24

4

7

9

5

Issuances

2022

Senior non-preferred

17

15

2

5

1

4

11

2

Redemptions¹

6

3

2025

Contractual maturities¹

13-18

4-5

1-2²

8-9

0-2

17

2

UN

Original Updated

issuance plan issuance plan

2023

3

10

1

2026

AT1/T2

Q2 2023 Fixed Income Investor Call

July 28, 2023

12-15

4-5

3-4²

4-5

1

10

UT

1 23 5 1

YTD

issuance

2027

11

Issuance plan remains at € 12-15bn

> Year-to-date issuance at € 11bn, ~80% of mid-

point of full-year target range

> Recent issuance highlights:

>

€ 1bn dual tranche Pfandbrief (May)

>

$1.25bn senior non-preferred bond (July)

>

€ 0.5bn senior preferred bond (July)

>

For rest of year, primary focus remains on

covered bonds and senior preferred notes

> Transition of USD LIBOR issuances to risk-free

rates has been completed, except for three AT1/

Tier 2 benchmark notes that rely upon fallback

provisions, including utilization of last available

rate

>

Bondholders have been informed of potential

last available rate, though resets do not occur

until 2025 / 2027

11View entire presentation