BlackRock Investor Conference Presentation Deck

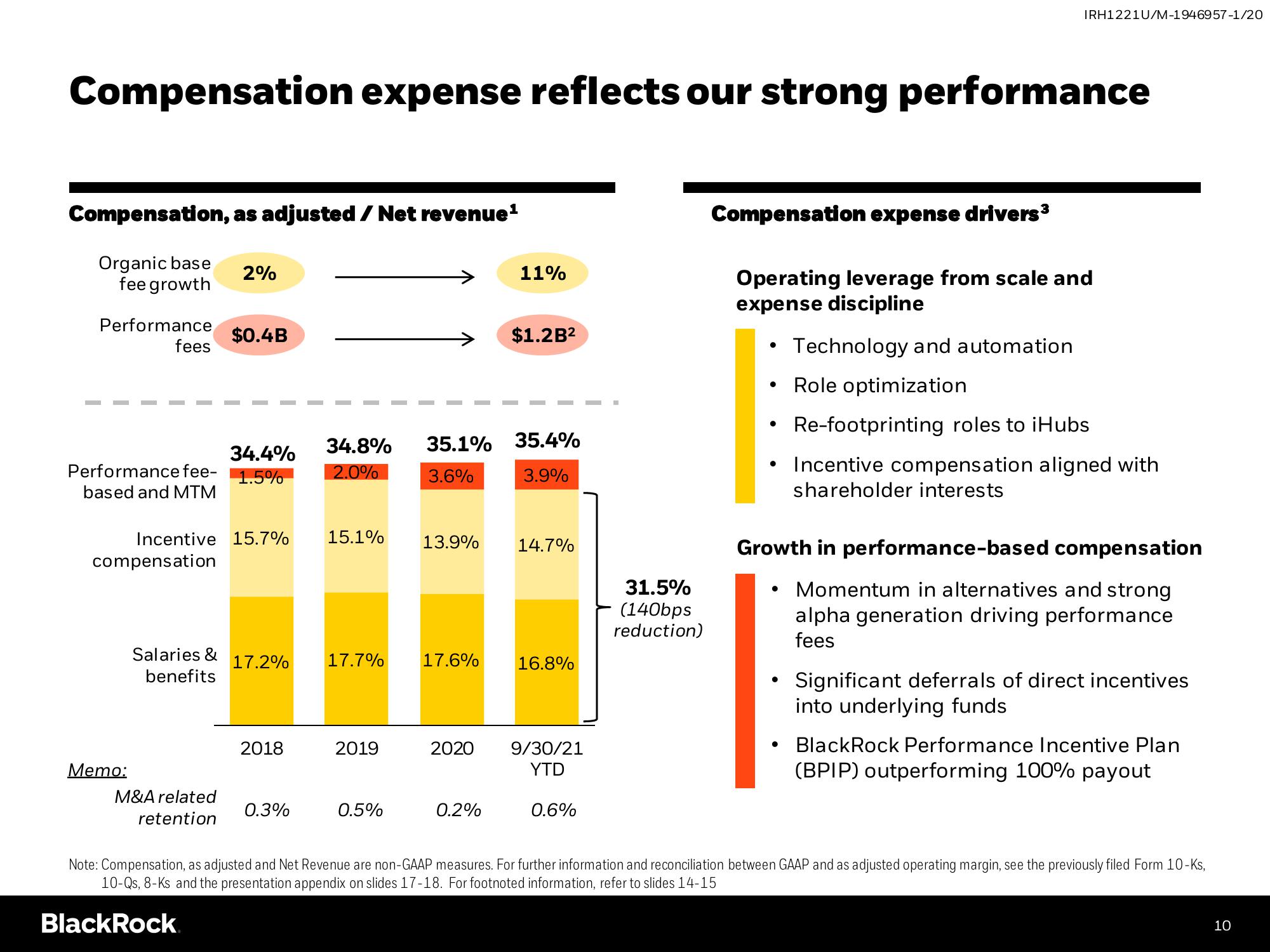

Compensation expense reflects our strong performance

Compensation, as adjusted / Net revenue¹

Organic base

fee growth

Performance

fees

Memo:

34.4%

Performance fee- 1.5%

based and MTM

compensation

2%

Incentive 15.7%

Salaries &

benefits

$0.4B

M&A related

retention

17.2%

2018

0.3%

15.1%

34.8% 35.1% 35.4%

2.0%

3.6%

3.9%

17.7%

2019

0.5%

13.9%

17.6%

11%

$1.2B²

0.2%

14.7%

16.8%

2020 9/30/21

YTD

0.6%

31.5%

(140bps

reduction)

Compensation expense drivers ³

Operating leverage from scale and

expense discipline

Technology and automation

• Role optimization

●

●

IRH1221U/M-1946957-1/20

●

Growth in performance-based compensation

Momentum in alternatives and strong

alpha generation driving performance

fees

●

Re-footprinting roles to iHubs

Incentive compensation aligned with

shareholder interests

Significant deferrals of direct incentives

into underlying funds

BlackRock Performance Incentive Plan

(BPIP) outperforming 100% payout

Note: Compensation, as adjusted and Net Revenue are non-GAAP measures. For further information and reconciliation between GAAP and as adjusted operating margin, see the previously filed Form 10-Ks,

10-Qs, 8-Ks and the presentation appendix on slides 17-18. For footnoted information, refer to slides 14-15

BlackRock

10View entire presentation