IGI SPAC Presentation Deck

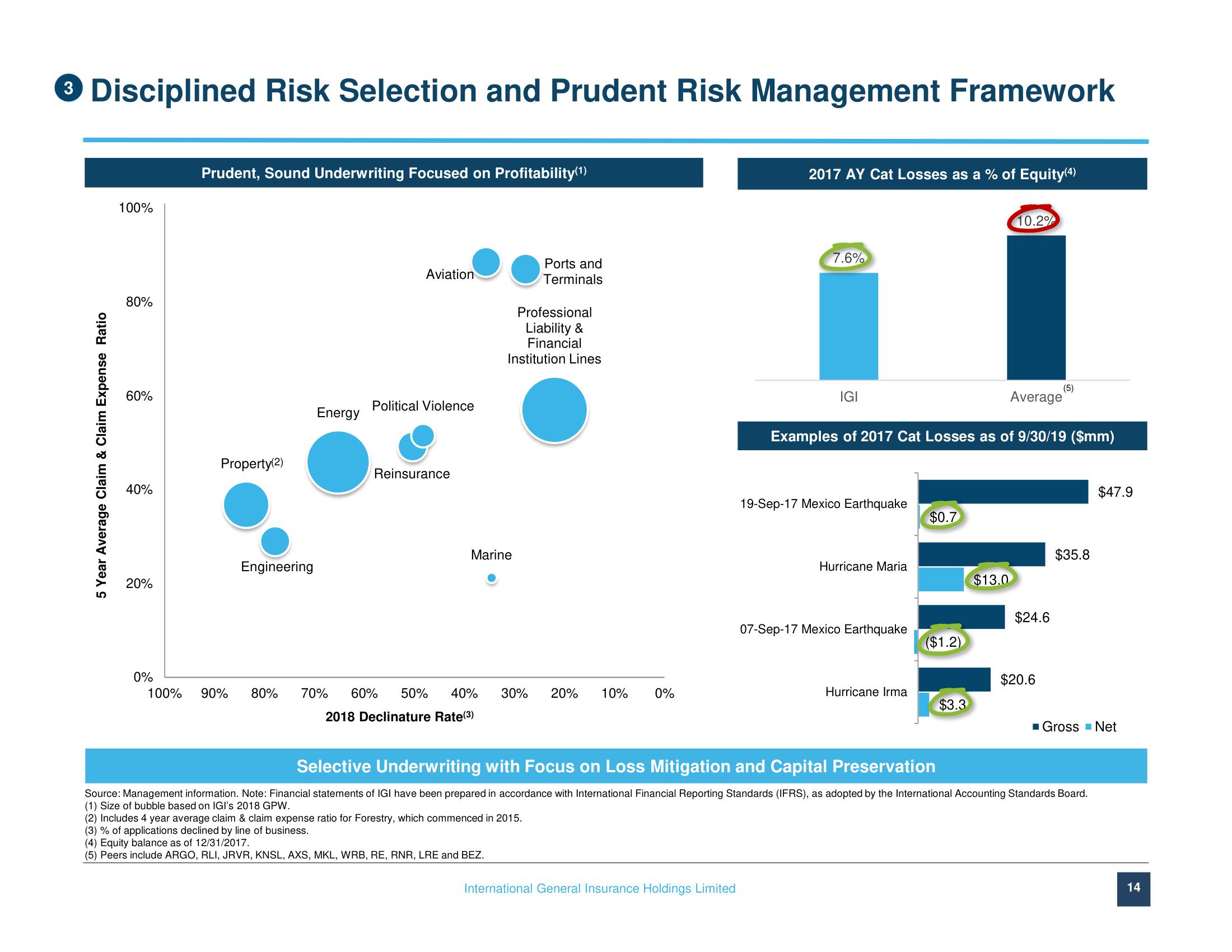

3 Disciplined Risk Selection and Prudent Risk Management Framework

5 Year Average Claim & Claim Expense Ratio

100%

80%

60%

40%

20%

0%

Prudent, Sound Underwriting Focused on Profitability(¹)

Property(2)

Engineering

100% 90% 80%

Energy

Aviation

Political Violence

Reinsurance

Professional

Liability &

Financial

Institution Lines

Marine

Ports and

Terminals

70% 60% 50% 40% 30% 20% 10% 0%

2018 Declinature Rate(³)

(2) Includes 4 year average claim & claim expense ratio for Forestry, which commenced in 2015.

(3) % of applications declined by line of business.

(4) Equity balance as of 12/31/2017.

(5) Peers include ARGO, RLI, JRVR, KNSL, AXS, MKL, WRB, RE, RNR, LRE and BEZ.

2017 AY Cat Losses as a % of Equity(4)

International General Insurance Holdings Limited

7.6%

IGI

19-Sep-17 Mexico Earthquake

Average

Examples of 2017 Cat Losses as of 9/30/19 ($mm)

Hurricane Maria

07-Sep-17 Mexico Earthquake

Hurricane Irma

$0.7

($1.2)

$3.3

10.2%

$13.0

$24.6

(5)

$20.6

$35.8

Selective Underwriting with Focus on Loss Mitigation and Capital Preservation

Source: Management information. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board.

(1) Size of bubble based on IGI's 2018 GPW.

$47.9

■ Gross Net

14View entire presentation