Nexters Results Presentation Deck

Key operating and non-IFRS metrics used in the presentation nexters

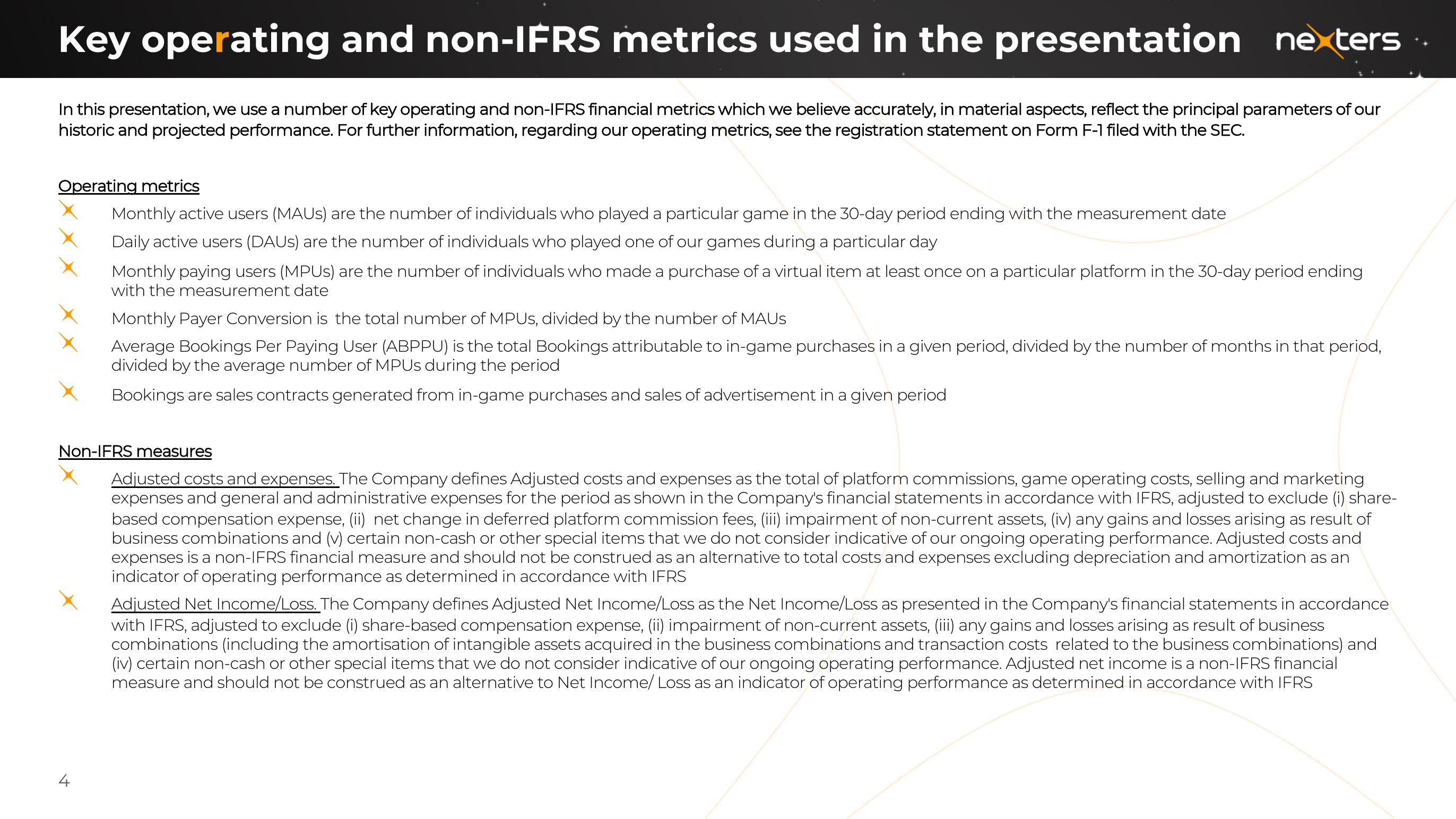

In this presentation, we use a number of key operating and non-IFRS financial metrics which we believe accurately, in material aspects, reflect the principal parameters of our

historic and projected performance. For further information, regarding our operating metrics, see the registration statement on Form F-1 filed with the SEC.

Operating metrics

Monthly active users (MAUS) are the number of individuals who played a particular game in the 30-day period ending with the measurement date

Daily active users (DAUS) are the number of individuals who played one of our games during a particular day

Monthly paying users (MPUs) are the number of individuals who made a purchase of a virtual item at least once on a particular platform in the 30-day period ending

with the measurement date

+

Monthly Payer Conversion is the total number of MPUS, divided by the number of MAUS

Average Bookings Per Paying User (ABPPU) is the total Bookings attributable to in-game purchases in a given period, divided by the number of months in that period,

divided by the average number of MPUS during the period

Bookings are sales contracts generated from in-game purchases and sales of advertisement in a given period

Non-IFRS measures

Adjusted costs and expenses. The Company defines Adjusted costs and expenses as the total of platform commissions, game operating costs, selling and marketing

expenses and general and administrative expenses for the period as shown in the Company's financial statements in accordance with IFRS, adjusted to exclude (i) share-

based compensation expense, (ii) net change in deferred platform commission fees, (iii) impairment of non-current assets, (iv) any gains and losses arising as result of

business combinations and (v) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. Adjusted costs and

expenses is a non-IFRS financial measure and should not be construed as an alternative to total costs and expenses excluding depreciation and amortization as an

indicator of operating performance as determined in accordance with IFRS

Adjusted Net Income/Loss. The Company defines Adjusted Net Income/Loss as the Net Income/Loss as presented in the Company's financial statements in accordance

with IFRS, adjusted to exclude (i) share-based compensation expense, (ii) impairment of non-current assets, (iii) any gains and losses arising as result of business

combinations (including the amortisation of intangible assets acquired in the business combinations and transaction costs related to the business combinations) and

(iv) certain non-cash or other special items that we do not consider indicative of our ongoing operating performance. Adjusted net income is a non-IFRS financial

measure and should not be construed as an alternative to Net Income/ Loss as an indicator of operating performance as determined in accordance with IFRSView entire presentation