Planet SPAC Presentation Deck

23

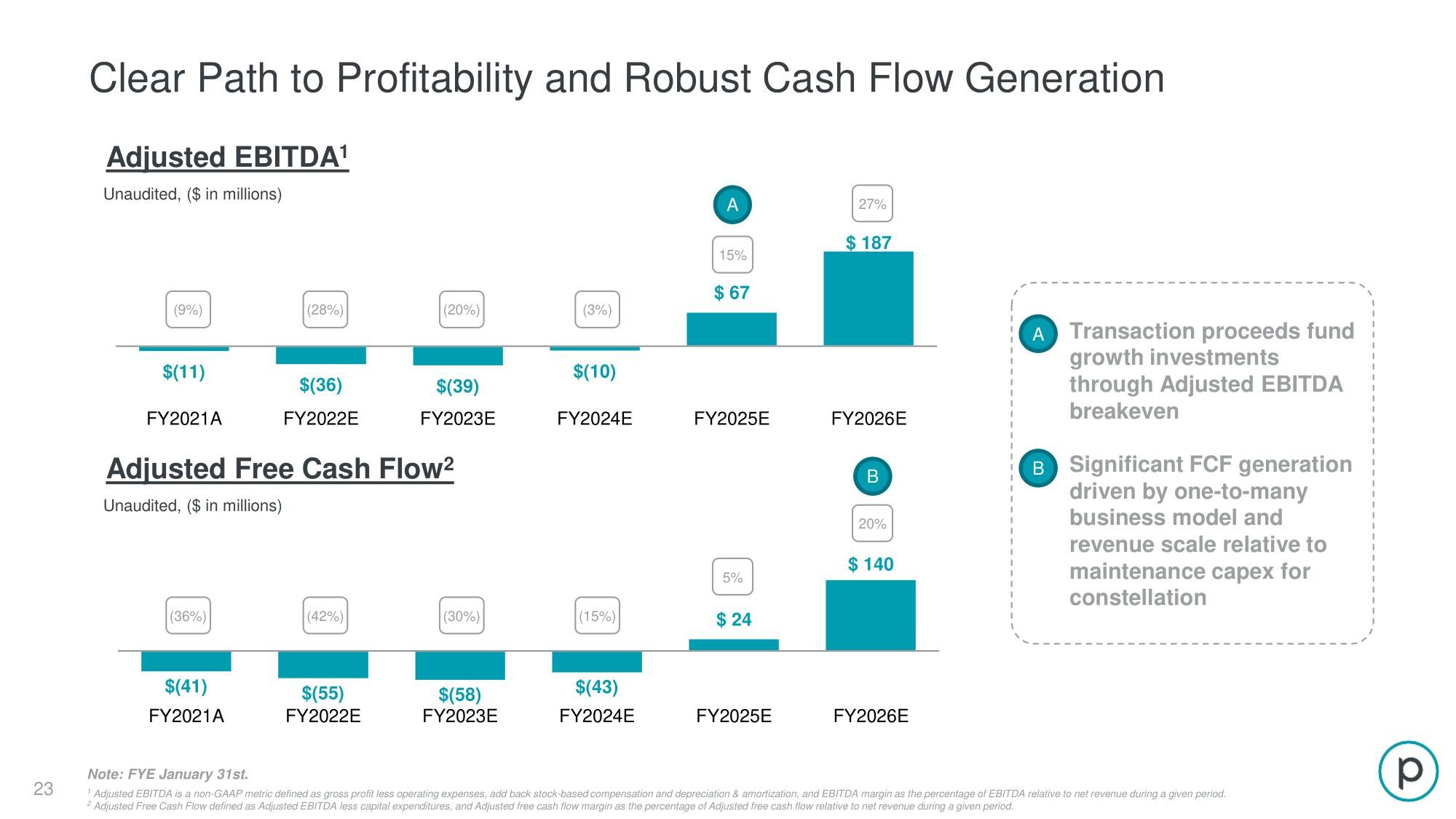

Clear Path to Profitability and Robust Cash Flow Generation

Adjusted EBITDA¹

Unaudited, ($ in millions)

(9%)

$(11)

FY2021A

(36%)

(28%)

$(41)

FY2021A

$(36)

FY2022E

Adjusted Free Cash Flow²

Unaudited, ($ in millions)

(42%)

(20%)

$(55)

FY2022E

$(39)

FY2023E

(30%)

$(58)

FY2023E

(3%)

$(10)

FY2024E

(15%)

$(43)

FY2024E

A

15%

$ 67

FY2025E

5%

$24

FY2025E

27%

$ 187

FY2026E

B

20%

$140

FY2026E

A Transaction proceeds fund

growth investments

through Adjusted EBITDA

breakeven

B Significant FCF generation

driven by one-to-many

business model and

revenue scale relative to

maintenance capex for

constellation

Note: FYE January 31st.

Adjusted EBITDA is a non-GAAP metric defined as gross profit less operating expenses, add back stock-based compensation and depreciation & amortization, and EBITDA margin as the percentage of EBITDA relative to net revenue during a given period.

2 Adjusted Free Cash Flow defined as Adjusted EBITDA less capital expenditures, and Adjusted free cash flow margin as the percentage of Adjusted free cash flow relative to net revenue during a given period.

рView entire presentation