Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

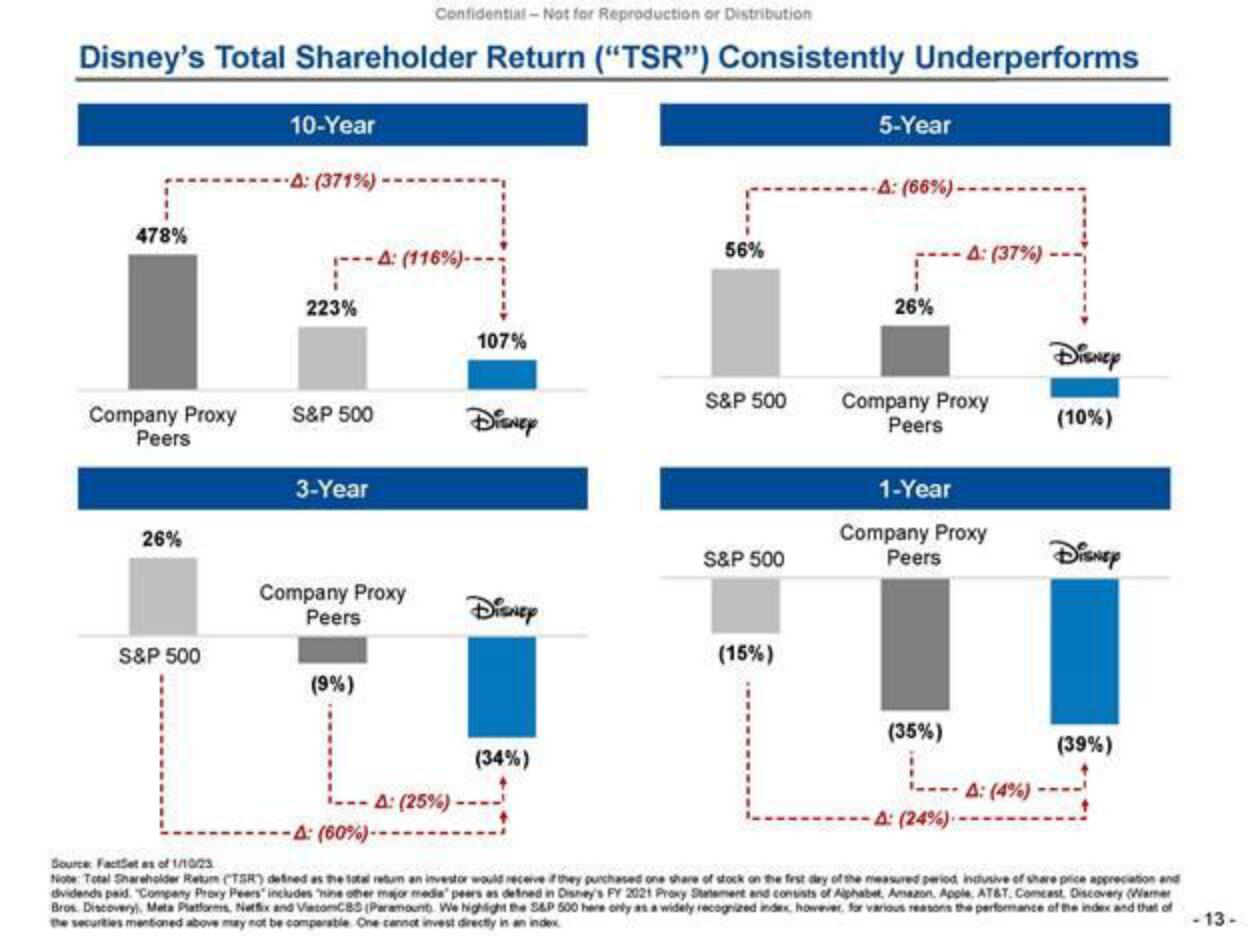

Disney's Total Shareholder Return ("TSR") Consistently Underperforms

478%

Company Proxy

Peers

26%

S&P 500

10-Year

A: (371%)

223%

S&P 500

3-Year

A: (116%) --

Company Proxy

Peers

(9%)

A: (25%)

-A: (60%) --

107%

Disney

Disney

(34%)

56%

S&P 500

S&P 500

(15%)

5-Year

-A: (66%)-

26%

Company Proxy

Peers

A: (37%)

1-Year

Company Proxy

Peers

(35%)

A: (24%).

A: (4%)

Disney

(10%)

Disney

(39%)

Source: FactSet as of 1/10/23

Note: Total Shareholder Reture (TSR) defined as the total return an investor would receive if they purchased one share of stock on the first day of the measured period indusive of share price appreciation and

dividends paid. "Company Proxy Peers includes hine other major media' peers as defined in Disney's FY 2021 Proxy Statement and consists of Alphabet, Amazon, Apple, AT&T. Comcast Discovery (Wamer

Bros. Discovery), Meta Platforms, Netflix and ViacomCBS (Paramount. We highlight the S&P 500 here only as a widely recognized index, however, for various reasons the performance of the index and that of

the securities mentioned above may not be comparable. One cannot invest directly in an index

-13-View entire presentation