TPG Investor Presentation Deck

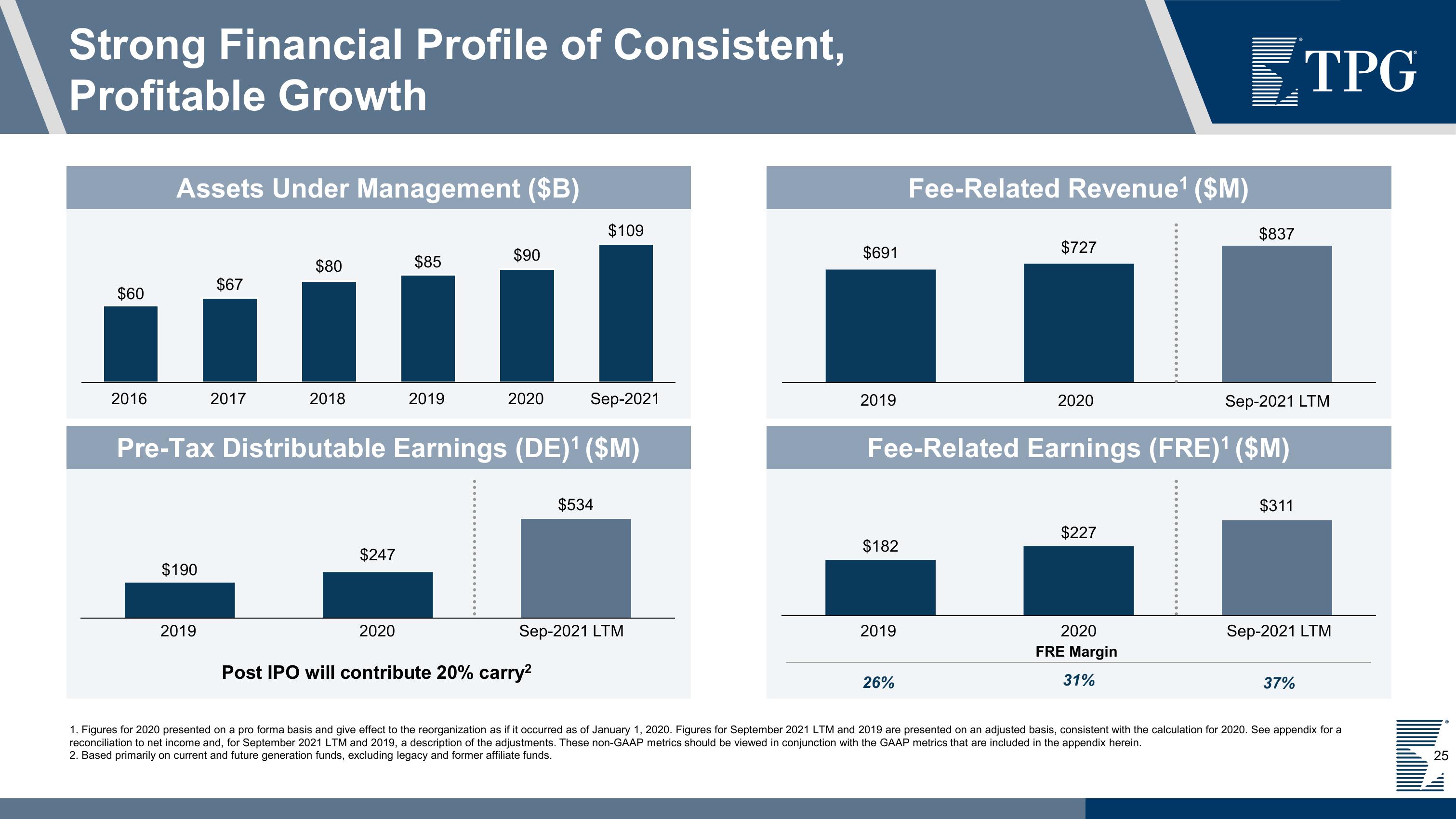

Strong Financial Profile of Consistent,

Profitable Growth

$60

Assets Under Management ($B)

2016

$190

$67

2019

$80

2017

2020 Sep-2021

Pre-Tax Distributable Earnings (DE)¹ ($M)

2018

$247

$85

2020

$90

2019

$109

$534

Post IPO will contribute 20% carry²

Sep-2021 LTM

$691

2019

$182

2019

Fee-Related Revenue¹ ($M)

26%

$727

2020

Sep-2021 LTM

Fee-Related Earnings (FRE)¹ ($M)

$227

$837

2020

FRE Margin

31%

$311

TPG

Sep-2021 LTM

37%

1. Figures for 2020 presented on a pro forma basis and give effect to the reorganization as if it occurred as of January 1, 2020. Figures for September 2021 LTM and 2019 are presented on an adjusted basis, consistent with the calculation for 2020. See appendix for a

reconciliation to net income and, for September 2021 LTM and 2019, a description of the adjustments. These non-GAAP metrics should be viewed in conjunction with the GAAP metrics that are included in the appendix herein.

2. Based primarily on current and future generation funds, excluding legacy and former affiliate funds.

25View entire presentation