Nerdy Investor Presentation Deck

12345

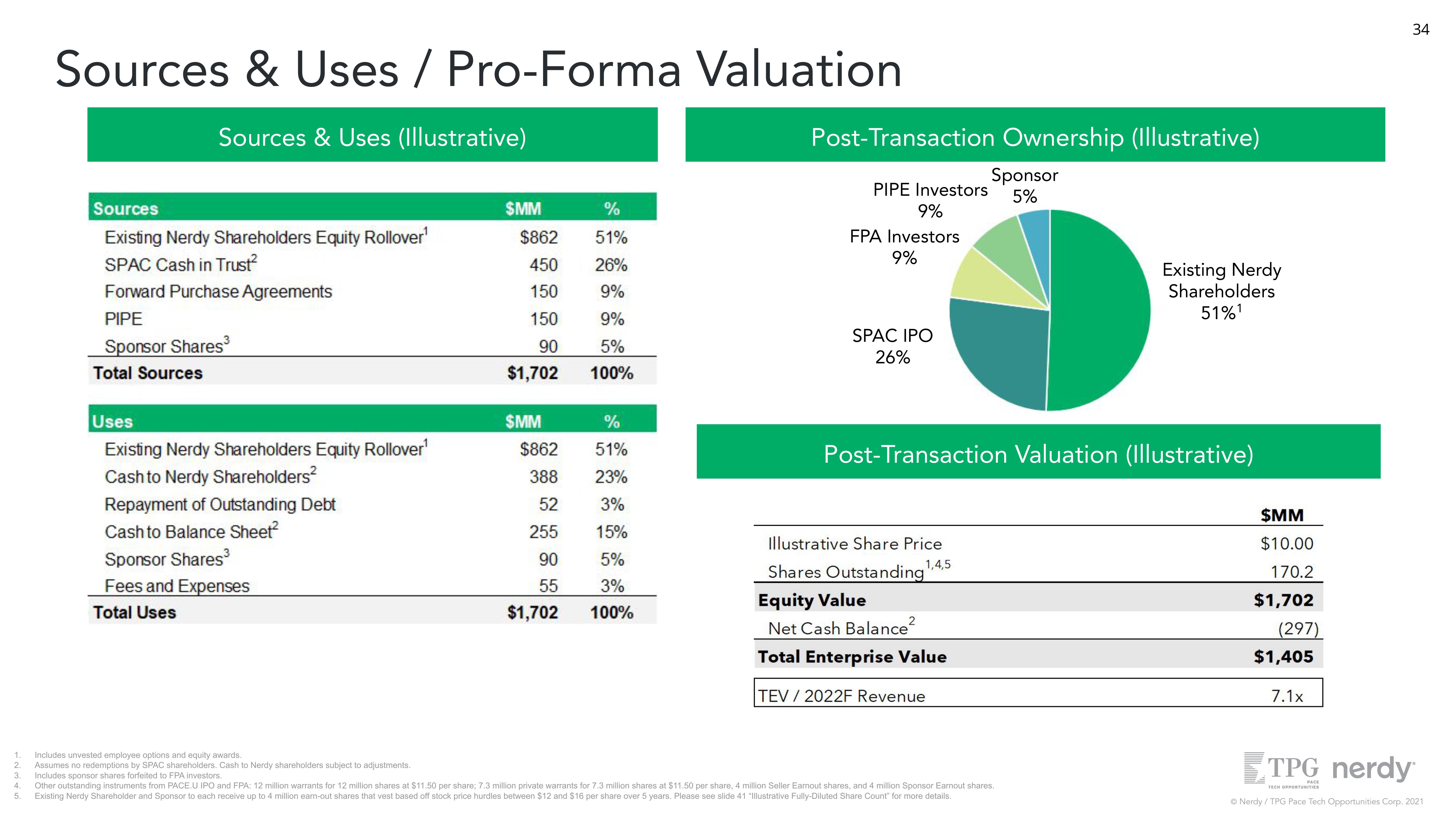

Sources & Uses / Pro-Forma Valuation

Sources & Uses (Illustrative)

Sources

Existing Nerdy Shareholders Equity Rollover¹

SPAC Cash in Trust²

Forward Purchase Agreements

PIPE

Sponsor Shares³

Total Sources

Uses

Existing Nerdy Shareholders Equity Rollover¹

Cash to Nerdy Shareholders²

Repayment of Outstanding Debt

Cash to Balance Sheet²

Sponsor Shares

Fees and Expenses

Total Uses

$MM

$862

450

150

150

90

$1,702

$MM

$862

388

52

255

90

55

$1,702

%

51%

26%

9%

9%

5%

100%

%

51%

23%

3%

15%

5%

3%

100%

Post-Transaction Ownership (Illustrative)

PIPE Investors 5%

9%

FPA Investors

9%

SPAC IPO

26%

Sponsor

Illustrative Share Price

1,4,5

Shares Outstanding"

Equity Value

Net Cash Balance²

Total Enterprise Value

TEV / 2022F Revenue

Post-Transaction Valuation (Illustrative)

Existing Nerdy

Shareholders

51%¹

Includes unvested employee options and equity awards.

Assumes no redemptions by SPAC shareholders. Cash to Nerdy shareholders subject to adjustments.

Includes sponsor shares forfeited to FPA investors.

Other outstanding instruments from PACE.U IPO and FPA: 12 million warrants for 12 million shares at $11.50 per share; 7.3 million private warrants for 7.3 million shares at $11.50 per share, 4 million Seller Earnout shares, and 4 million Sponsor Earnout shares.

Existing Nerdy Shareholder and Sponsor to each receive up to 4 million earn-out shares that vest based off stock price hurdles between $12 and $16 per share over 5 years. Please see slide 41 "Illustrative Fully-Diluted Share Count" for more details.

$MM

$10.00

170.2

$1,702

(297)

$1,405

7.1x

34

TPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation