Clever Leaves IPO Presentation

Adjusted EBITDA Reconciliation

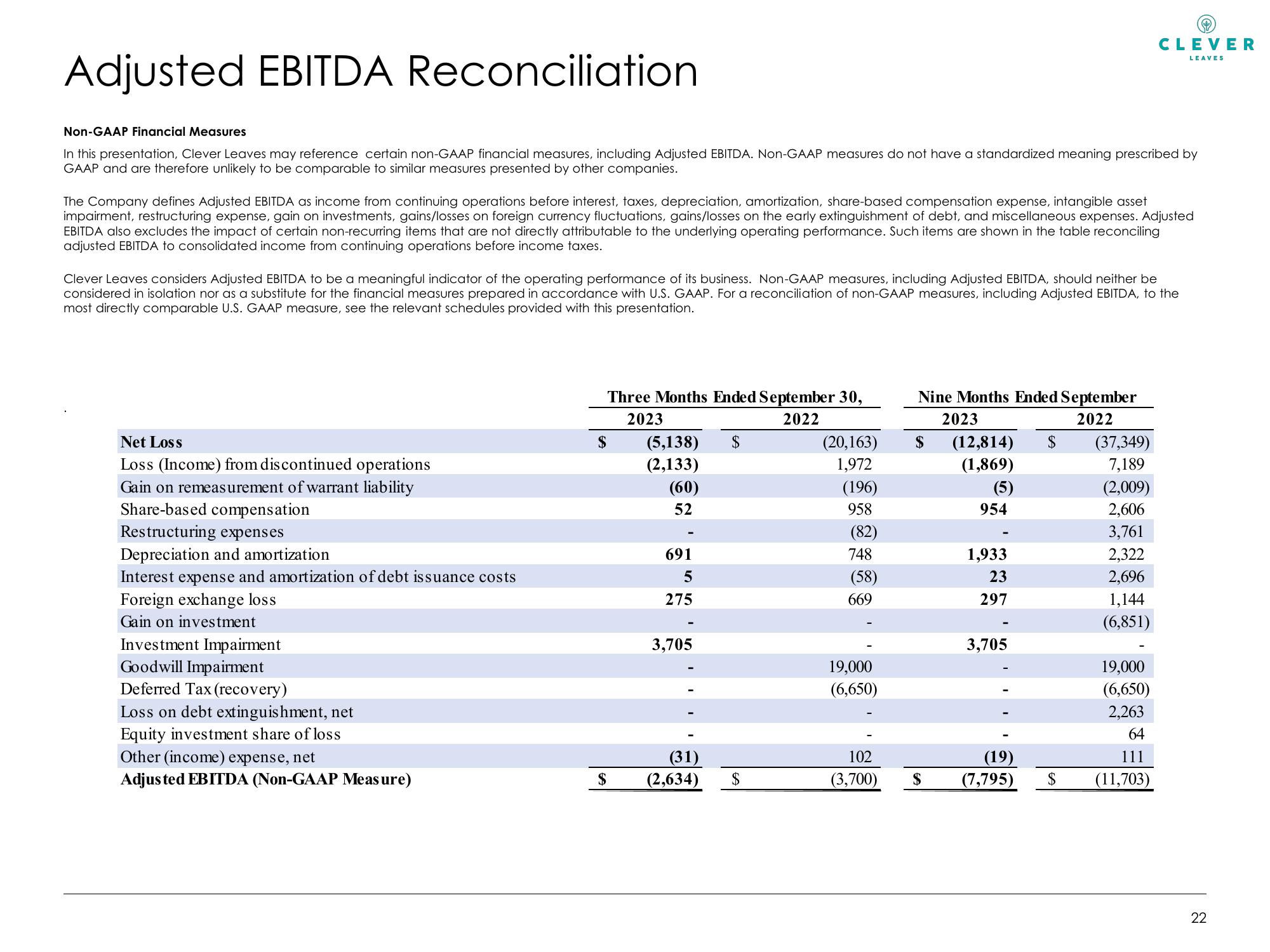

Non-GAAP Financial Measures

In this presentation, Clever Leaves may reference certain non-GAAP financial measures, including Adjusted EBITDA. Non-GAAP measures do not have a standardized meaning prescribed by

GAAP and are therefore unlikely to be comparable to similar measures presented by other companies.

The Company defines Adjusted EBITDA as income from continuing operations before interest, taxes, depreciation, amortization, share-based compensation expense, intangible asset

impairment, restructuring expense, gain on investments, gains/losses on foreign currency fluctuations, gains/losses on the early extinguishment of debt, and miscellaneous expenses. Adjusted

EBITDA also excludes the impact of certain non-recurring items that are not directly attributable to the underlying operating performance. Such items are shown in the table reconciling

adjusted EBITDA to consolidated income from continuing operations before income taxes.

Clever Leaves considers Adjusted EBITDA to be a meaningful indicator of the operating performance of its business. Non-GAAP measures, including Adjusted EBITDA, should neither be

considered in isolation nor as a substitute for the financial measures prepared in accordance with U.S. GAAP. For a reconciliation of non-GAAP measures, including Adjusted EBITDA, to the

most directly comparable U.S. GAAP measure, see the relevant schedules provided with this presentation.

Net Loss

Loss (Income) from discontinued operations

Gain on remeasurement of warrant liability

Share-based compensation

Restructuring expenses

Depreciation and amortization

Interest expense and amortization of debt issuance costs

Foreign exchange loss

Gain on investment

Investment Impairment

Goodwill Impairment

Deferred Tax (recovery)

Loss on debt extinguishment, net

Equity investment share of loss

Other (income) expense, net

Adjusted EBITDA (Non-GAAP Measure)

$

Three Months Ended September 30,

2023

2022

(5,138) $

(2,133)

(60)

52

691

5

275

3,705

(31)

$ (2,634)

$

(20,163)

1,972

(196)

958

(82)

748

(58)

669

19,000

(6,650)

102

(3,700)

Nine Months Ended September

2023

2022

$

$

(12,814)

(1,869)

(5)

954

1,933

23

297

3,705

(19)

(7,795)

$

(37,349)

7,189

(2,009)

2,606

3,761

2,322

2,696

1,144

(6,851)

CLEVER

LEAVES

19,000

(6,650)

2,263

64

111

$ (11,703)

22View entire presentation