Melrose Results Presentation Deck

Automotive: restructuring

■

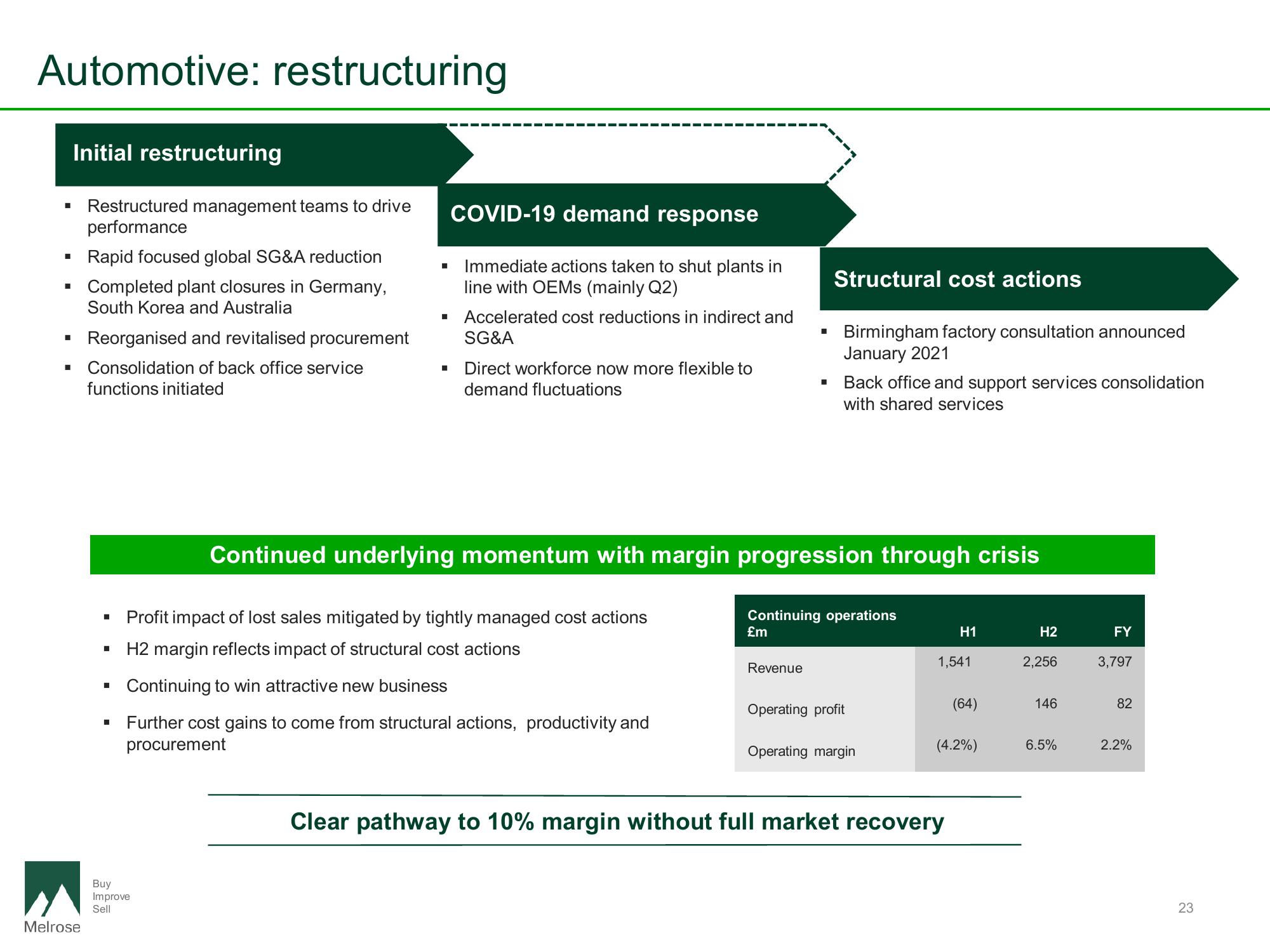

Initial restructuring

Rapid focused global SG&A reduction

Completed plant closures in Germany,

South Korea and Australia

Reorganised and revitalised procurement

■ Consolidation of back office service

functions initiated

■

Restructured management teams to drive

performance

Melrose

■

■

I

COVID-19 demand response

Immediate actions taken to shut plants in

line with OEMs (mainly Q2)

Accelerated cost reductions in indirect and

SG&A

Direct workforce now more flexible to

demand fluctuations

Buy

Improve

Sell

Profit impact of lost sales mitigated by tightly managed cost actions

H2 margin reflects impact of structural cost actions

Continuing to win attractive new business

Further cost gains to come from structural actions, productivity and

procurement

■

■

Revenue

Structural cost actions

Birmingham factory consultation announced

January 2021

Continued underlying momentum with margin progression through crisis

Back office and support services consolidation

with shared services

Continuing operations

£m

Operating profit

Operating margin

H1

1,541

Clear pathway to 10% margin without full market recovery

(64)

(4.2%)

H2

2,256

146

6.5%

FY

3,797

82

2.2%

23View entire presentation