J.P.Morgan Shareholder Engagement Presentation Deck

A Say-on-Pay Response

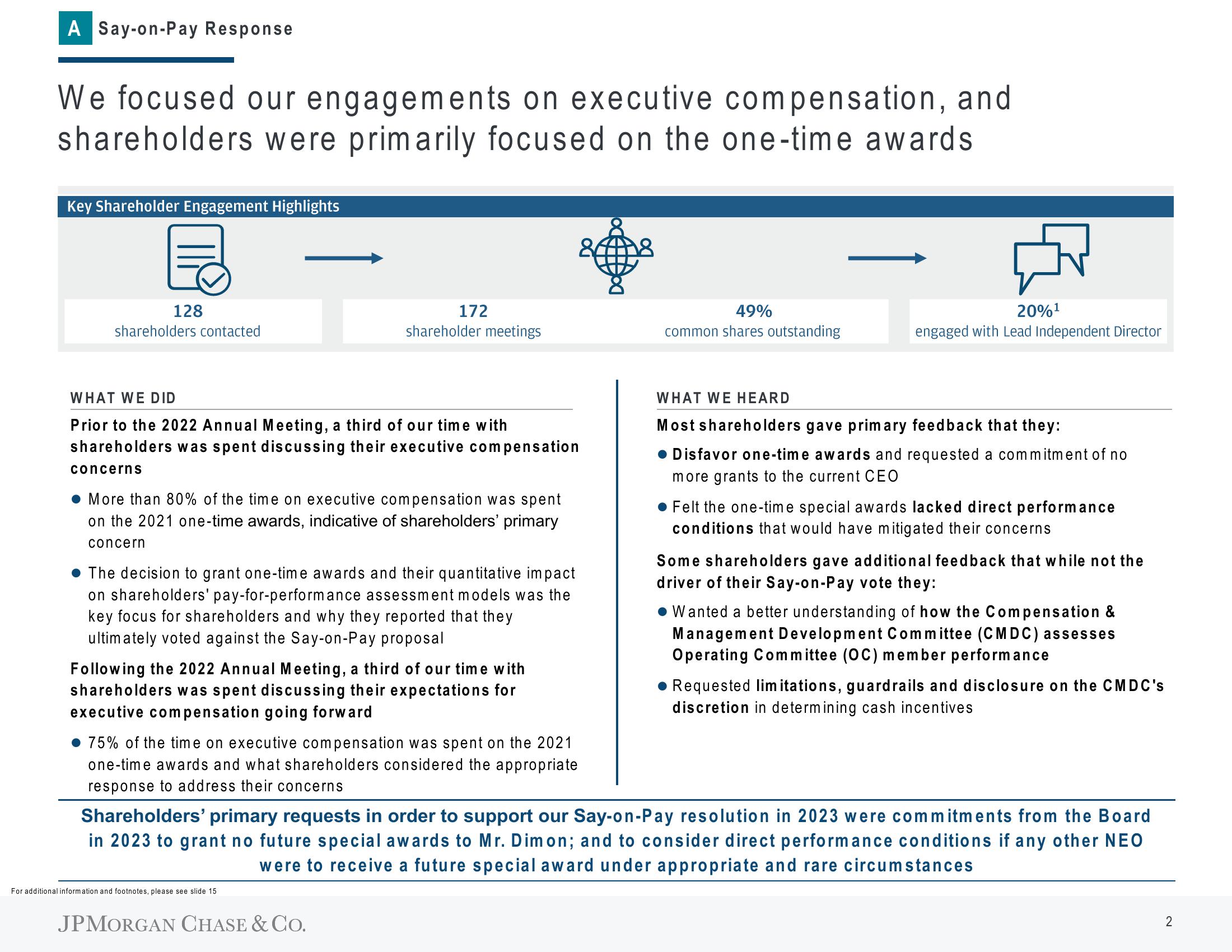

We focused our engagements on executive compensation, and

shareholders were primarily focused on the one-time awards

Key Shareholder Engagement Highlights

128

shareholders contacted

WHAT WE DID

Prior to the 2022 Annual Meeting, a third of our time with

shareholders was spent discussing their executive compensation

concerns

172

shareholder meetings

. More than 80% of the time on executive compensation was spent

on the 2021 one-time awards, indicative of shareholders' primary

concern

The decision to grant one-time awards and their quantitative impact

on shareholders' pay-for-performance assessment models was the

key focus for shareholders and why they reported that they

ultimately voted against the Say-on-Pay proposal

Following the 2022 Annual Meeting, a third of our time with

shareholders was spent discussing their expectations for

executive compensation going forward

75% of the time on executive compensation was spent on the 2021

one-time awards and what shareholders considered the appropriate

response to address their concerns

For additional information and footnotes, please see slide 15

JPMORGAN CHASE & CO.

49%

common shares outstanding

H

20%¹

engaged with Lead Independent Director

WHAT WE HEARD

Most shareholders gave primary feedback that they:

● Disfavor one-time awards and requested a commitment of no

more grants to the current CEO

Felt the one-time special awards lacked direct performance

conditions that would have mitigated their concerns

Some shareholders gave additional feedback that while not the

driver of their Say-on-Pay vote they:

Wanted a better understanding of how the Compensation &

Management Development Committee (CMDC) assesses

Operating Committee (OC) member performance

Shareholders' primary requests in order to support our Say-on-Pay resolution in 2023 were commitments from the Board

in 2023 to grant no future special awards to Mr. Dimon; and to consider direct performance conditions if any other NEO

were to receive a future special award under appropriate and rare circumstances

● Requested limitations, guardrails and disclosure on the CMDC's

discretion in determining cash incentives

2View entire presentation