Matterport SPAC Presentation Deck

●

●

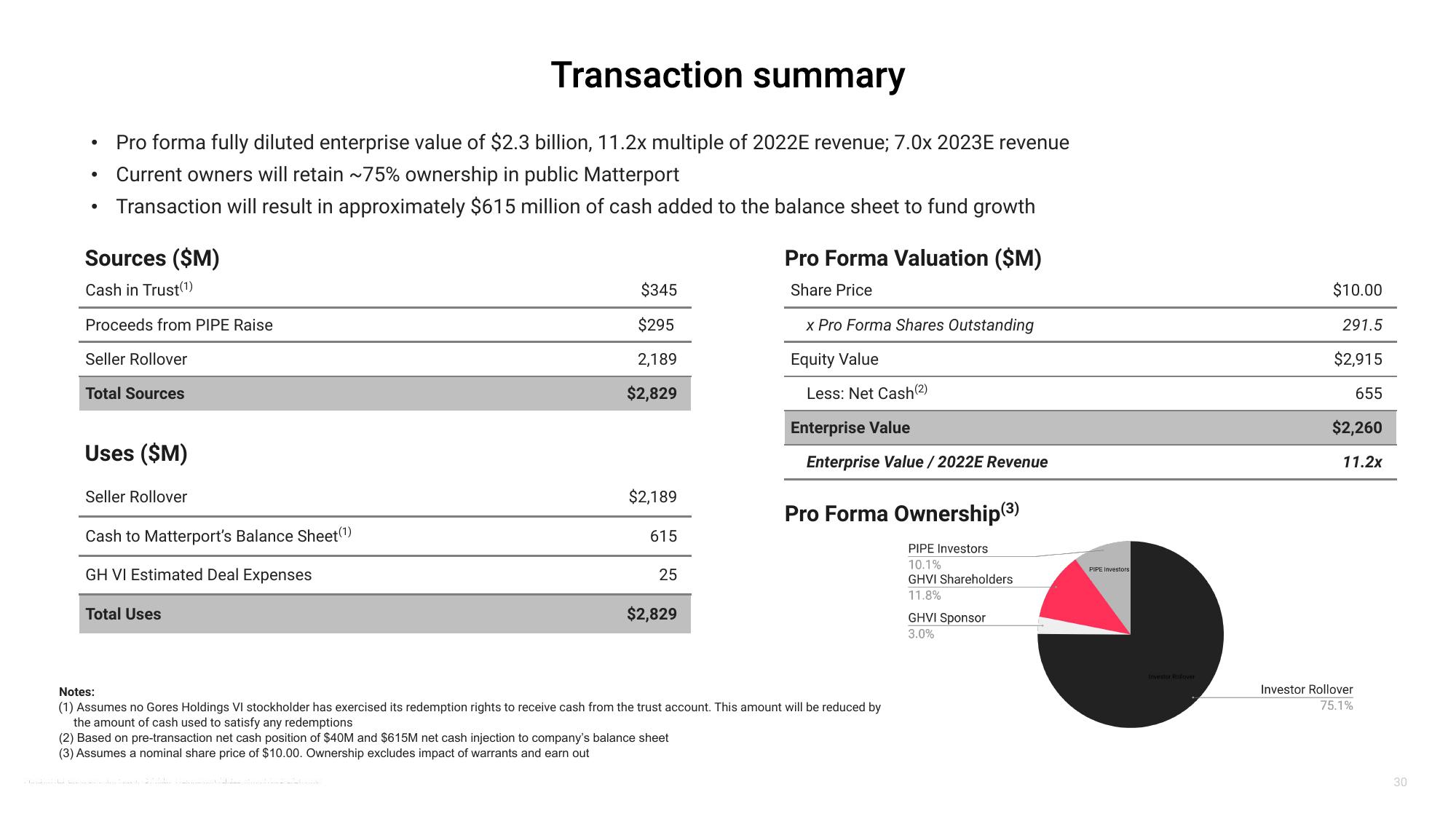

Transaction summary

Pro forma fully diluted enterprise value of $2.3 billion, 11.2x multiple of 2022E revenue; 7.0x 2023E revenue

Current owners will retain ~75% ownership in public Matterport

Transaction will result in approximately $615 million of cash added to the balance sheet to fund growth

Sources ($M)

Cash in Trust(1)

Proceeds from PIPE Raise

Seller Rollover

Total Sources

Uses ($M)

Seller Rollover

Cash to Matterport's Balance Sheet(1)

GH VI Estimated Deal Expenses

Total Uses

$345

$295

2,189

$2,829

$2,189

615

25

$2,829

Pro Forma Valuation ($M)

Share Price

x Pro Forma Shares Outstanding

Equity Value

Less: Net Cash (2)

Enterprise Value

Enterprise Value/2022E Revenue

Pro Forma Ownership (³)

PIPE Investors

10.1%

GHVI Shareholders

11.8%

Notes:

(1) Assumes no Gores Holdings VI stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by

the amount of cash used to satisfy any redemptions

(2) Based on pre-transaction net cash position of $40M and $615M net cash injection to company's balance sheet

(3) Assumes a nominal share price of $10.00. Ownership excludes impact of warrants and earn out

GHVI Sponsor

3.0%

PIPE Investors

Investor Rullover

$10.00

291.5

$2,915

655

$2,260

11.2x

Investor Rollover

75.1%

30View entire presentation