Evercore Investment Banking Pitch Book

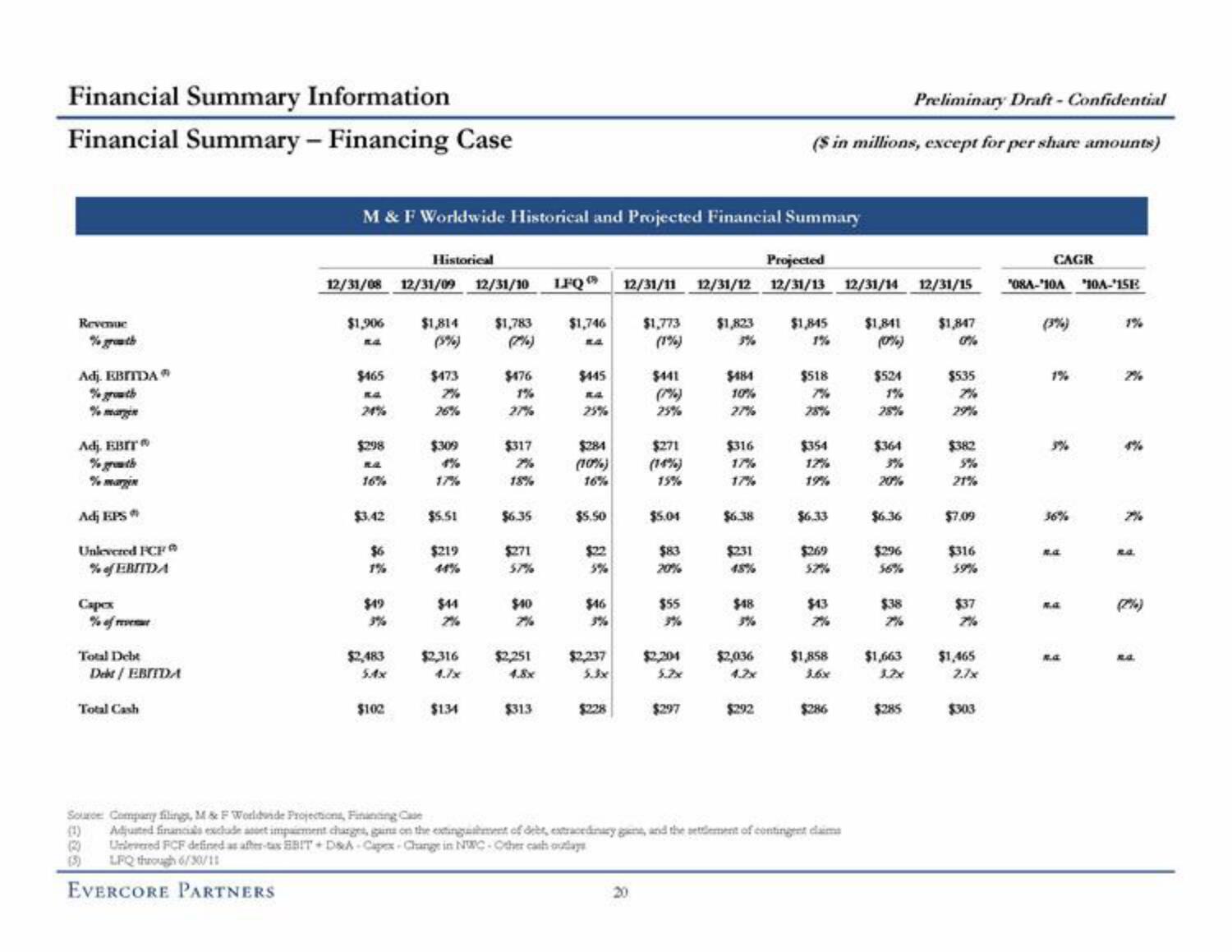

Financial Summary Information

Financial Summary - Financing Case

Revenue

Adj. EBITDA

% growth

% margen

Adj. EBIT

% growth

% margin

Adj EPS

Unlevered FCF

% of EBITDA

Capex

% of revent

Total Debt

Debt / EBITDA

Total Cash

(1)

(3)

M & F Worldwide Historical and Projected Financial Summary

12/31/08 12/31/09 12/31/10 LFQ

$1,814 $1,783

(2%)

$476

$1,906

K4

$465

$298

Ra

16%

$3.42

$6

$49

$2,483

Historical

$102

$473

2%

26%

$309

$5.51

$219

44%

$44

7%

$2,316

4.7x

$134

27%

$317

$6.35

$271

$40

7%

$2,251

4.8x

$313

$1,746 $1,773

1.4

(1%)

$441

$445

RA

25%

$284

(10%)

16%

$5.50

$22

5%

$46

$2,237

5.3x

$228

Projected

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15

25%

$271

(14%)

15%

$5.01

$83

20%

$55

$2,201

5.7x

$297

$1,823

$484

10%

27%

$316

17%

17%

$6.38

$231

45%

$48

3%

Preliminary Draft - Confidential

($ in millions, except for per share amounts)

$2,036

4.2x

$292

$1,845

1%

$518

7%

78%

$354

12%

19%

$6.33

$269

52%

$43

7%

$1,858

3.6x

$286

Source Company filings, M & F Worldende Projections, Financing Case

Adjusted financials exclude asoet impairment charges, gains on the extingashment of debt, extracednary gans, and the settlement of contingent claims

Unlevered FCF defined as after-tax BBIT+ D&A Capex Change in NWC-Other cash outlays

LFQ through 6/30/11

EVERCORE PARTNERS

$1,841 $1,847

(0%)

0%

$524

28%

$364

3%

$6.36

$296

56%

$38

$1,663

3.2x

$285

$535

2%

29%

$382

5%

21%

$7.09

$316

59%

$37

$1,465

2.7x

$303

CAGR

08A-10A 10A-15E

(3%)

3%

36%

R.A.

2%

7%

R.A.

R...A..View entire presentation